Sustainable Equity Fund Report

The European Fund and Asset Management Association (EFAMA) releases a report on sustainable equity fund, aimed at summarizing the development trends of sustainable equity funds in Europe.

Sustainable equity fund is an important asset class in sustainable investment, with the highest proportion (53%) among sustainable funds. These funds incorporate sustainability into their investment objectives and use binding ESG criteria to screen assets.

Related Post: CFA Institute Releases ESG Fund Classification System Report

Development Trends of Sustainable Equity Fund

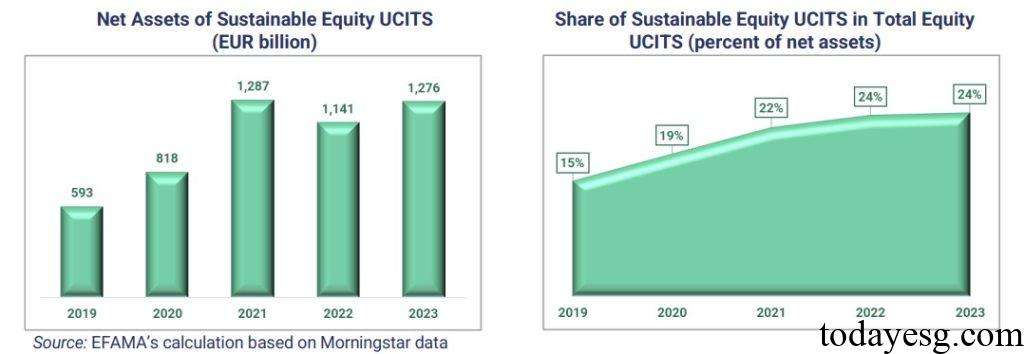

In the past five years, the total asset size of sustainable equity funds in Europe has increased from 593 billion EUR to 128 trillion EUR, and their proportion has grown from 15% in 2019 to 23% in 2023. In 2021, sustainable equity funds recorded the largest net inflow of funds, reaching 230 billion euros. The net inflow of funds in 2022 and 2023 has decreased to 69 billion euros and 30 billion euros respectively, mainly due to the increased attractiveness of fixed income assets to the market in an environment of high interest rates and high inflation.

In terms of investment methods for sustainable equity funds, 63% are actively managed, with a total size of 804 billion EUR. 37% belong to passive investment type, with a total scale of 472 billion EUR. Since 2022, the allocation of market funds to passive investment funds has been higher than active investment funds, with sustainable ETFs being highly sought after by investors. The investment strategy of sustainable equity funds tends to choose large companies, with a preference for growth companies over value companies.

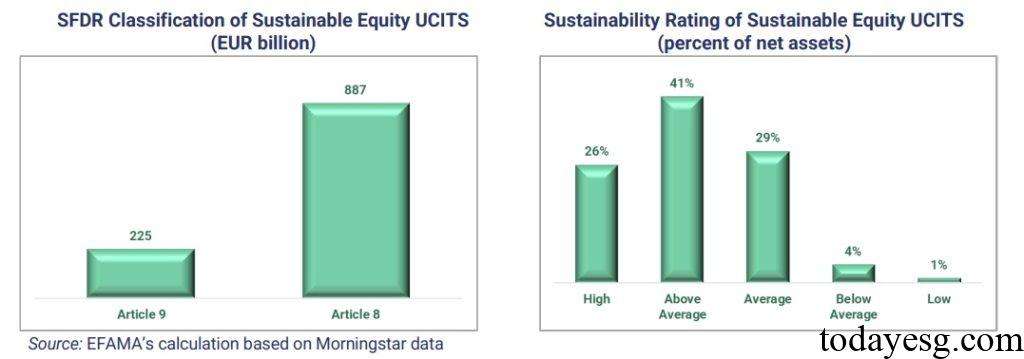

Sustainable Equity Fund and SFDR Classification

The Sustainable Finance Disclosure Regulation (SFDR) classifies sustainable funds based on their investment objectives and methods, with 18% of sustainable equity funds being Article 9 funds (225 billion EUR) and 70% being Article 8 funds (887 billion EUR). Many sustainable investments are still in the past stage and have not yet met the classification criteria for Article 9 funds. Some asset management companies hold a cautious attitude towards the classification of Article 9 funds, as they are concerned that categorizing funds may lead to greenwashing risks in the future.

The EFAMA analyzes the sustainability ratings of sustainable equity funds in Morningstar and found that the majority of funds are rated as high (26%) or above average (41%). The EFAMA believes that there is still limited overlap and transparency between sustainable financial disclosure regulations and ESG ratings, and regulators need to consider them in policy adjustments. These problems are mainly barriers for potential growth in sustainable investment market.

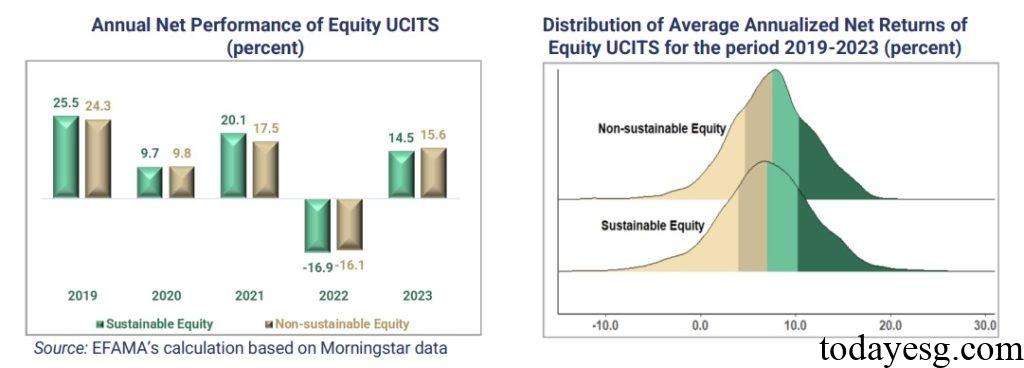

Performance and Cost of Sustainable Equity Fund

In the past five years, European sustainable equity funds have only recorded negative returns in 2022, and positive returns at all other times. Overall, the performance of sustainable equity funds and non sustainable equity funds is very similar, so investors do not need to bear some financial losses by choosing sustainable products. From the analysis of the annualized return distribution over the past five years, the performance of sustainable equity funds and non sustainable equity funds mainly depends on the individual characteristics of the funds.

From the analysis of the annual cost ratio between sustainable and non sustainable funds, the cost of sustainable equity funds in 2023 is 0.69%, while the cost of non sustainable equity funds is 0.89%. Since 2020, sustainable equity funds have demonstrated lower cost advantages, which may be an active choice for asset management companies in high market competition. Companies that allocate sustainable funds may have lower financing costs and achieve higher ESG performance, thereby reducing the management costs borne by investors.

Reference:

Sustainable Equity UCITS: Promoting Sustainable Business Models

Contact:todayesg@gmail.com