Asian Carbon Market Report

The World Economic Forum (WEF) releases a report on the Asian carbon market, aimed at summarizing the development of the Asian carbon market and international cooperation.

The World Economic Forum believes that the carbon market is a key mechanism for mobilizing climate resources and reducing costs. Asia accounts for over 50% of global carbon emissions, and the carbon market will play a role in the net zero transition.

Related Post: Asian Development Bank Releases Report on Carbon Credit by Asian Regulators

Introduction to Asian Carbon Market

There are 17 national or local carbon pricing tools and 4 national carbon emission trading systems in Asia, including compliance carbon markets and voluntary carbon markets. The World Economic Forum categorizes the Asian carbon market into three types:

- China: China’s carbon emissions trading system is the world’s largest carbon emissions trading system, with a market capacity of 8 billion tons of carbon dioxide by 2025 and 900 to 1.1 billion tons of carbon dioxide by 2030. China also restarts the voluntary carbon market CCER in 2024.

- Developed economies: Japan, South Korea, and Singapore have established carbon pricing mechanisms and have both mandatory and voluntary carbon markets and are developing carbon credit compensation mechanisms.

- Emerging economies: Thailand and Malaysia are considering establishing or developing carbon markets and establishing regional cooperation frameworks.

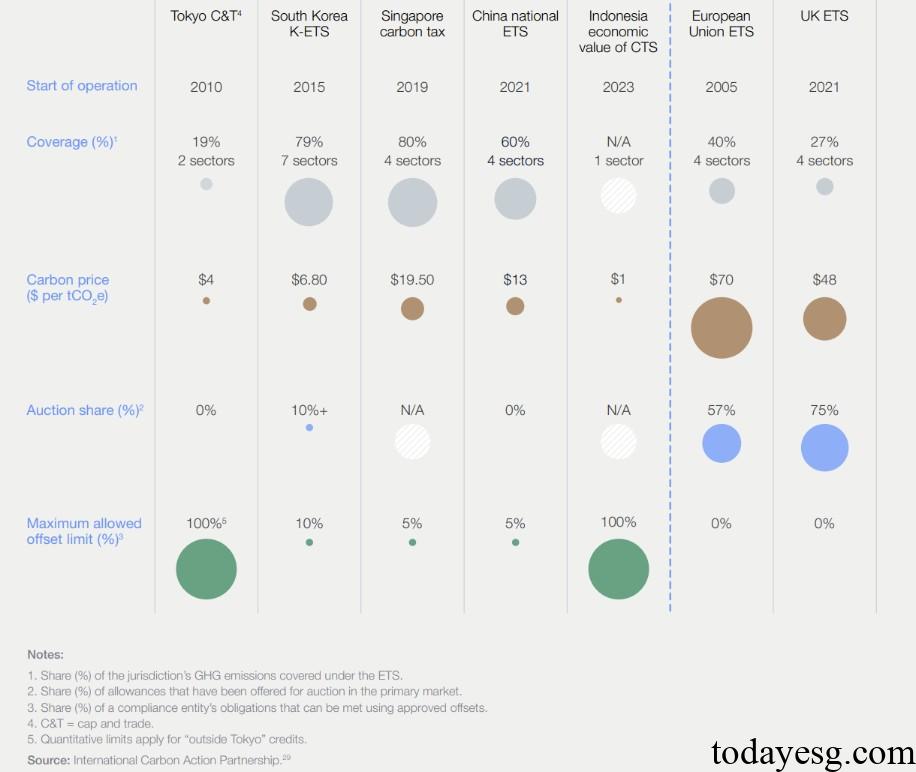

The carbon market in Asian economies usually develops since 2010, with significant differences in carbon prices, auction ratios, and carbon offset usage ratios. For example, Singapore’s carbon price is $19.5 per ton, while China, South Korea, and Japan’s carbon prices are $13 per ton, $6.8 per ton, and $4 per ton, respectively. Compared to the EU Emissions Trading System ($70 per ton) and the UK Emissions Trading System ($48 per ton), the Asian carbon market has relatively lower prices and allows for a higher proportion of carbon offsets.

Asian Carbon Market and Global Cooperation

Article 6 of the Paris Agreement plans to create an international cooperation framework to promote cooperation among countries through the mitigation of transferred mitigation outcomes. Some Asian economies have established joint carbon credit markets, such as the ASEAN Common Carbon Framework, which focuses on expanding high-quality carbon projects and improving market liquidity. The differences in carbon pricing mechanisms among different countries pose challenges to cooperation, and the World Economic Forum believes that there are opportunities for coordination as follows:

- Cross border market matching: There are opportunities for matching the supply and demand of carbon credits in Asia, and China, as the world’s largest carbon market, has a significant demand for carbon credits. After establishing a monitoring, reporting, and verification mechanism for carbon emissions in Southeast Asia, sufficient carbon credits can be provided.

- Joint capacity and project building: There are differences in infrastructure and professional knowledge in the development of carbon markets in Asian countries. China has a dual framework of national and local carbon markets, which can promote carbon credit mutual recognition clauses and provide development suggestions for emerging economies’ carbon markets.

- Innovative linkage mechanisms: Asian countries are participating in the development of the international carbon market, and some countries have cooperated with developing countries to jointly develop carbon projects and share emission reduction quotas. Some countries have initiated the Coalition to Grow Carbon Markets, which establishes recognized principles of high integrity carbon credits and encourages businesses to participate.

Reference:

Asia’s Carbon Markets: Strategic Imperatives for Corporations