Sustainable Disclosure Rules for Listed Companies

The Singapore Exchange (SGX) releases sustainable disclosure rules for listed companies, aiming to incorporate international sustainable disclosure standards into listed companies.

In March 2024, the Singapore Exchange released a consultation on sustainable information disclosure, proposing to develop climate disclosure guidelines for listed companies in accordance with IFRS sustainable disclosure standards, and to shift sustainable information disclosure from comply or explain to mandatory disclosure, while soliciting a timetable from stakeholders.

Related Post: Singapore Introduces Mandatory Climate Disclosures

Response to the Consultation on Sustainable Information Disclosure

The Singapore Exchange collects stakeholder opinions on three major issues related to sustainable information disclosure.

- Align with ISSB standards: Many respondents approve of incorporating international sustainable disclosure standards into Singapore’s listed company disclosure rules, believing that this can improve transparency, consistency, and interoperability. These measures can help investors evaluate and compare the sustainable performance of listed companies and encourage companies to manage climate related risks. A small number of respondents believe that the company will face an increase in compliance costs and request regulatory agencies to provide more training guidance. On the issue of Scope 3 carbon emission data disclosure, some respondents believe that the complexity of its calculation methods and the possibility of duplicate calculations will have a significant impact, and therefore suggest delaying or phasing in the introduction of Scope 3 carbon emission information disclosure.

- From comply or explain to mandatory disclosure: Most respondents agree to change the sustainable information disclosure rules to mandatory disclosure to compare sustainable information. A small number of respondents believe that the method of explaining without compliance can be more flexible, and mandatory disclosure will bring about disclosure costs and resource issues. Some respondents also believe that when a listed company is unable to meet information disclosure requirements, the impact it receives should be lower than when it fails to meet financial information disclosure requirements.

- Sustainability disclosure timetable: Most respondents agree that listed companies should release sustainability reports for the fiscal year starting in January 2026, while a few believe that sustainability reports should be released together with financial reports. Some respondents also believe that when listed companies choose to conduct external audits of sustainability reports, they need to consider the timing of the audit and therefore can postpone its release.

Introduction to Sustainable Disclosure Rules for Listed Companies

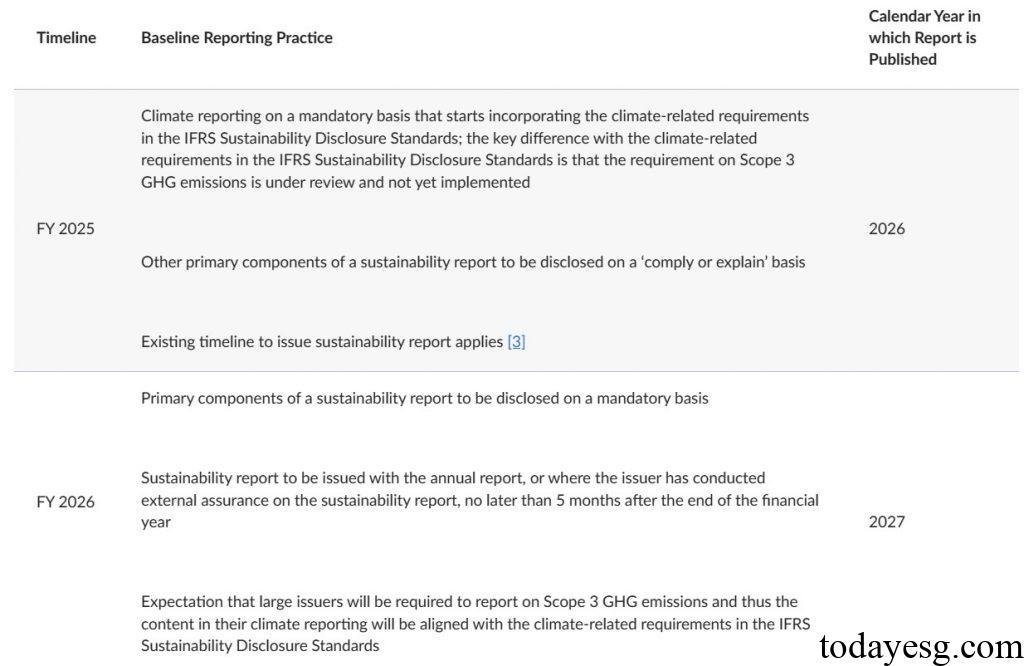

After considering the responses to the above three questions, SGX formulates sustainable disclosure rules. This rule is a revision of the Listing Rules and will take effect in two years.

- Fiscal year starting from 2025 (sustainability report released in 2026): Mandatory climate report based on IFRS standards, including Scope 1 and Scope 2 carbon emission data, with no requirement for Scope 3 carbon emission data. The sustainable development report is still based on comply or explain basis.

- Fiscal year starting from 2026 (sustainability report released in 2027): Mandatory disclosure for sustainable development report and released together with financial reports. For listed companies that have conducted external audits, they can release reports within five months after the end of the fiscal year. Large companies are required to disclose Scope 3 carbon emission data in their climate reports, while small and medium-sized listed companies are not required to do so.

To help listed companies understand how to carry out sustainable disclosure, the Singapore Exchange will collaborate with the Institute of Singapore Chartered Accountants to release sustainability report illustrative that provide detailed explanations of sustainable disclosure rules. The Singapore Exchange will also collaborate with the Global Reporting Initiative to provide training on Scope 3 carbon emissions calculation and reporting for large companies.

Reference:

SGX to Start Incorporating IFRS Sustainability Disclosure Standards into Climate Reporting Rules

Contact:todayesg@gmail.com