Report on Exchange Sustainability Survey

The World Federation of Exchanges (WFE) releases a report on exchange sustainability survey, aimed at understanding the sustainable progress of exchanges in various jurisdictions.

The World Federation of Exchanges believes that exchanges play a unique role in the global sustainable economic transition, with surveys showing that exchanges’ participation in sustainability has reached a historic high.

Related Post: World Federation of Exchanges Releases Report on Commodity Climate Risk Premium

Background of Exchange Sustainability Survey

In 2024, there will be significant changes in global sustainable financial regulatory policies, with widening regional disparities. The demand for sustainable information disclosure from global businesses and investors continues to grow, and some exchanges have begun to adopt the International Sustainability Standards Board (ISSB) standards and develop climate-related disclosure rules.

To write the 11th edition of the annual report, the World Federation of Exchanges sent a questionnaire to its member exchanges and affiliated institutions and received responses from 57 exchanges. The total market value of listed companies related to these exchanges is $83.78 trillion, accounting for 73% of the global total market value. The market value proportions of the Asia Pacific region, the Americas region, and the Europe region are 43%, 42%, and 15%, respectively.

Exchange Sustainability Survey Results

The sustainability survey results can be classified into the following categories:

Exchanges and Sustainability

The WFE Sustainability Principles provide guidance for the sustainable development of exchanges, including:

- Sustainable issues for participants in the education exchange ecosystem: 91%, compared to 94% last year.

- Promoting ESG information availability: 91%, compared to 90% last year.

- Promoting stakeholder participation in sustainable development: 87%, compared to 86% last year.

- Providing markets and products that support sustainable financial development: 88%, compared to 82% last year.

- Incorporating sustainable factors into exchange governance, strategy, and organizational structure: 96%, compared to 100% last year.

In terms of transition plans, 22 exchanges plan to develop transition plans, and 12 exchanges have already released transition plans. Climate issues, social issues, and environmental factors have a relatively high proportion in the transformation plan. The purpose of the exchange’s participation in sustainable development includes expanding its business opportunities (95%), addressing sustainability issues (93%), and enhancing its reputation (91%).

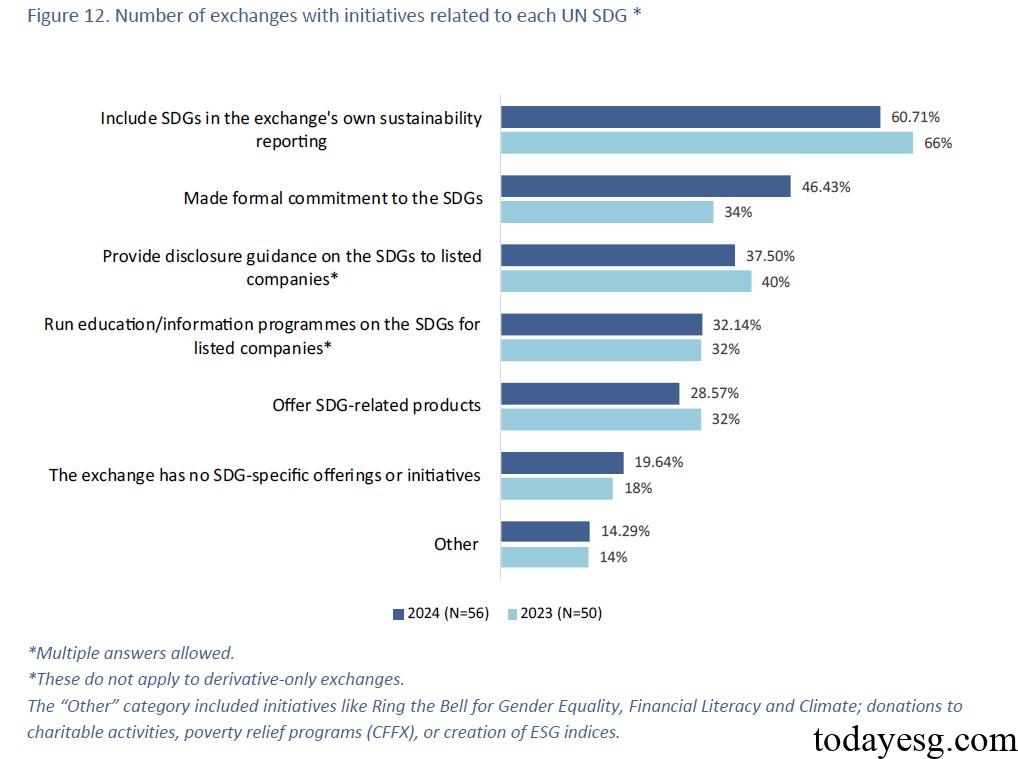

Participation in the United Nations Sustainable Development Goals

The United Nations Sustainable Development Goals (UNSDGs) include 17 indicators, which have been included in 60% of exchanges’ sustainability reports. 46% make formal commitments, and 37% provide disclosure guidelines for sustainable development goals to listed companies. 18 exchanges offer products related to sustainable development goals.

In terms of specific sustainable development goals, Goal 5 on gender equality, Goal 8 on decent work and economic growth, and Goal 13 on climate action have the highest proportions, reaching 86%, 86%, and 82% respectively.

Transparency and Information Disclosure

94% of exchanges believe that investors have a demand for sustainable disclosure, and 78% of exchanges believe that listed companies disclosing sustainable information will not have a negative impact on their business. In terms of sustainable disclosure formats, the proportion of integrated reports (28), individual sustainable development reports (26), and any format (26) is relatively high.

