EU Emissions Trading System

This article introduces the representative of global compliance carbon market, the European Union Emissions Trading System (EU ETS). The EU Emissions Trading System is the world’s first large-scale carbon market and also the carbon market with the highest total trading value.

As an important component of the EU’s climate change strategy under European Green Deal, the EU Emissions Trading System aims to effectively reduce greenhouse gas emissions. The EU plans to reduce carbon emissions to 55% of 1990 levels by 2030 and achieve carbon neutrality by 2050.

Related Post: EU Deploys Revenues from Emission Trading System

Structure of EU Emissions Trading System

The EU Emissions Trading System includes governance, coverage, carbon offset, carbon allowance, and supply and demand relationships.

Governance: The EU Emissions Trading System has a multi-level governance framework, including the European Commission, EU member states, and regulators. The European Commission is responsible for managing the entire system, determining emission limits for participants, and formulating relevant laws. EU member states are responsible for daily management, translating EU directives into national laws, and managing quota allocation.

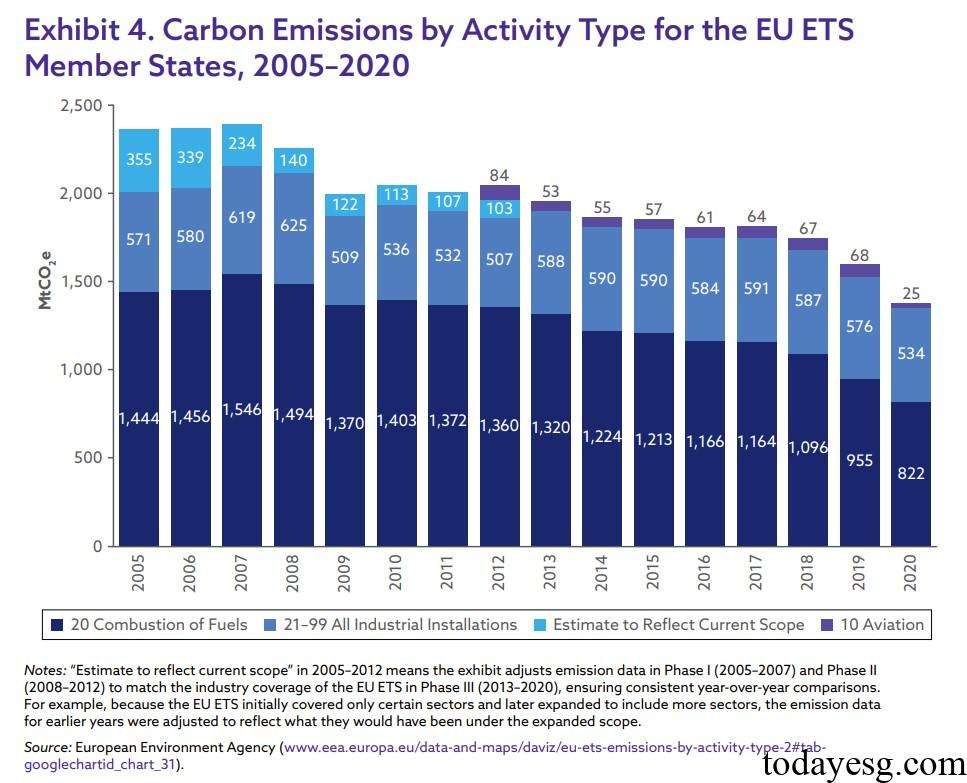

Coverage: The EU Emissions Trading System covers 27 EU member states and includes Iceland, Liechtenstein, and Norway through the European Economic Area Agreement. The emissions trading system covers over 11000 energy intensive facilities and covers major sources of greenhouse gases in Europe, such as electricity, heating, steel, aviation, and other industries. Since 2015, the total carbon emissions of some industries have decreased.

Carbon Offset: The EU Emissions Trading System initially allowed the use of Clean Development Mechanism carbon credits, but due to excessive quota supply and low prices, companies did not use any carbon credits. Subsequently, EU required that carbon credits can only offset a certain proportion of carbon emissions, and in 2015, EU no longer allowed carbon credits from the first commitment period of the Kyoto Protocol. In 2021, EU Emissions Trading System stopped accepting any carbon offsets.

