Information Disclosure Guidance for Financial Institutions

The Task Force on Nature Related Financial Disclosures (TNFD) releases information disclosure guidance for financial institutions, aimed at providing additional disclosure guidance for financial institutions such as banks, asset management companies, and insurance companies besides the general TCFD recommendations.

TCFD released a general recommendation on nature related information disclosure in September last year, aimed at providing market participants with a universal framework for natural risk management and information disclosure. After considering the suggestions of market participants in the financial industry, TCFD has released guidance for financial institution information disclosure based on industry characteristics and enhance the disclosure results.

Related Post: TNFD Issues Recommendations on Nature-related Information Disclosure

Additional Disclosure Guidance for Financial Institutions

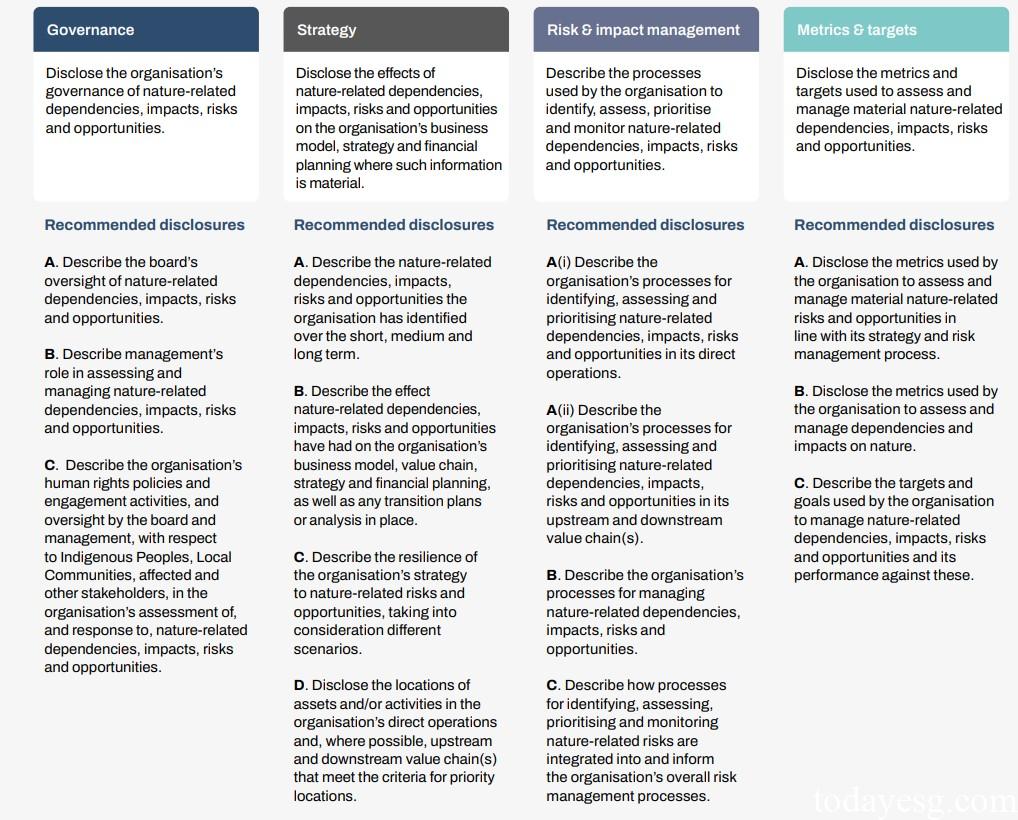

The Task Force on Nature Related Financial Disclosures generally recommends a total of 14 aspects for all participants, including governance, strategy, risk & impact management, and metrics & targets. TCFD believes that financial institutions can additionally disclose from these aspects:

- Governance: Financial institutions should describe the assessment of natural dependencies, impacts, risks, and opportunities among stakeholders such as customers, counterparties, and invested companies that generate financial relationships with them.

- Strategy: Financial institutions should describe policies related to specific natural industries in their consulting, investment, lending, or insurance activities, and disclose how they consider natural related risks and opportunities in their products and services. For example, banks should disclose information about natural dependencies, impacts, risks, and opportunities in their due diligence on customers. In addition, financial institutions need to consider the duration of their business activities in scenario analysis and conduct risk management based on relevant time frames.

- Risk and Impact Management: Financial institutions should focus on risk management in downstream value chains, as well as asset portfolios involved in lending, investment, and financing activities. Financial institutions should also describe how their risk management and business departments (loans, investments, or underwriting) regulate natural risks in their business activities and integrate natural risks into credit risk, market risk, etc.

- Metrics and Targets: Financial institutions should focus on disclosing the most relevant indicators to their business models, as well as the basic assumptions and calculation methods of these indicators. These disclosures need to be made at an overall level, rather than as a single investment portfolio or trading exposure. Financial institutions should also consider dividing indicators by industry or region.

Additional Disclosure Metrics for Financial Institutions

The indicator system of TCFD Recommendations is divided into three categories, namely Core Global Disclosure Metrics, Core Sector Disclosure Metrics, and Additional Disclosure Metrics.

TCFD divides information disclosure indicators in the financial industry into two categories: operating activity indicators and financial portfolio indicators. For core global disclosure indicators, financial institutions need to disclose operating activity indicators that have substantial impact and can disclose financial assets directly when data allows. For core industry disclosure indicators, financial institutions do not need to disclose operating activity indicators, but need to disclose financial asset indicators related to the industry and location. For additional disclosure indicators, financial institutions can choose to disclose substantial indicators of operating activities and financial assets.

TCFD recommends that financial institutions consider additional information disclosure indicators, including:

- Indicators based on footprint methods, such as ecosystem footprint and biodiversity footprint.

- Principal Adverse Impact (PAI) indicators based on the European Sustainable Financial Disclosure Regulations (SFDR).

- The number and proportion of companies that have negative impacts on biodiversity, lack of biodiversity policies, or controversy events related to biodiversity and ecosystem.

TCFD plans to release an information disclosure report on the impact of financial assets by the end of this year, supplementing additional disclosure indicators for financial institutions.

Reference:

TNFD Additional Guidance for Financial Institutions

Contact:todayesg@gmail.com