Releases Report on Nature Risk Management for Financial Firms

Global Association of Risk Professionals (GARP) releases a report on nature risk management for financial firms, aiming to analyze the progress of nature risk management.

Global Association of Risk Professionals surveys 29 banks, 11 asset management companies, and 8 insurance companies worldwide, with a total asset value of $31 trillion.

Related Post: TNFD Releases Information Disclosure Guidance for Financial Institutions

Progress in Nature Risk Management for Financial Firms

The survey on nature risk management of financial firms includes six dimensions, namely:

Governance

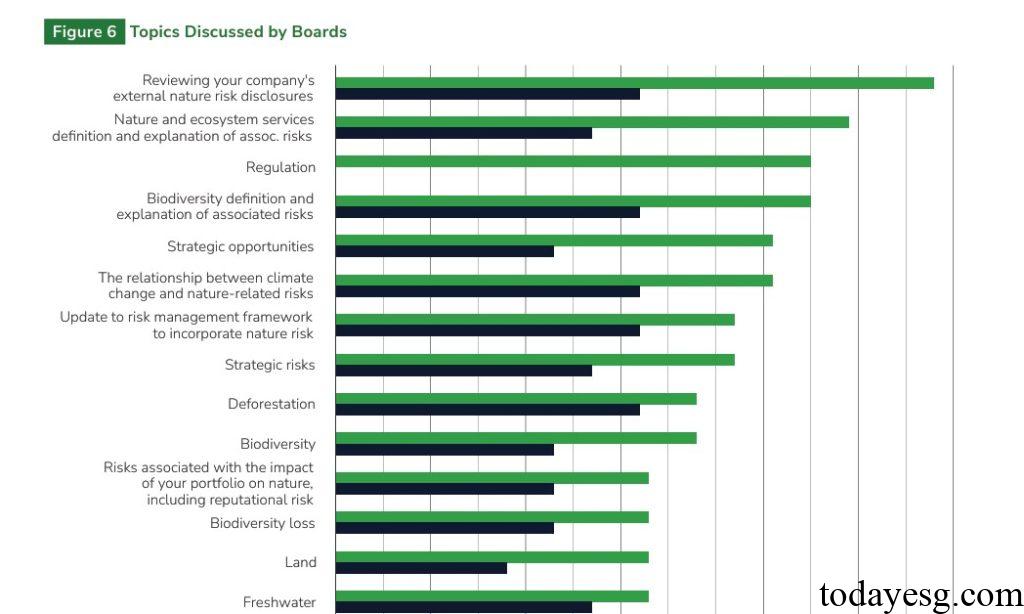

50% respondents state that the board has already conducted supervision on natural risks, an increase of four percentage points compared to last year. The frequency of board discussions on natural issues continues to increase, with over 29% of respondents discussing them four or more times a year. In terms of the selection of natural issues, natural risk disclosure, definition and interpretation, and natural regulatory policies are the most common topics.

The board of directors and senior management are more inclined to delegate responsibility for nature risk management to junior employees (40%), which is significantly higher than climate risk (2%). 21% of respondents have appointed a Chief Risk Officer and a Sustainability Manager to oversee natural and climate risks simultaneously. 17% of respondents have set up a dedicated dashboard for natural risks.

Strategy

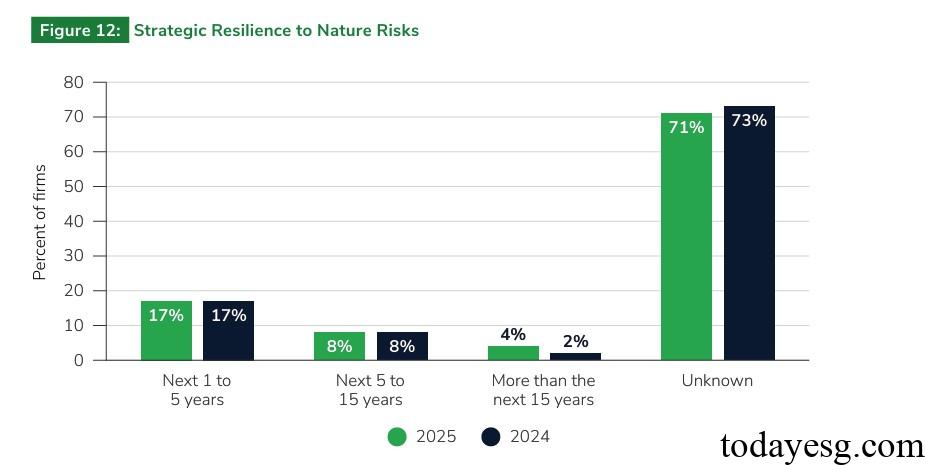

42% respondent state that they have identified natural risks and opportunities, an increase of 17 percentage points compared to last year. 6% of respondents believe that natural risks and opportunities will have a material impact on corporate strategy within the next five years, 15% believe that the impact will occur within the next five to fifteen years, and 13% believe that the events that will have an impact will occur fifteen years later. However, many companies (71%) are not aware of the strategic resilience to natural risks.

