Nature-related Risks for Systemically Important Banks Report

The World Wildlife Fund releases a report on the nature-related risks for systemically important banks, aiming to recommend incorporating nature-related risks into the risk management and decision-making process of systemically important banks.

The WWF believes that there is a close relationship between climate change, natural losses, and financial stability. As climate change is included in risk management, regulators need to effectively manage nature-related risks in the financial system.

Related Post: Financial Stability Board Releases Report on Nature-related Financial Risks

Nature-related Risks and Systemically Important Banks

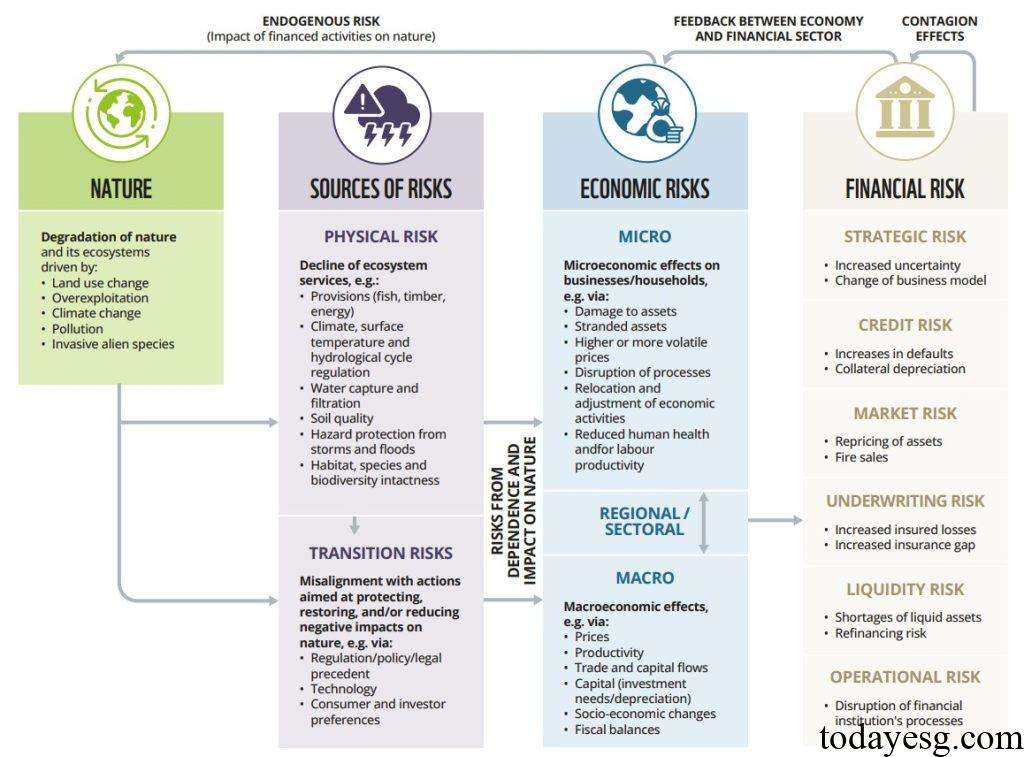

Nature and its ecosystems provide support for human economic activities, and the World Economic Forum believes that half of the global GDP is moderately or highly dependent on nature. However, the negative feedback generated by human activities on nature is leading to biodiversity loss and environmental degradation. The Network for Greening the Financial System suggests that natural losses pose risks to global economic and financial stability, including:

- Strategic risks: Increased economic uncertainty, changes in business models.

- Credit risk: Rising credit default rate, depreciation of collateral.

- Market risk: Changes in asset pricing methods.

- Underwriting risk: Increased insurance gap, increased insurance losses.

- Liquidity risk: increased difficulty in refinancing and decreased liquid assets.

- Operational risk: business interruption of financial institutions.

Systemically important banks hold a dominant position in the global financial system, and the risks they face may constitute systemic risks due to their size and interconnectedness. The Bank for International Settlements (BIS) believes that although nature-related risks have begun to be priced, the current prices do not fully reflect the potential scale of risks. The European Central Bank (ECB) believes that voluntary commitments to sustainable development are insufficient to address environmental risks, and the voluntary actions of financial institutions have not yet reached the scale required to effectively mitigate nature-related risks.

