2025 Green Economy Investment Report

The London Stock Exchange Group (LSEG) releases 2025 Green Economy Investment Report, which aims to analyze the size, growth, and financial performance of the global green economy across different asset classes.

The London Stock Exchange believes that the world needs to invest a total of $109 trillion to $275 trillion in the green economy industry by 2050 to achieve long-term climate change goals.

Related Post: London Stock Exchange Group Releases Global Green Economy Investment Report

Current Status of Green Economy

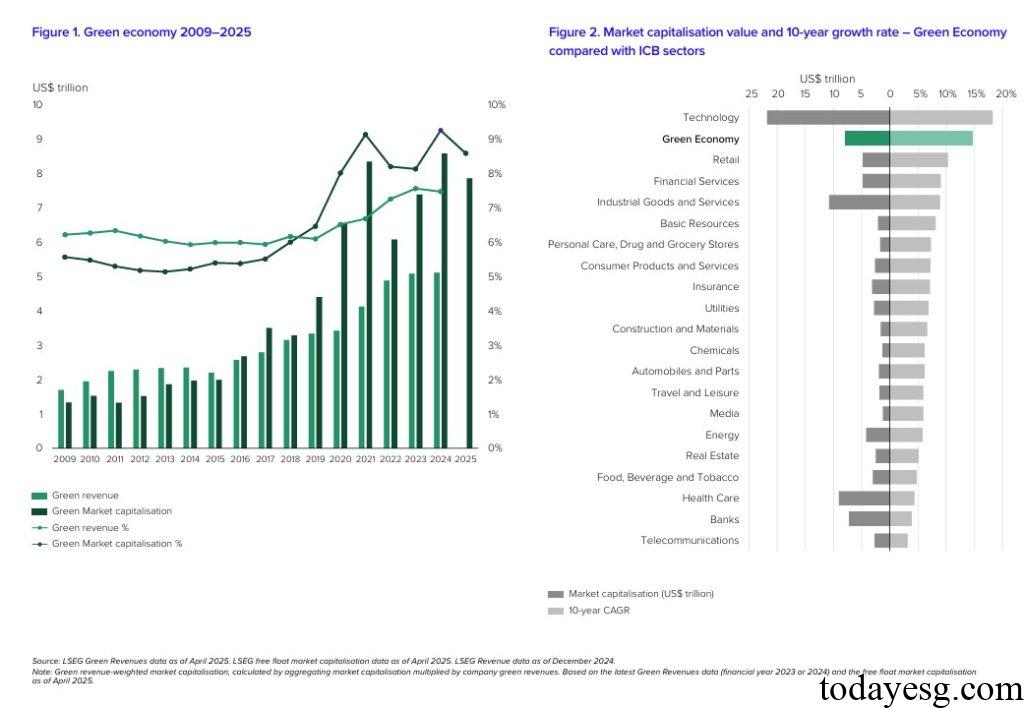

In 2024, the total global green economy revenue exceeded $5 trillion for the first time, with a compound annual growth rate of 15% over the past decade, only lower than the technology industry’s 18%. As of the first quarter of 2025, the global green economy accounts for 8.6% of the total assets of listed companies, with a market value of $7.9 trillion, only lower than the technology, industrial, and healthcare industries.

Excluding the stock assets of listed companies, the green economy is developing rapidly in the bond sector, with an annual issuance of $572 billion in the green bond market in 2024, a year-on-year increase of 10%. As of the first quarter of 2025, the outstanding amount of global green bonds is $2.9 trillion.