In the application challenges of natural strategies, firms believe that data availability, model availability, and regulatory policy uncertainty are the greatest, which may slow down the development of nature risk management systems.

Risk Management

Many companies are studying which natural material factors will have an impact on their business, such as climate change (75%), deforestation (54%), air pollution (50%), and water resources (50%). In terms of natural risk assessment, 46% of firms are evaluating the natural impacts generated by counterparties, 31% are evaluating natural transition risks, and 29% are evaluating natural physical risks.

In terms of incorporating natural risks into risk management frameworks, 44% of companies include them in other risk types, and 35% of companies consider natural risks together with climate risks. In terms of natural risk classification, credit risk (31%), reputation risk (25%), and strategic risk (21%) account for a relatively high proportion.

Metrics, Targets, and Limits

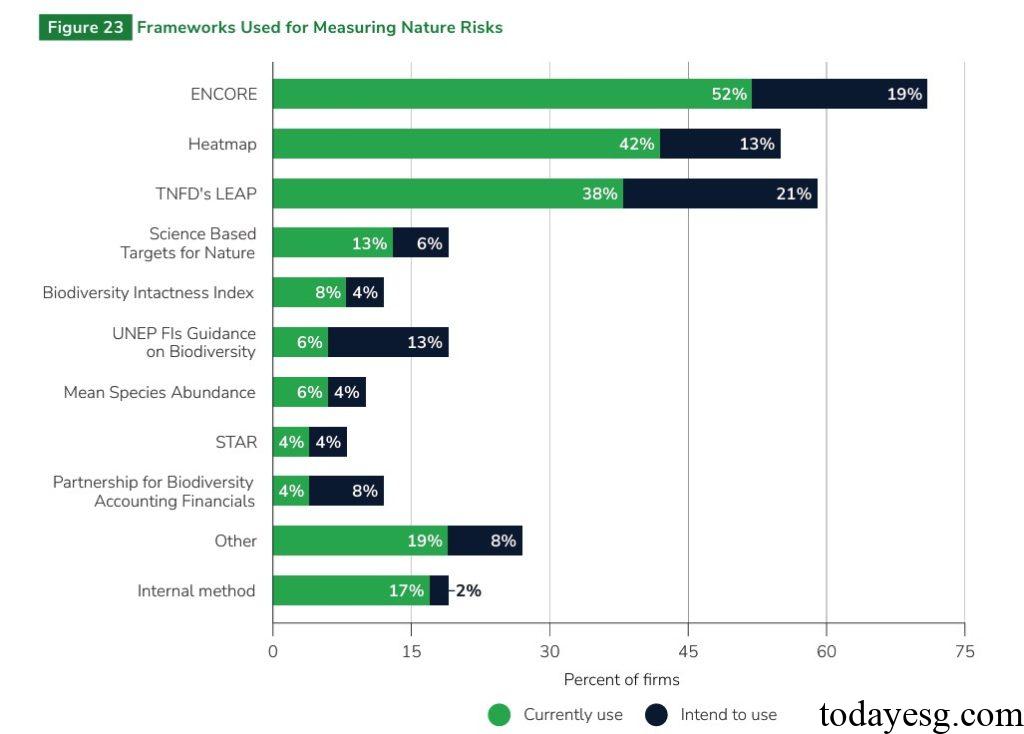

21% of firms have started using indicators, targets, and limits to manage natural risks, an increase of four percentage points compared to last year. The commonly used nature risk management frameworks for firms include the natural capital opportunity, risk, and exposure tool ENCORE (52%), the Heatmap (42%), and the Taskforce on Nature-related Financial Disclosures (TNFD) tool LEAP (38%). Firms can use indicators, targets, and constraints to reduce the impact of their investment portfolio on nature, meet regulatory requirements, and fulfill their fiduciary responsibilities.

Scenario Analysis

Scenario analysis is a tool for identifying and quantifying potential financial risks caused by natural losses, and 21% of businesses are using scenario analysis to understand the impact of natural risks on their balance sheets and investment portfolios. These scenarios mainly come from the Taskforce on Nature-related Financial Disclosures and the World Wildlife Fund.

Disclosures

54% of companies have issued natural statements, such as signing the Finance for Biodiversity Pledge, joining the Principles for Responsible Banking or Principles for Sustainable Insurance. In terms of disclosure categories, natural impact (54%), governance (44%), risk management (40%), and strategy (25%) account for a relatively high proportion.

Reference: