Individual Investor Sustainable Investment Report

Morgan Stanley Institute for Sustainable Investing releases 2025 Individual Investor Sustainable Investment Report, which aims to analyze individual investors’ attitudes and actions towards sustainable investment.

Morgan Stanley surveys over 2000 individual investors in North America, Europe, and the Asia Pacific region to reflect global trends in sustainable investment development.

Related Post: Morgan Stanley Releases 2024 Sustainable Investment Report

Individual Investor Sustainable Investment Attitude

88% of global respondents express interest in sustainable investment, with decreasing proportions in Asia Pacific (92%), Europe (88%), and North America (84%). Young investors have a more friendly attitude towards sustainable investment, with only 72% of investors over the age of 50 interested in sustainable investment, while over 97% of investors under the age of 30 are interested in sustainable investment. Morgan Stanley compares this survey with a survey two years ago and finds that investors’ overall attitudes remained largely unchanged.

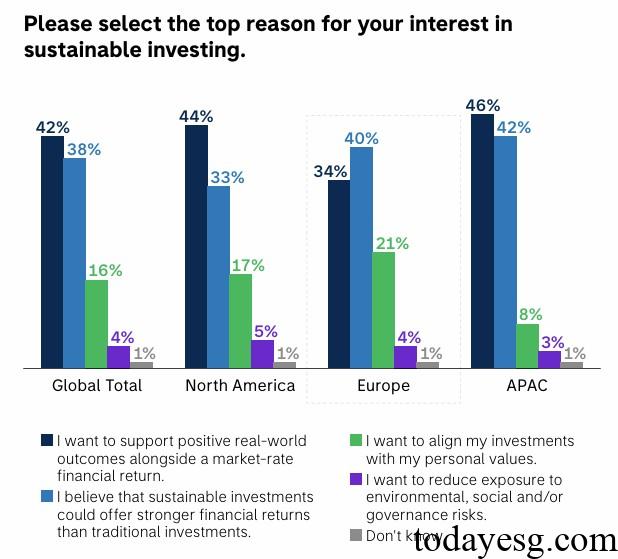

On the question of why choose sustainable investment, 42% of investors hope to have a positive impact on the world while achieving financial returns, 38% of investors believe that sustainable investment can bring higher investment returns than traditional investment, 16% of investors believe that sustainable investment is consistent with their values, and 4% of investors hope to reduce environment, social and governance risks in their investments.

In terms of the relationship between sustainability and financial performance, 85% of investors believe that the two can be balanced, and 83% believe that companies can generate positive environmental and social impacts without affecting profitability. This indicates that investors do not believe that sustainability requires sacrificing financial returns. Investors believe that companies should address environmental issues (88%) and social issues (80%), with over 70% of investors stating that they will pay attention to sustainable actions of investees in their investment decisions.

Individual Investor Sustainable Investment Allocation

Individual investors around the world have similar sustainable investment allocations, with over one-third of respondents planning to invest 20% to 50% of their total funds in sustainable assets, and 13% planning to invest more than half of their funds in sustainable assets. Young investors have a higher investment inclination. More than half of investors plan to increase their sustainable asset allocation next year, with over 75% of young people planning to increase their sustainable asset allocation.

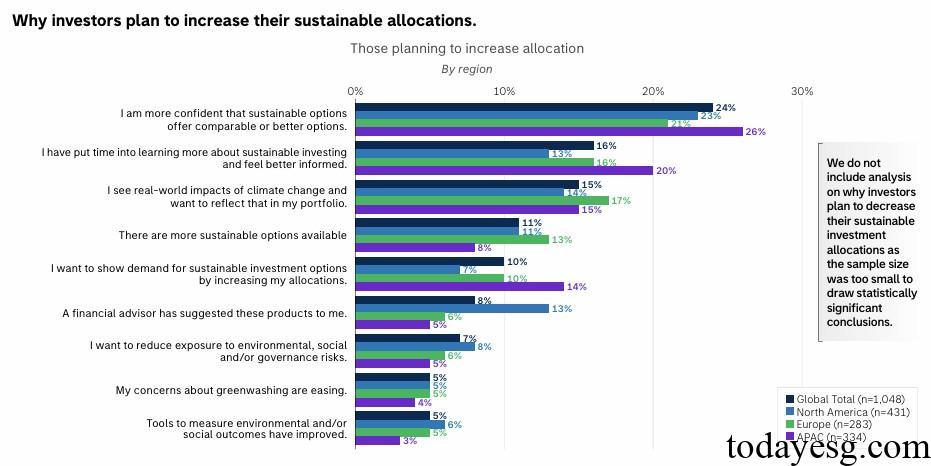

In terms of the reasons for allocating sustainable assets, 24% of investors believe that their investment returns are higher, 16% of investors hope to learn more about sustainable investment knowledge, and 15% of investors hope to reduce the impact of climate change. Regarding the reasons for choosing not to increase sustainable investment, 26% of investors are satisfied with their existing investment portfolio, 15% believe that sustainable investment returns fluctuate greatly, 13% are concerned about greenwashing risks, and 12% of investors are concerned about changes in sustainable regulatory policies.

Individual Investor Sustainable Investment Themes

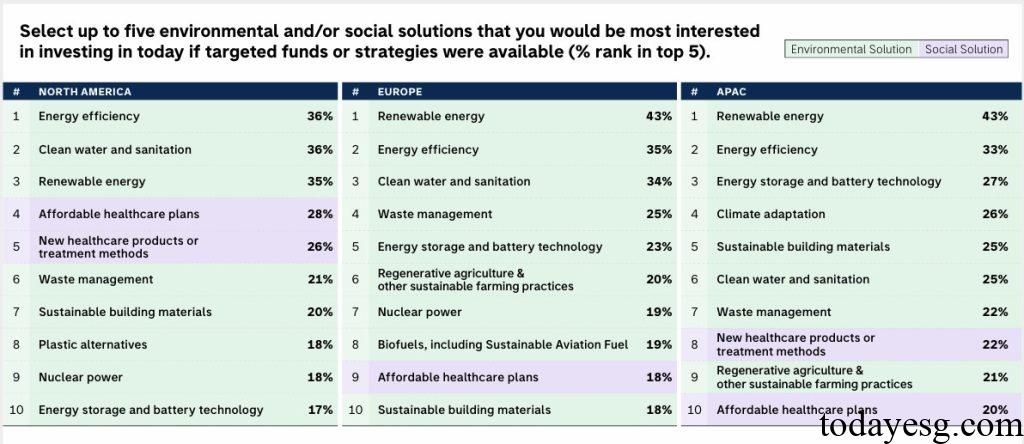

Global individual investors are most interested in renewable energy and energy efficiency, followed by clean water and sanitation facilities, energy storage, and battery technology. These sustainable investment themes indicate that investors are more concerned about environmental and social impacts. Among the expected investment outcomes, reducing pollution and waste is the top priority in all regions, followed by reducing greenhouse gas emissions. In general, social issues rank lower than environmental issues.

Investors have a relatively high level of attention to climate investment strategies, with 67% believing that climate goals should be prioritized and 84% believing that investments in clean energy transition should be made. 40% of investors hope to purchase carbon offsets for their investment portfolios to reduce the impact of climate change.

Reference:

Individual Investor Interest in Sustainable Investing Remains Strong

Contact:todayesg@gmail.com