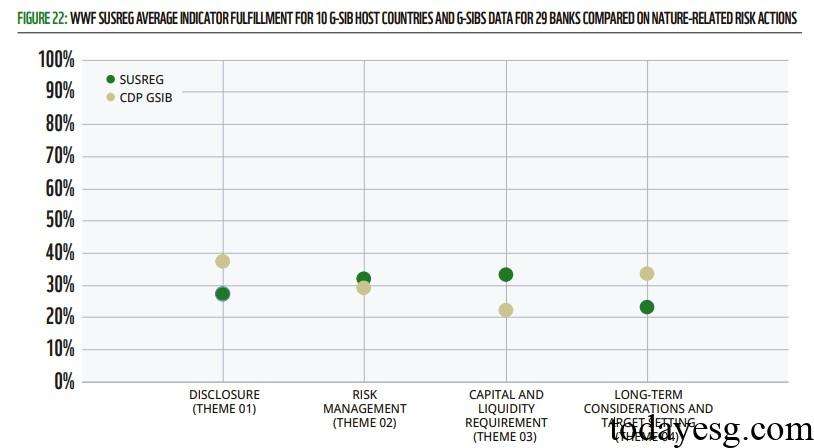

The Taskforce on Nature-related Financial Disclosures (TNFD) finds that since the release of the TNFD Recommendation in September 2023, 25% of globally systemically important banks have started disclosing information, but 75% still need to strengthen nature related risk disclosure and management. The WWF, based on SUSREG data and CDP questionnaires, has linked the regulatory performance of financial regulators with banks’ implementation of nature-related actions for the first time, studying whether regulatory agencies provide guidance to banks on nature-related topics and whether banks comply with their requirements.

Research on Nature-related Risks for Systemically Important Banks

The WWF conducts research on the nature-related risks for systemically important banks and obtains the following insights:

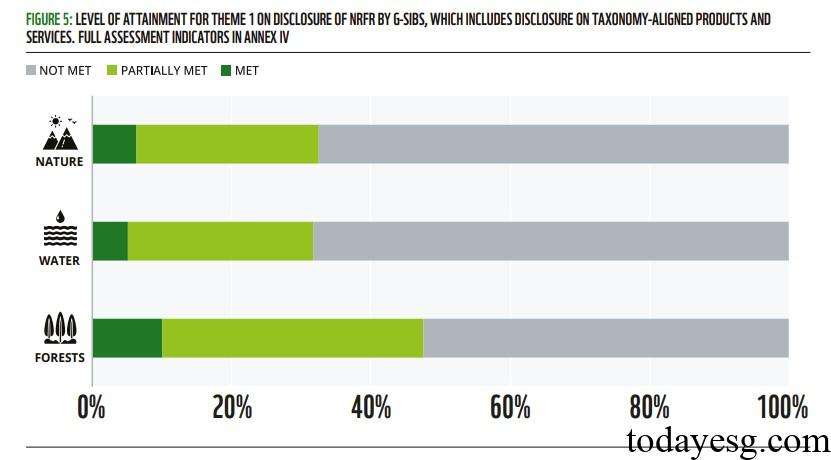

Regulators have insufficient requirements for nature-related disclosure, and there is a gap in systemically important bank disclosure: most regulators have fewer requirements for environmental disclosure, and the EU and China are leading the way in progress. Systemically important banks gradually reduce their disclosure in forests, nature, and water resources, with less than 10% of entities fully meeting the standards.

Lack of regulations for the banking industry in some jurisdictions: Some jurisdictions have not formulated regulations for natural risks related to banking industry, while EU member states such as France, Germany, and the Netherlands have made leading progress. The European Central Bank has listed water resource risks as part of environmental risks in its Climate and Environment Guidelines, but has not yet introduced specific regulatory policies for financial institutions.

Capital and liquidity framework has not yet taken into account nature-related risks: Double materiality assessments, scenario analysis, and stress testing for nature-related risks have not been included in the bank’s capital and liquidity framework. Systemically important banks typically operate in multiple jurisdictions worldwide and may face incompatible regulatory requirements. Currently, no systemically important bank has adopted a comprehensive risk management process to assess, manage, and mitigate nature-related risks, while considering them as liquidity factors.

Some systemically important banks need higher systemic risk buffers: Inconsistent global regulations may lead to higher nature-related risks for systemically important banks, and implementing higher systemic buffers can help banks manage long-term risks. The design of the European Central Bank’s macroprudential capital buffer to mitigate climate-related risks can serve as a reference for addressing nature-related risks.

Recommendations by World Wildlife Fund

The World Wildlife Fund provides recommendations to systemically important banks and their regulators as follows:

- Financial Stability Board and Basel Committee on Banking Supervision: Incorporate nature-related risks into capital buffer calculations, implement higher regulatory expectations in nature-related management, and include nature-related risk indicators in annual evaluations.

- Regulators in jurisdictions: Incorporate nature-related factors into the framework of national systemically important banks, incorporate nature-related risks in financial stability, capital adequacy ratio, liquidity requirements, etc., and conduct environmental stress testing of financial system.

- Systemically Important Banks: Strengthen disclosure of nature-related information, assess the synergy between climate and nature, incorporate nature-related risks into bank strategic decision-making and risk management processes, and understand the financial impact of nature-related risks.

- International financial forums and conferences: G20, Conference of the Parties to the Convention on Biological Diversity, and Conference of the Parties to the United Nations Framework Convention on Climate Change should take measures to incorporate nature and biodiversity into the regulatory framework of systemically important banks, to meet global climate change and biodiversity goals.

Reference:

Global Financial Regulation Urgently Needs to Address Nature-related Risks, Particularly for Systemically Important Banks

Contact:todayesg@gmail.com