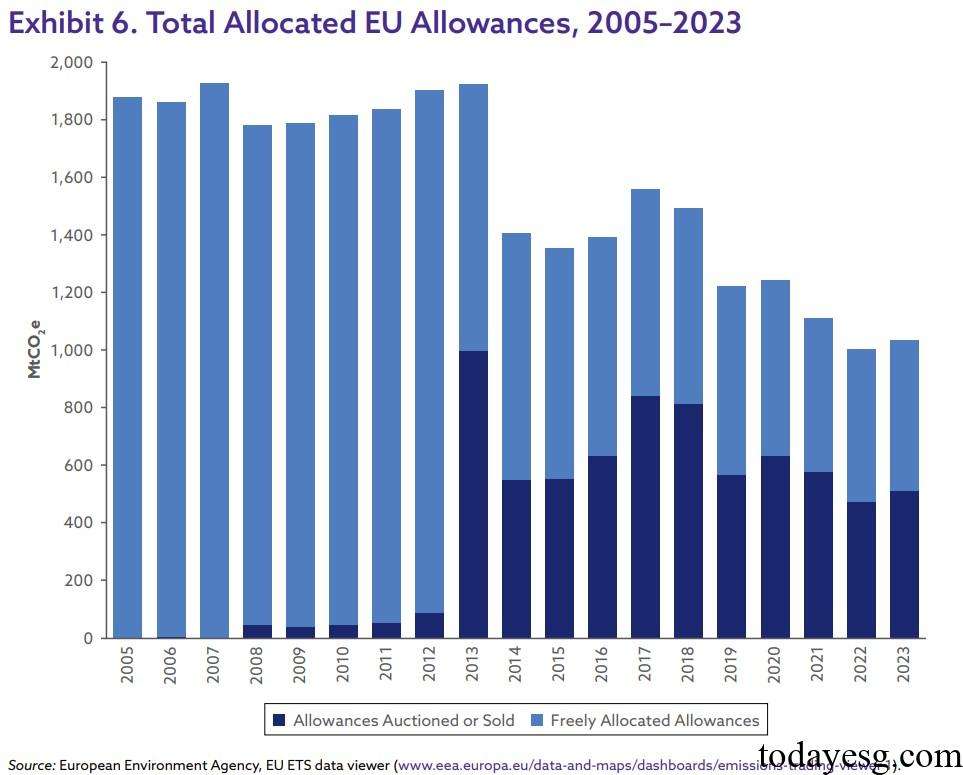

Carbon Allowance: EU carbon allowances are divided into two types: free allocation and auction and sale. Since 2005, the EU carbon emission system has gradually allocated carbon allowances through auction or sale. The early use of free allocation can reduce the burden on enterprises, and the subsequent shift to auction or sale can incentivize enterprises to participate in carbon reduction activities. Since 2013, the total amount of carbon emission permits has also been decreasing, due to reasons such as improved energy efficiency and the application of renewable energy. These changes indicate that the EU Emissions Trading System has played a role in reducing carbon emissions.