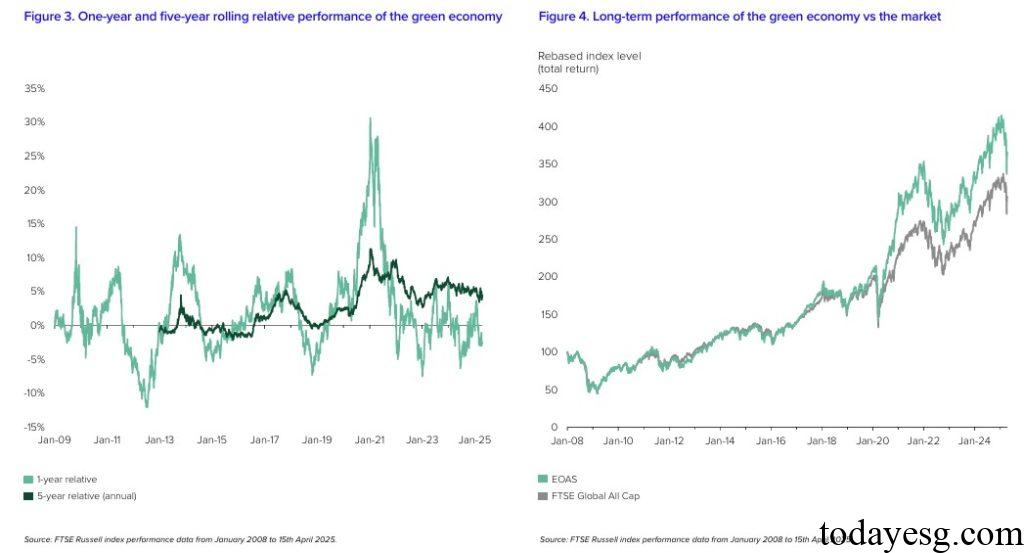

Although the green economy has a long-term development trend, it is still affected by short-term fluctuations. Taking the FTSE Environmental Opportunities All Share Index as an example, the volatility of the index in the past year is significantly higher than that in the past five years (whether it is rising or falling). However, the index has an annualized return rate of 5.6% over the past five years, with an excess return rate of 59% since 2008.

Different Asset Classes in Green Economy

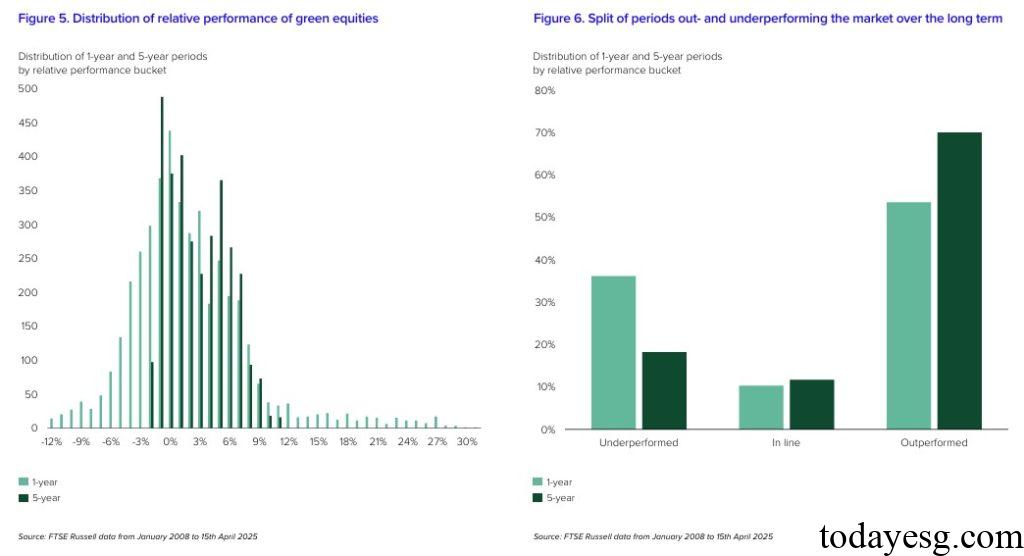

The categories of green economy assets include stocks, bonds, funds, commodities, infrastructure, etc., among which stocks, bonds, and funds have larger scales. The investment characteristics of green stocks and green bonds are different. Green stocks have greater volatility relative to the market (usually with a beta greater than 1), while green bonds have lower volatility compared to other bonds. Taking the FTSE Environment Opportunity All Share Index as an example, there are more positive excess returns and fewer negative excess returns in its one-year excess performance.

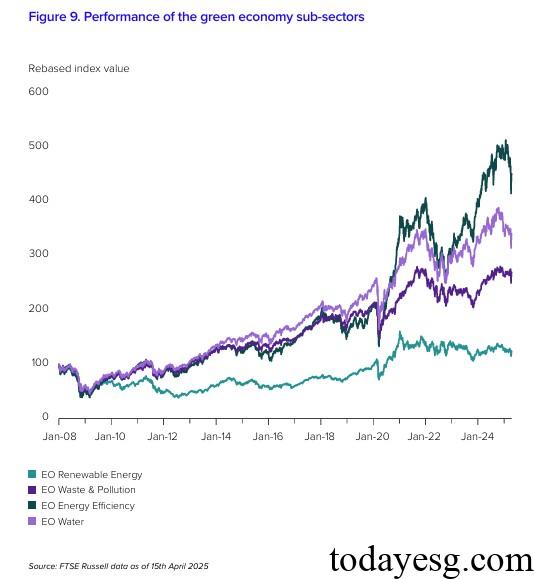

In the past decade, the performance of the green economy industry has only been lower than that of the technology industry. Within the green industry, the energy efficiency sector, water resources sector, and pollution sector have higher investment returns, while the renewable energy sector performs relatively weakly. This may be due to factors such as interest rate levels, government subsidy policies, and market competition environment.

