2025 Q1 Global Sustainable Fund Report

Morningstar releases 2025 Q1 Global Sustainable Fund Report, which aims to summarize changes in sustainable fund liquidity, asset size, and issuance.

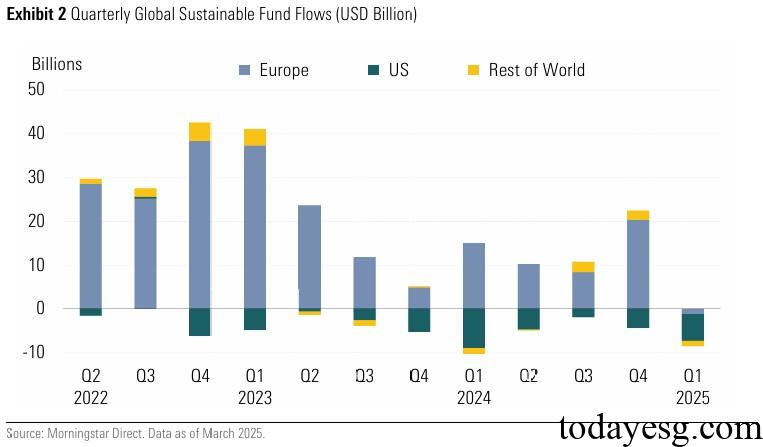

In 2025 Q1, the global sustainability fund recorded a record high outflow of $8.6 billion. The main reason is the relaxation of sustainable regulations and the increasing ESG resistance.

Related Post: Morningstar Releases 2024 Asset Owner ESG Survey Report

Global Sustainable Development Fund

The total size of global sustainable funds in 2025 Q1 is 3.16 trillion USD, with 7428 funds and an average size of 425 million USD per fund. In the fourth quarter of 2024, sustainable funds recorded a net inflow of $18.1 billion, while this quarter recorded a net outflow of $8.6 billion. This outflow mainly comes from the United States ($6.1 billion) and Europe ($1.2 billion), with the United States recording net outflows for the 10th consecutive quarter and Europe recording net outflows for the first time in 2018.

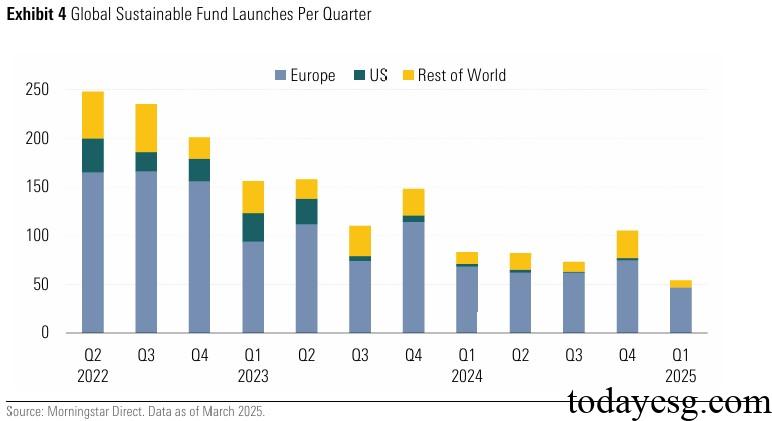

The global sustainable fund asset size decreased by 0.7% in 2025 Q1, lower than $3.18 trillion in the fourth quarter of last year. The total size of sustainable funds in Europe and the United States is $2.67 trillion and $329 billion respectively, accounting for 84% and 10% of the total market size. Against the backdrop of the continued slowdown in ESG development, a total of 54 sustainable funds were issued in the first quarter, hitting a historic low, and 105 sustainable funds were issued in the fourth quarter of 2024.

