Overview

With the development of ESG securities and ESG bonds, ESG indices have gradually become a necessary financial product in the market. Although active management is still the main method in ESG investment, the growth of the passive market means that ESG index will play an essential role in asset allocation.

In addition to index companies and exchanges, some research institutions also launches different types of ESG indices.

ESG Indices Classification

The categories of ESG indices are similar to ESG investment methods, and methods such as negative screening, positive screening, and thematic investment can all be used for index construction.

Exchanges and index companies are the main groups providing ESG indices, which may be used for passive asset allocation in the future and become financial products.

Nasdaq Carbon Academy Launches Five Free Carbon Courses

Nasdaq Carbon Academy launches five free carbon courses aimed at helping users understand and utilize the carbon market

Institutional Investors Group on Climate Change Releases Net Zero Transition Index Investing Report

Institutional Investors Group on Climate Change (IIGCC) releases Net Zero Transition Index investing Report

Shenzhen Stock Exchange Adds ESG Negative Screening Rules to ChiNext Index

Shenzhen Stock Exchange announces the inclusion of ESG negative screening rules in ChiNext Index

Shanghai Stock Exchange Includes ESG Ratings in SSE 180 Index

SSE releases a new version of the compilation plan for the SSE 180 Index, which includes ESG ratings in the selection method

Bloomberg Launches Government Climate Tilted Bond Indices

Bloomberg launches the Government Climate Tilted Bond Indices, aiming to provide new benchmarks for the low-carbon transition

Morningstar Launches Low Carbon Transition Leaders Indexes

Morningstar launches the Low Carbon Transition Leaders Indexes to help investors allocate funds to companies leading transition

S&P Launches Two Biodiversity Indices

S&P Dow Jones Indices launches two biodiversity indices

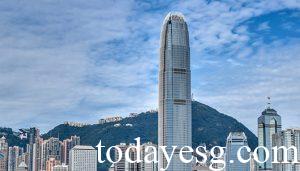

Hang Seng Indexes Company Launches Four ESG Indices

Hang Seng Indexes Company launches four ESG indices to provide the market with more sustainable investment options