Draft of Corporate Net Zero Standard

Science Based Targets Initiative (SBTi) releases the draft of corporate net zero standard, aiming to update the standard based on feedback from stakeholders and scientific progress.

SBTi believes that the draft of Corporate Net Zero Standard still uses the 1.5-degree Celsius warming target as the benchmark for net zero path, helping companies set net zero targets to achieve global net zero emissions by 2050.

Related Post: International Organization for Standardization Plans to Develop International Standard for Net Zero

Draft of Corporate Net Zero Standard Updates

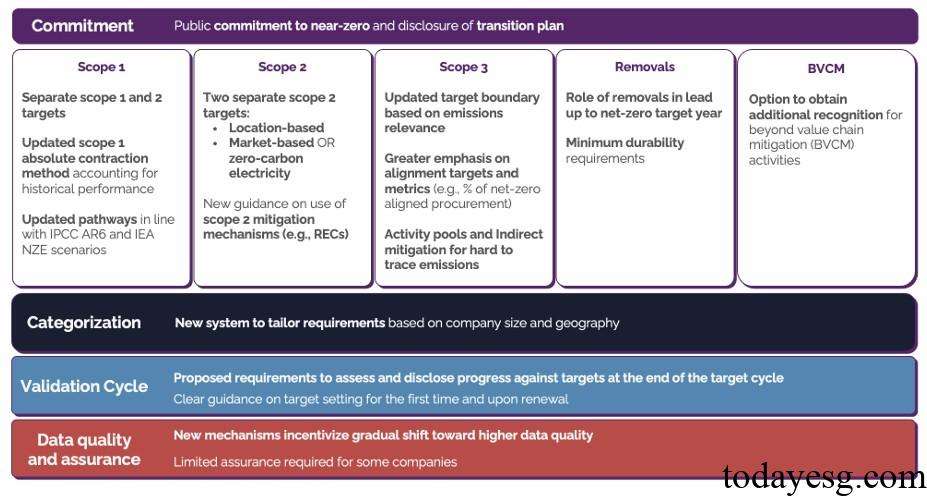

Compared to the previous version of the Corporate Net Zero Standard, the draft of the Corporate Net Zero Standard has made updates in areas such as net zero commitment, goal setting, performance evaluation, and value chain impact. These updates include:

General

The existing standard focuses on setting net zero targets, without distinguishing between types of corporates, and only validate models before setting net zero targets, lacking standardized evaluation of target progress. The new draft covers multiple aspects such as benchmark performance evaluation, net zero target implementation, progress evaluation, etc., covering the entire cycle, and making differentiated requirements based on the size and geographical location of the corporate.

Net zero commitment

The existing standard are mainly based on documents issued by the SBTi, and do not require companies to develop transition plans. The new draft requires companies to develop net zero commitments based on the recommendations of the UN High level Expert Group and recommends that companies develop transition plans.

Assessing performance in the base year

The existing standard does not require companies to provide data verification of their carbon emissions in the base year. The new draft requires eligible companies to obtain limited third-party verification of their greenhouse gas emissions in the base year.

Target setting

The existing standard is based on the Fifth Assessment Report (AR 5) released by the Intergovernmental Panel on Climate Change, which requires all businesses to set short-term and long-term goals related to Scope 1, Scope 2, and Scope 3 (excluding Scope 3 goals for small and medium-sized corporates), and these goals can be combined. The new draft is based on the Sixth Assessment Report (AR 6) released by the United Nations Intergovernmental Panel on Climate Change, which reduces the requirement for companies to set short-term and long-term goals but requires each goal to be set separately.

The new draft provides more detailed requirements for the carbon emissions of Scope 1, Scope 2, and Scope 3, but relaxes the requirements for Scope 3. The new draft proposes three solutions for residual emissions and provides a clearer definition of greenhouse gas mitigation measures.

Addressing the impact of ongoing emissions

The existing standard recommends that companies take mitigation measures for carbon emissions outside the value chain, and the new draft provides stronger incentives for these mitigation measures to encourage companies to apply them.

Assessing and communicating progress against targets

The existing standard lacks guidance on target progress and only requires reporting on the annual net zero target completion status. They also require review every five years and revalidation of targets as necessary, but do not require setting new targets. The new draft provides detailed progress guidelines and requires companies to evaluate progress at the end of the target cycle and set new goals at the end of the cycle.

Claim

The existing standard provides claims based on the SBTi Communications Guide, while the new draft establishes clear claims for net zero statements based on the net zero standard.

The SBTi invites stakeholders to submit feedback by June and revise the Corporate Net Zero Standard based on the new feedback.

Reference:

Corporate Net-Zero Standard Version 2.0 Public Consultation

Contact:todayesg@gmail.com