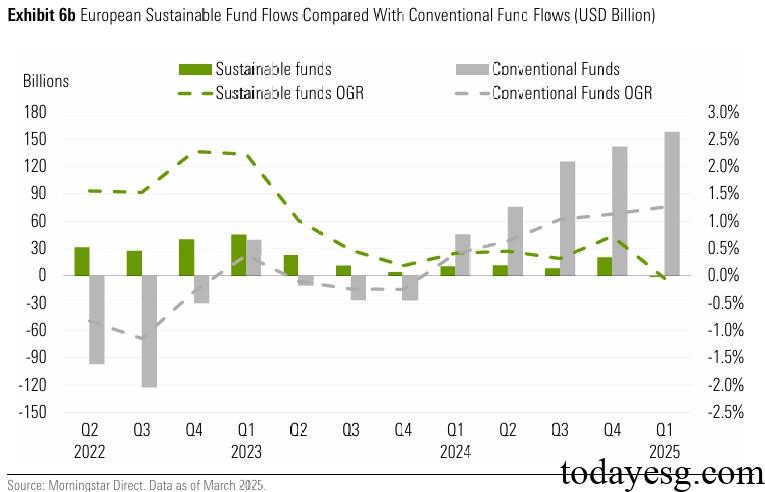

European Sustainable Fund Development

In 2025 Q1, the European Sustainable Fund saw an outflow of $1.2 billion, including $4.9 billion from actively managed funds and $3.7 billion from passively managed funds. The total capital flow was lower than that of traditional funds ($162 billion in the first quarter). The growth rate of the European sustainable fund is -0.05%, which is also lower than that of traditional funds (1.26%). Since 2022, the capital flow and growth rate of sustainable funds have both hit new lows in this quarter, while the capital flow and growth rate of traditional funds have both hit new highs.

The total size of the European sustainable fund in 2025 Q1 is 2.67 trillion USD, of which two-thirds are actively managed funds and one-third are passively managed funds. In the first quarter, a total of 47 sustainable funds were issued in Europe, reaching a historic low. Under the ESG fund naming rules and the Sustainable Finance Disclosure Regulation (SFDR), asset management companies are taking more cautious actions. In the first quarter, a total of 335 funds changed their names, of which 216 replaced ESG terms with other sustainable terms and 116 abolished ESG terms.

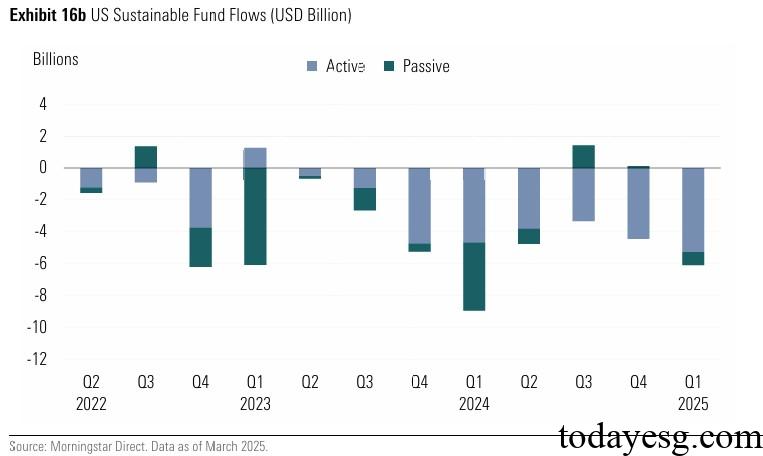

US Sustainable Fund Development

In 2025 Q1, the outflow of sustainable funds in the United States was $6.1 billion, an increase of 40% compared to the previous quarter. Among them, the outflow of actively managed funds was $5.2 billion, and the outflow of passively managed funds was $900 million. The growth rate of sustainable funds decreased from -1.3% to -1.8%, while the inflow of traditional funds was $138 billion, with a growth rate of 0.45%. The release of some anti ESG policies has led asset management companies to reduce their sustainability commitments and adopt a cautious attitude in their business.

In terms of asset categories, sustainable stock funds had an outflow of $6.3 billion and sustainable bond funds had an inflow of $380 million in the first quarter. The total size of sustainable funds in the United States in 2025 Q1 was $329 billion, a decrease of 4% compared to the previous quarter. There were no sustainable fund issuances this quarter, and 20 sustainable funds were closed.

Reference:

Global Sustainable Fund Flows: Q1 2025 in Review

Contact:todayesg@gmail.com