Net Zero Standard for Financial Institutions

The Science Based Targets Initiative (SBTi) has released a net zero standard for financial institutions, aiming to provide a scientific net zero framework for financial institutions.

The Science Based Targets Initiative believes that the lending, investment, insurance, and capital market activities of financial institutions are related to the global net zero transition, and the net zero standard can help them reduce climate risk exposure and enhance competitiveness.

Related Post: SBTi Releases Draft of Corporate Net Zero Standard

Background of Net Zero Standard for Financial Institutions

The net zero standard for financial institutions applies to all public and private financial institutions. Financial institutions are defined as those that generate more than 5% of their total revenue from the following financial activities:

- Lending.

- Asset Owner Investing.

- Asset Manager Investing.

- Insurance Underwriting.

- Capital Market Activities.

If the proportion of a company’s financial business revenue is less than 5%, it can also consider using this standard to set a net zero target. To promote interoperability between the net zero standard of financial institutions and other regulatory policies, the Science Based Targets Initiative provides a series of methods to measure the degree of consistency between investment portfolios and net zero. The net zero standard for financial institutions and corporate net zero standard complement each other. The corporate net zero standard mainly involve carbon emissions from Scope 1, Scope 2 and Scope 3 category 1 to category 14. The net zero standard for financial institutions mainly involves carbon emissions in Scope 3 category 15.

How to Apply Net Zero Standard for Financial Institutions

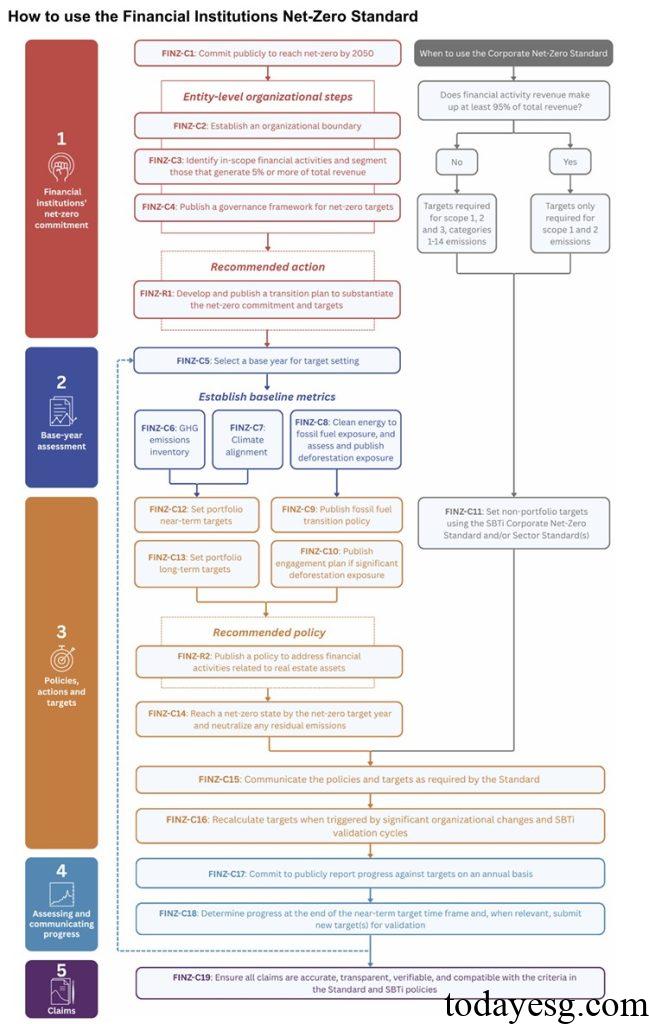

The application of net zero standard for financial institutions is divided into the following parts:

- Financial institutions’ net zero commitment: Financial institutions can issue commitments to strive for net zero emissions by 2050 or earlier. After determining the business boundaries of the institution, financial institutions need to identify the business activities to be included in the net zero framework. For these business activities, the SBTi provides different levels, which are related to the types of high carbon emission industries. Institutions can determine priority industries for net zero based on these levels.

- Base year assessment: After selecting a net zero base year, financial institutions need to conduct multiple assessments. These assessments include greenhouse gas emission information (institutional level, value chain level), climate consistency assessment (degree of consistency between business activities and net zero), clean energy comparison (exposure to clean energy and traditional energy), and forest exposure (risk exposure related to forests).

- Policies and target settings: Financial institutions can achieve net zero through both policies and targets. In terms of policy, financial institutions need to release energy transition policies and assess forest and real estate transition risks. In terms of goals, financial institutions need to set net zero targets for Scope 1 and Scope 2. If the proportion of financial business revenue is less than 95% of total revenue, Scope 3 goals need to be established, which must comply with the requirements of the Science Based Targets Initiative. For investment portfolios, financial institutions also need to set short-term and long-term net zero targets.

- Assessment and communication progress: Financial institutions are required to publicly disclose their total greenhouse gas emissions, business climate consistency, clean energy exposure, and forest exposure annually. Financial institutions also need to separately disclose Scope 1 and Scope 2 carbon emissions, as well as Scope 1, Scope 2, and Scope 3 carbon emissions at the investment level. If carbon removal and carbon credits are applied in carbon emission data, additional disclosure of this information is required. The net zero standard requires financial institutions to disclose complete greenhouse gas emission information and conduct comprehensive climate consistency assessments for all activities before 2030.

- Claims: Financial institutions need to ensure that all net zero claims are clear, accurate, credible, and verifiable. The Science Based Targets Initiative provides various technical documents to assist financial institutions in implementing net zero standard.

Reference: