This article introduces the incentive mechanism of carbon pricing tools for carbon reduction.

Carbon pricing tools set clear prices for greenhouse gas emissions, enabling companies to internalize emission costs. Carbon pricing tools can increase the cost of carbon intensive products and have an impact on production behavior and consumption activities.

Related Post: Net Zero Asset Owners Alliance Releases Position Paper on Governmental Carbon Pricing

Incentive Mechanism of Carbon Pricing Tools for Carbon Reduction

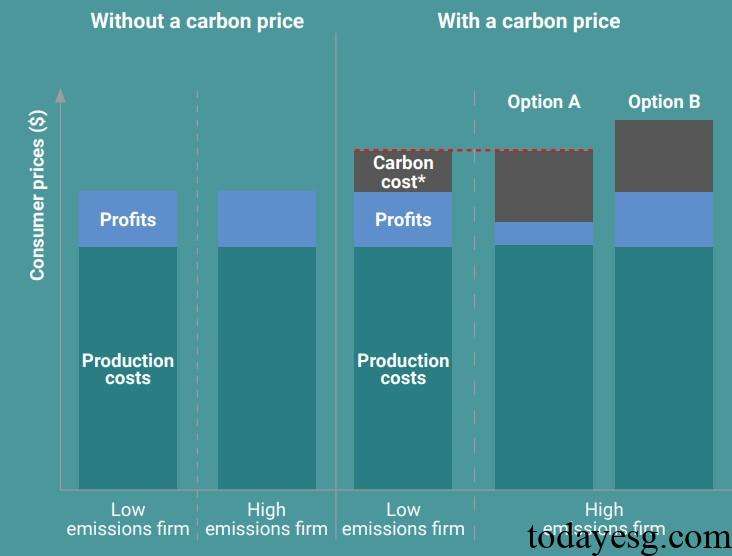

Carbon pricing tools mitigate the impact of production and consumption on the decisions of businesses and consumers. Assuming there are two companies in a certain industry that produce the same product, with company A having lower carbon emissions and company B having higher carbon emissions. Assuming that the production costs and profits of two companies are the same without carbon pricing tools.

After the incorporation of carbon pricing tools, both Company A and Company B need to bear additional costs based on their carbon emissions, with Company A bearing lower carbon emissions costs and Company B bearing higher carbon emissions costs. In this situation, the total production costs of both Company A and Company B will increase. Enterprise B has two options in this situation:

- Option 1, bear the cost of high carbon emissions, that is, maintain product prices and reduce product profits. For consumers, the product prices of Company A and Company B are the same, but the profit of Company B is lower than that of Company A.

- Option 2, transfer the cost of high carbon emissions to consumers by raising product prices and maintaining product profits. For consumers, the price of Company B’s product will be higher than that of Company A. Assuming that other characteristics of the product are the same, consumers tend to purchase Company A’s product.

For Company A, choosing to bear the cost of low-carbon emissions or transferring the cost of low-carbon emissions to consumers has a lower impact on both the enterprise itself and consumers than Company B. In the long run, the competitive advantage of Company A will be higher than that of Company B. Therefore, the incentives for carbon reduction through carbon pricing tools are reflected in the following aspects:

- Firstly, increase the competitive advantage of low-carbon emission enterprises.

- Secondly, encourage consumers to choose low-carbon emission products.

Compared to directly regulating carbon emissions of enterprises, carbon pricing tools are more efficient and can play a market regulatory role, making them more cost-effective. Carbon pricing tools can be divided into two categories: carbon emission trading systems and carbon taxes. The carbon emission trading system sets an upper limit on the total amount of greenhouse gas emissions and trades quotas through allocation and auction. Common carbon emission trading systems include the European Union Emissions Trading System (EU ETS), the China National Emissions Trading Scheme, and the California Cap and Trade Program.

The carbon tax requires companies to pay a fixed price per ton of greenhouse gas emissions, with relatively stable emission costs. There are also some tools that combine the characteristics of carbon emission trading systems and carbon taxes, known as hybrid carbon pricing tools. Some jurisdictions that impose carbon taxes allow companies to use carbon credits to offset the carbon emissions that should be included.

Reference:

Net-Zero Asset Owner Alliance’s Updated Position on Governmental Carbon Pricing