ESG Fund Classification System

The CFA Institute Research and Policy Center releases a report on the ESG fund classification system, aiming to summarize the global ESG fund classification methods and propose a new ESG fund classification system.

The CFA Institute believes that since ESG was used in fund names in 2010, investors, asset management companies, and regulators have been defining and clarifying the meaning of ESG funds, but the market has not yet reached a consensus.

Related Post: Introduction to Sustainable Investment Classification Method Released by Eurosif

Common Explanations for ESG Fund Naming

There are usually three explanations in the market regarding why funds are named ESG funds:

Firstly, ESG funds are funds that engage in ESG investments, which is like the explanation that stock funds are funds that invest in stocks, i.e. ESG appears as a modifier for fund investment portfolios. However, stocks are a common asset class and ESG is not an asset, so ESG funds are considered to have an ESG focus on asset selection and portfolio building. Although this concept aligns with the views of some investors, its definition has a large explanatory space and cannot meet regulatory and research needs.

Secondly, ESG funds are funds that have a positive impact on the environment and society. This view holds that ESG funds need to exclude assets that have a negative impact on the environment and society, and that environmental and social measurement standards should coexist with fund risk return measurement standards. What is a positive impact? How to measure positive impact? These issues do not yet have a consistent standard in practical operation, and different investors’ perspectives can also have divergent impacts.

Thirdly, ESG funds are funds that consider ESG information, issues, and conditions. This type of definition does not express expectations for ESG fund investment targets, nor does it make judgments about the fund from an environmental and social perspective. This type of explanation includes the explanations of the two types of ESG funds mentioned above. After considering ESG information, issues, and conditions, these funds may reduce investment risks and may also have a positive impact on the environment and society.

The CFA Institute believes that among the three different interpretations mentioned above, the third one has the widest scope and does not have the shortcomings of vague boundaries and value judgments. If a more detailed classification of ESG information, issues, and conditions can be made, a universally applicable ESG fund classification system can be proposed.

Existing ESG Fund Classification Systems

The CFA Institute analyzes existing ESG fund classification systems to understand their characteristics and help in designing new ESG fund classification systems. These ESG fund classification systems include the EU Sustainable Finance Disclosure Regulation, US Enhanced Disclosures by Certain Investment Advisers and Investment Companies about Environmental, Social, and Governance Investment Practices for Specific Investments, and UK Sustainability Disclosure Requirements and Investment Labels.

The EU Sustainable Financial Disclosure Regulation aims to provide sustainability related information to the market. Although EU regulators do not plan to classify it as a fund classification system, the market has already classified funds as non-sustainable Article 6 funds, light green Article 8 funds, and dark green Article 9 funds. This classification method measures the degree of fit of funds for sustainable development, but its classification is based on the sustainable impact of the fund (no impact, low impact, and high impact), rather than the classification method that CFA Institute hopes to design considering ESG information, issues, and conditions.

The Enhanced Disclosures by Certain Investment Advisers and Investment Companies about Environmental, Social, and Governance Investment Practices for Specific Investments in the United States has been proposed by the Securities and Exchange Commission and is still in the development stage. This rule defines three different types of funds, including Integration Funds, ESG Focused Funds, and Impact Funds. When the fund meets the characteristics of the corresponding type, disclosure also needs to be completed as required. This classification method is in line with the fund classification system that CFA Institute hopes to design, where the definitions of integrated funds and ESG key funds are mutually exclusive, while ESG key funds and impact funds may coexist.

The UK’s sustainability disclosure requirements and investment labels are proposed by the UK Financial Conduct Authority, which divides funds into Sustainability Focus, Sustainability Improvers, Sustainability Impact, and Sustainability Mixed Goals. Each fund can only have one label, and this classification applies only to products seeking positive sustainable development outcomes, which is smaller than the classification system that CFA Institute hopes to design.

CFA Institute ESG Fund Classification System

After considering the existing ESG fund classification systems, CFA Institute proposes three features for classifying funds that consider ESG information, issues, and conditions:

- Feature 1: There are one or more processes that consider ESG information aimed at improving risk adjusted returns. This feature indicates that the fund incorporates ESG information into the analysis and decision-making process but does not guarantee the degree of impact of ESG information on the fund. This feature only promises to consider ESG information and ensure that ESG risks and opportunities are adopted.

- Feature 2: There is one or more policies that increase or decrease the exposure of fund investors to specific system ESG issues. This feature indicates that investors can choose funds that are suitable for their needs and preferences, which have specific ESG exposures, but the funds only promise to act on ESG matters, but do not guarantee environmental and social impact.

- Feature 3: There is a clear intention statement or action plan aimed at achieving future environmental and social goals and measuring progress. This feature can help investors achieve their environmental and social goals but does not assume a priority relationship between these impacts and the fund’s investment returns.

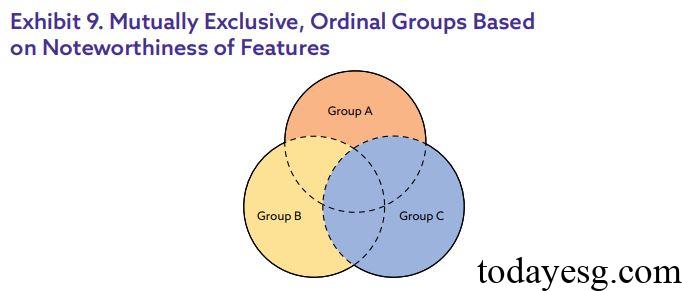

Based on the above three characteristics, CFA Institute divides ESG funds into three different groups:

- Group A consists of one component, which is a fund with only feature 1.

- Group B consists of two parts, namely funds with only feature 2 and funds with feature 1 and feature 2 but without feature 3.

- Group C consists of four parts: funds with only feature 3, funds with features 2 and 3 but without feature 1, funds with features 1 and 3 but without feature 2, and funds with features 1, 2, and 3.

For different investors, the ESG fund classification system of CFA Institute is suitable for:

- Group A: Investors who do not invest based on ethical needs and preferences.

- Group B: Investors who do not wish to achieve specific environmental or social future goals, but still hope that the fund will have an impact on systemic ESG issues.

- Group C: Investors who hope to invest in a state that helps achieve specific environmental and social future goals.

The CFA Institute analyzes the relationship between existing ESG investment classification methods and ESG fund classification systems:

- Group A: ESG integration.

- Group B: Negative screening, positive screening, norm-based screening, ESG index, ESG themed investing, proactive management, stewardship.

- Group C: Impact investment, community investment.

The CFA Institute will continue to provide a more detailed classification for feature 2 in future research and consider extending its applicability from funds to other financial assets and invite market participants to provide feedback on the testing results of the fund classification system.

Reference:

How to Build a Better ESG Fund Classification System

Contact:todayesg@gmail.com