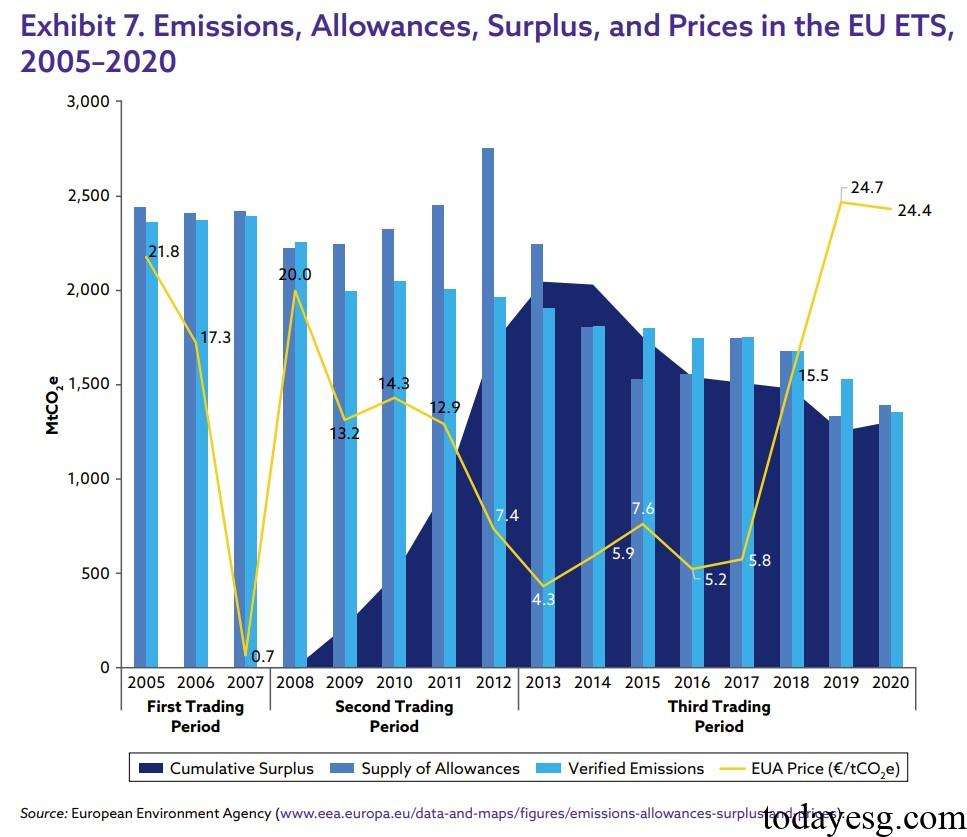

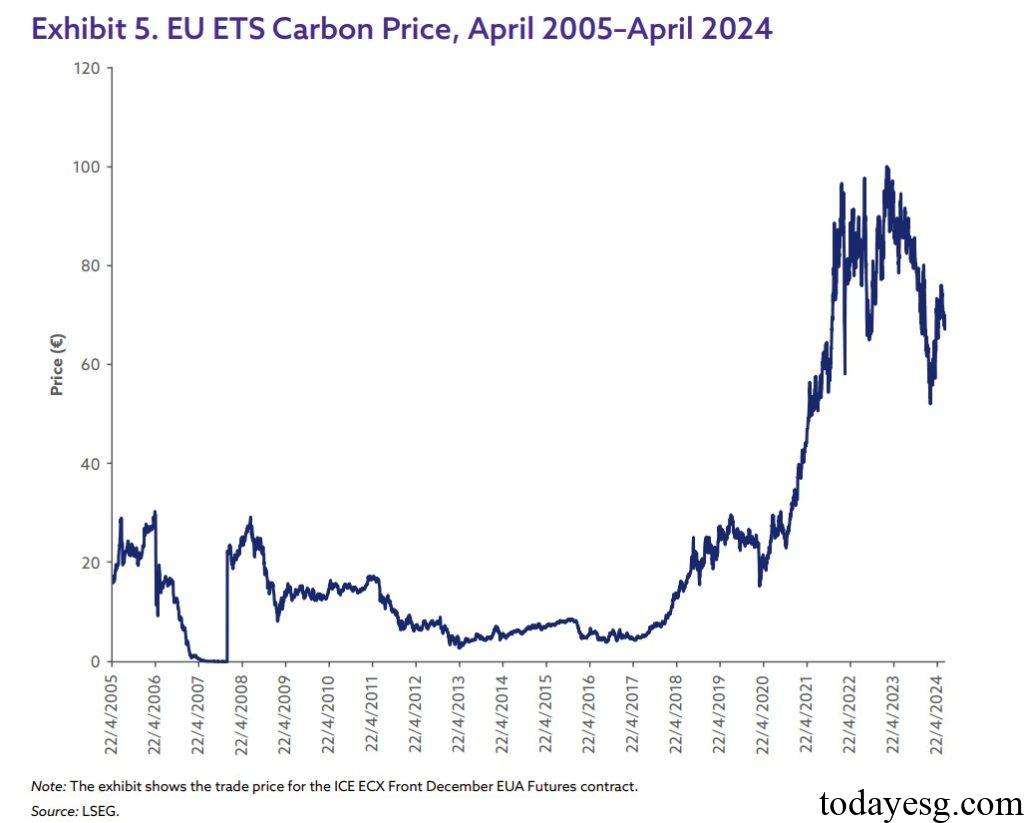

Supply and Demand: From 2005 to 2012, the supply of carbon quotas often exceeded carbon emissions, resulting in an oversupply in the market. Therefore, since 2008, carbon quotas have generated a significant surplus, leading to a decrease in carbon prices. Since 2013, the European Union has gradually lowered its carbon emission cap, resulting in a decrease in quota supply and a change in supply and demand, leading to an increase in carbon prices. Since 2018, the European Union has implemented measures to reduce its quota surplus and set stricter carbon emission targets, leading to a rapid increase in carbon prices.

Development Stages of EU Emissions Trading System

The EU Emissions Trading System can be divided into the following stages:

- Phase 1 (2005-2007): The EU launched a pilot carbon emissions trading system with the goal of establishing a carbon market and testing relevant mechanisms. All carbon quotas are distributed through free allocation, and quotas allow for free trading. Due to member states overestimating their actual carbon emissions, the total quota amount is significantly higher than the actual emissions, resulting in a sharp drop in quota prices.

- Phase 2 (2008-2012): The EU addressed supply issues by tightening quota limits and improving data accuracy, and expanded the scope of the carbon emissions trading system. The carbon emission cap for the second stage has decreased by 6.5% compared to 2005, and the quota price is more stable, subject to changes influenced by the EU’s economic and industrial activities.

- Phase 3 (2013-2020): The EU abolished individual countries’ carbon emission caps and introduced consistent emission caps, while offering some quotas to enterprises through auctions. In 2019, the European Union established the Market Stability Reserve, which aims to automatically adjust allowance supply through pre-defined price ranges in order to manage market allowance surpluses and enhance the ability to resist systemic risks.

- Phase 4 (2021-2030): The EU lowers its annual carbon emission cap by 2.2% and tightens the policy of free allocation to encourage businesses to reduce carbon emissions. The significant increase in carbon prices since 2020 reflects the policy actions of the EU ETS on emissions.

Reference:

A Foundational Overview of Global Carbon Markets

Contact:todayesg@gmail.com