ESG Thematic Due Diligence Scores

RepRisk, an international ESG product provider, releases the world’s first ESG thematic Due Diligence Scores, aimed at helping market participants quickly and effectively assess ESG risks in companies.

As regulatory requirements for sustainable information disclosure gradually mature, companies need to identify, avoid, and reduce the risks caused by their business activities while disclosing ESG information. The EU has previously approved the Corporate Sustainability Due Diligence Directive, which requires companies to strengthen governance and reduce negative externalities to the environment and society.

Related Post: The EU Adopted Corporate Sustainable Due Diligence Directive

Introduction to ESG Thematic Due Diligence Scores

RepRisk is a globally renowned ESG product provider that applies machine learning technology to the ESG field. It has the world’s largest ESG database and a leading position in ESG risk data. RepRisk’s users include banks, asset management companies, and regulatory agencies. For example, the European Banking Authority uses the ESG risk database provided by RepRisk to analyze the greenwashing problem in the European banking industry to determine which entities are facing controversies.

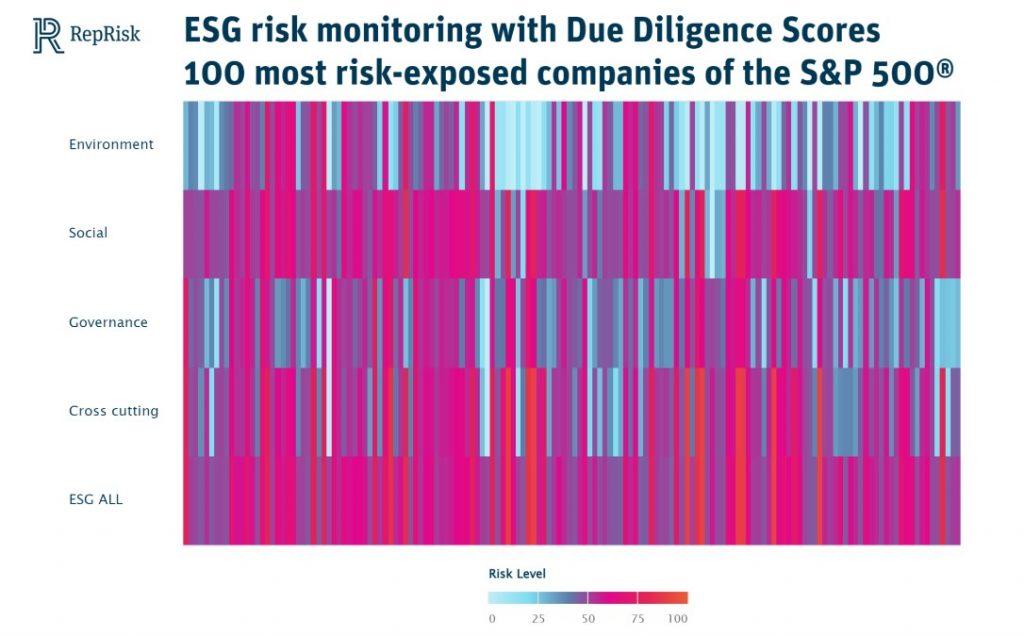

The basic data for the thematic Due Diligence Scores also comes from RepRisk’s ESG risk database, which provides due diligence scores for a company in environmental, social, and governance aspects, as well as under regulatory frameworks such as the United Nations Sustainable Development Goals and the Sustainability Accounting Standards Board. These due diligence scores range from 0 (low risk) to 100 (high risk), allowing users to understand where the company’s ESG risk primarily exists.

For example, RepRisk uses Due Diligence Scores to analyze 100 listed companies with higher ESG risk in the S&P 500 index, and classified these companies into different risk levels. From the chart, we can see that the ESG risks of most listed companies mainly exist at the social aspect, followed by the governance and environmental aspects. For listed companies, using these data can determine where the company has room for improvement. For investors, using these data can simplify due diligence work.

Reference:

RepRisk Launches Industry-first Thematic Due Diligence Scores

Contact:todayesg@gmail.com