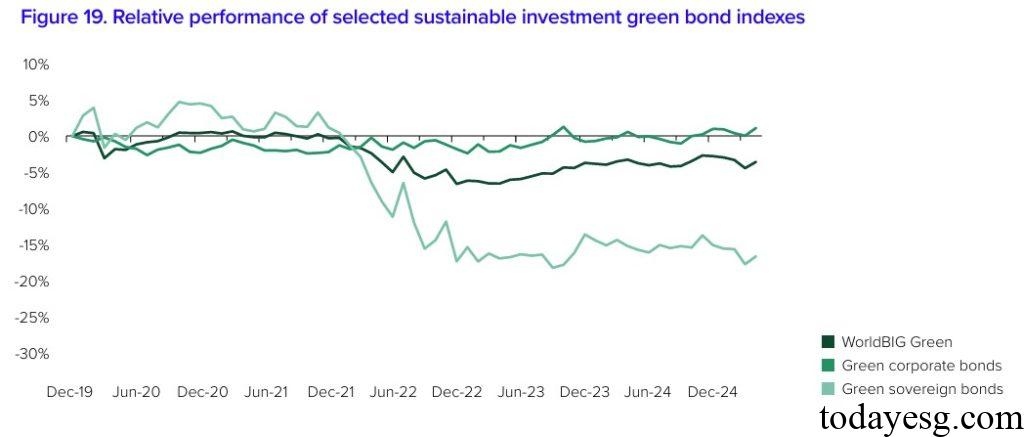

In 2024, the issuance of green bonds in the industry reached a historic high, but the proportion of total bond issuance was only 4.5%. Corporate issuers are the largest issuers, accounting for two-thirds. The global issuance of green bonds in the first quarter of 2025 was $146 billion, a year-on-year decrease of 13%. The overall performance of green bonds is like other bonds, with green sovereign bonds showing relatively weaker performance due to their longer duration and they face greater impact in an environment of rising interest rates.

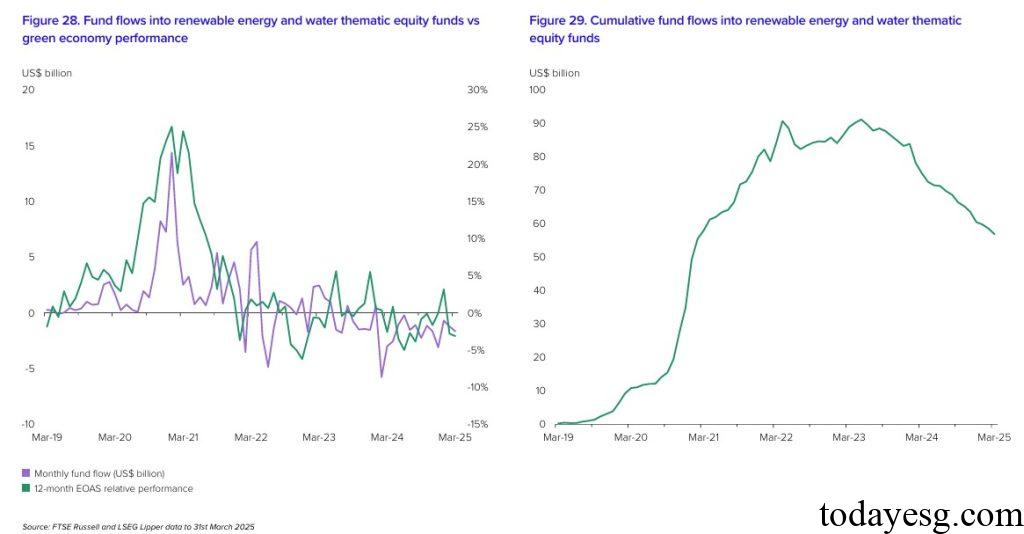

Green funds are an emerging investment theme, with a high proportion of funds related to alternative energy and water resources. As of the first quarter of 2025, the total asset size reached 74 billion US dollars, a decrease of nearly 20 billion US dollars from the historical peak in 2022. There are differences in the proportion of green income among different green funds. Taking the investment labeling system proposed by the Financial Conduct Authority in the UK as an example, the London Stock Exchange Group investigated the proportion of green income among funds with different investment labels and found that the Sustainability Focus fund had the highest proportion of green income.

Reference:

Investing in the Green Economy 2025: Navigating Volatility and Disruption