Global Green Economy Investment Report

The London Stock Exchange Group (LSEG) releases a global green economy investment report, aimed at analyzing the development of the global green economy and the performance of different green asset classes.

The London Stock Exchange Group believes that as the core of climate and environmental solutions, the global green economy is one of the biggest investment opportunities of the 21st century in terms of scale, growth trajectory, and financial performance.

Related Post: Common Terms of Green Finance and ESG (Continuous Updating)

Introduction to Global Green Economy

The London Stock Exchange analyzes the global green economy as a separate sector, with a market value of over $7 trillion in 2023, only below the healthcare, industrial, and technology industries. The global green economy has achieved an average annual growth rate of 13.8% over the past decade, which is higher than the average level (8.3%) and second only to the technology industry. The average annual growth rate of green economy income has reached 7.6%, which is also higher than the global average level (5.3%).

The global green economy involves over 50 developed and emerging market economies, with the United States accounting for 60% of the total market value of the green economy due to its large stock market size. If measured by green economy exposure (i.e. the proportion of green economy in the entire economy), the green economy exposure of the United States is 9%, while Germany, Canada, and China, although having smaller green economy sizes, have higher green exposure than the market average.

Despite the impact of supply chain disruptions and rising interest rates on the global green economy, the global green market value has accounted for 9% of the total global market value in the first quarter of 2024 and has become a strategic development focus for various jurisdictions. In the global green economy, the green energy management industry has performed the best, with a growth rate of 17% in the past five years. At present, the green energy management industry accounts for 46% of the total market value of green economy stocks and 30% of the total market value of green economy bonds.

Global Green Economy Investment Performance

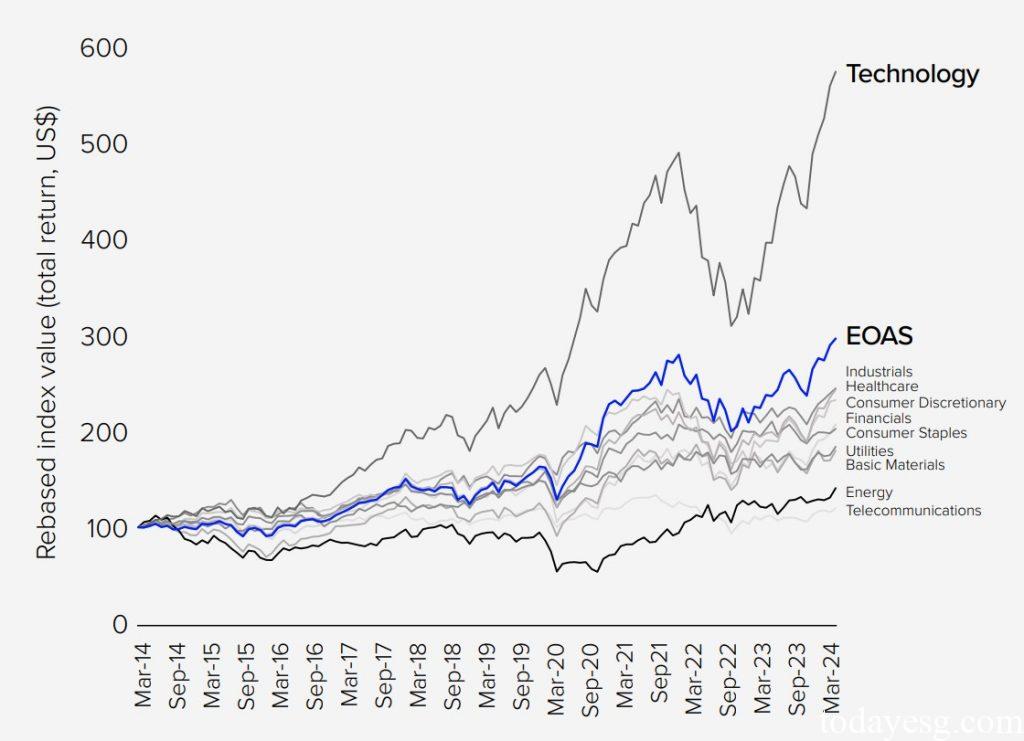

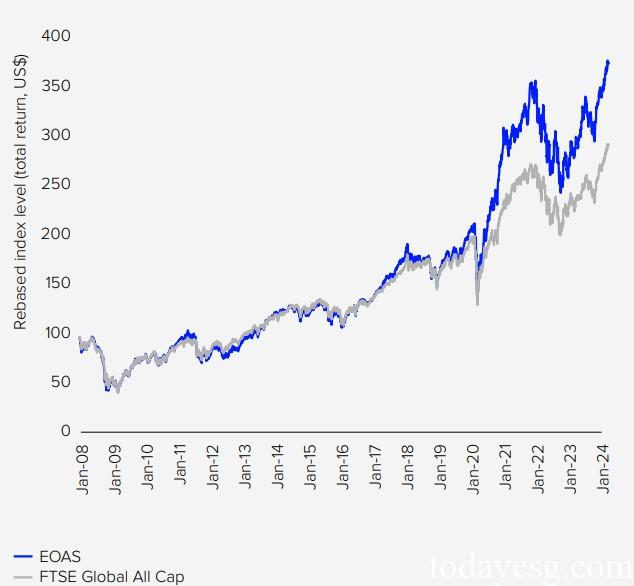

The FTSE Russell Environmental Opportunities All Share Index represents the industry’s performance in measuring the green economy. In 2023, the index rose by 32%, outperforming the FTSE Global All Cap Index. Since 2008, the FTSE Russell Environment Opportunity All Share Index has outperformed the FTSE Global All Share Index by 82% and performed the best in 2020 and 2021. The high interest rate environment in 2022 has led to poor performance of the technology industry in the index, but with the increasing market demand in the green economy in the past two years, the index has resumed its upward trend.

The investment performance of the Green Economy Index is better than that of the benchmark index, which is closely related to the allocation effect and selection effect. The allocation effect refers to the stronger industry allocation in the green economy index compared to the industrial, technological, and utility industries, while the selection effect refers to the inclusion of companies that meet the characteristics of the green economy in these industries. Based on performance analysis over the past decade, the selection effect contributes 80% to the green economy index, while the allocation effect contributes 20%.

Green Economy and Global Bond Market

The global issuance of green bonds in 2023 is $540 billion, an increase of 7% compared to 2022, but still 5% lower than the peak volume in 2021. As of the first quarter of 2024, the total amount of existing green bonds reached $2.5 trillion, of which 82% came from developed economies. Although the existence of green bonds accounts for only 2% of the total global bond market, the size of newly issued green bonds each year accounts for 6% of all newly issued bonds.

Despite the rapid growth of the green bond market in the past decade, bond financing for carbon intensive economic activities is still on a larger scale. The global issuance of carbon intensive industry bonds in 2022 is $1.4 trillion, which is 2.5 times the issuance of green bonds. With the acceleration of low-carbon transition in the future, this gap may decrease in the future.

Reference:

Investing in the Green Economy 2024: Growing in a Fractured Landscape

Contact:todayesg@gmail.com