Global ESG Funds Report

The Institute for Energy Economics and Financial Analysis (IEEFA) releases a global ESG funds report aimed at analyzing the investment performance and cash flows of ESG funds relative to traditional funds in recent years.

Despite controversies in the market regarding ESG investments, the demand for ESG fund allocation from investors continues to grow as regulatory authorities prioritize sustainability issues. The global ESG fund management scale has reached nearly $3 trillion, but at the same time, the attention to greenwashing is also constantly increasing.

Related Post: PwC Releases Annual Report on European ESG Funds

Investment Performance of ESG Funds

The median investment return of ESG funds in 2023 is 12.6%, while the median investment return of traditional funds is 8.6%, and the result is robust in equity funds, fixed income funds, and multi-asset funds. ESG funds have a relatively low investment proportion in the energy industry. Except for the rise in energy prices in 2022, which resulted in traditional funds having higher investment returns than ESG funds, ESG funds have outperformed traditional funds in investment returns in recent years. This fact also indicates that the view that ESG funds are not performing as well as traditional funds needs further investigation.

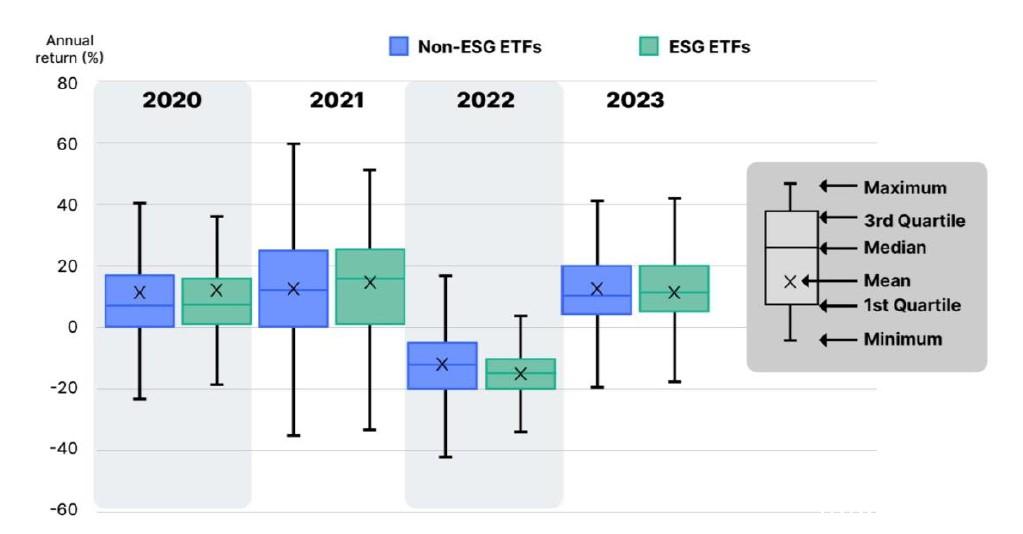

The Institute of Energy Economics and Financial Analysis analyzes the investment returns of ESG ETFs and traditional industry ETFs, and finds that the higher investment returns of ESG funds are still applicable in the field of passive investment. The median investment return of ESG ETFs in 2023 is 10.5%, which is higher than the median investment return of traditional ETFs of 10.1%. This performance also occurred in 2020 and 2021, with only a reversal in 2022. ESG funds which prefer the clean energy industry have higher investment returns than traditional funds which prefer the traditional energy industry.

ESG Funds Inflows and Outflows

Since 2020, global ESG funds have continuously received inflows of funds, with a net inflow of over $600 billion in 2021 and a decrease in net inflows in 2022 and 2023. In the fourth quarter of 2023, global ESG funds experienced a brief net outflow of funds, with the size of approximately $88 million.

From the perspective of regions, in the first quarter of 2024, European ESG funds had a net inflow of $10.9 billion, US ESG funds had a net outflow of $8.8 billion, and Asian ESG funds had a net inflow of approximately $100 million. The flow of funds in different regions reflects their differences in sustainable investment preferences. For example, 18 states in the United States have issued regulatory policies to boycott ESG investments, restricting asset owners from considering ESG factors in investment decisions.

84% of global ESG funds are located in Europe, followed by the United States (11%) and Asia (2%). Therefore, despite some resisting ESG investments, global ESG funds still receive cash inflows.

ESG Funds in Asset Managers and Asset Owners

As regulatory agencies gradually focus on sustainable risks such as climate change, the demand for ESG funds in the market is also continuing to grow. Regulatory policies require companies to disclose sustainable data in standardized formats, so the cost of tracking and managing sustainable investments will decrease, and the transparency of ESG funds will also increase. The European Union released a consultation paper on the Sustainable Finance Disclosure Regulation in May this year, planning to raise the certification threshold for Article 8 and Article 9 funds in the future to reduce greenwashing risk in the asset management industry.

As asset managers are increasingly influenced by regulatory policies, asset owners have incorporated ESG into their investment decision-making processes. According to data from the United Nations Principles for Responsible Investment, 59% of asset owners have included climate change in their scenario analysis, a higher proportion than asset managers (34%). 79% of asset owners have considered both sustainable and financial outcomes as investment returns. Asset owners usually consider outsourcing some of their money to asset managers, and the investment activities of asset managers should meet the expectations of asset owners.

Reference:

ESG Investing: Steady Growth Amidst Adversity

Contact:todayesg@gmail.com