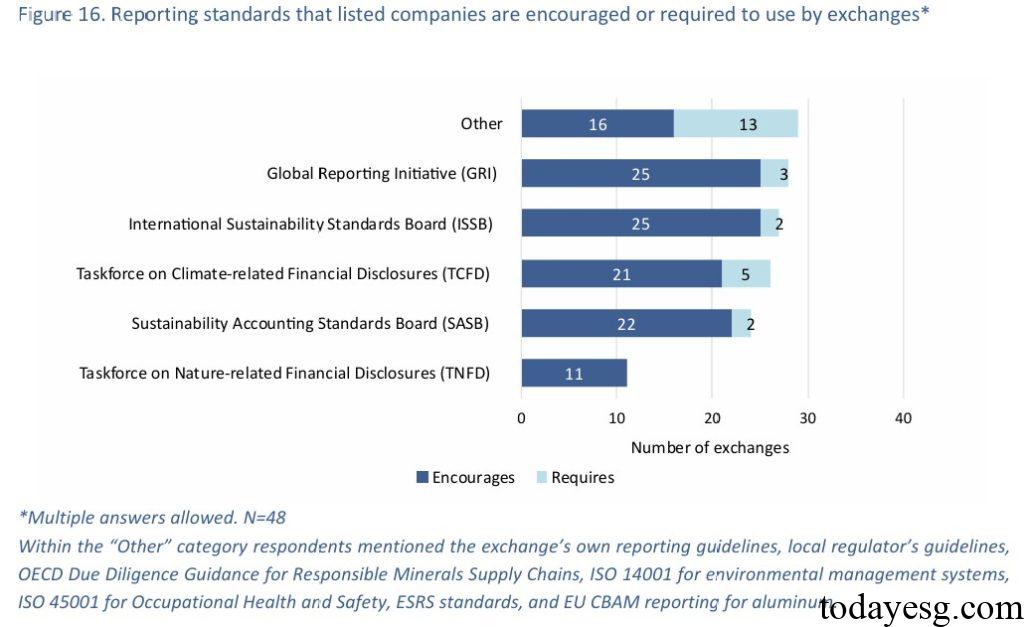

In terms of sustainability reporting standards, the Global Reporting Initiative (GRI), the International Sustainability Reporting Standards (ISSB), the Taskforce on Climate-related Financial Disclosures (TCFD), the Sustainability Accounting Standards Board (SASB), and the Taskforce on Nature-related Financial Disclosures (TNFD) have a relatively high proportion.

Sustainable Products

92% of exchanges believe that investors have a demand for sustainable products, and 72% of exchanges have launched sustainable products. Common sustainable products include green bonds (38), sustainable bonds (34), social bonds (31), sustainability indices (28), and ESG ETFs (23). For bond products, the vast majority of exchanges require issuers to disclose both the purpose of fundraising and the sustainable impact. For sustainability indices, most exchanges offer 1 to 5.

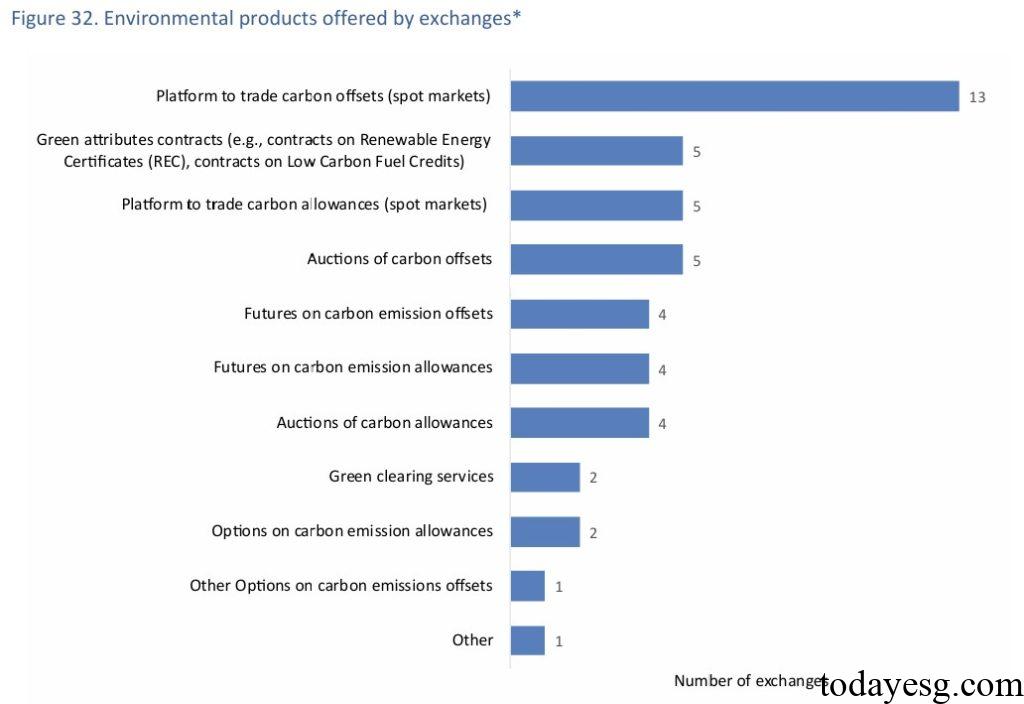

In terms of labels related to sustainable products, the Green, Social, and Sustainable Bond Standards issued by the International Capital Market Association (ICMA) are most used. 50% of exchanges apply the Green Equity Principles to define sustainable securities. 41% of respondents plan to develop transition labels, and 60% plan to incorporate sustainability factors into derivatives. Some respondents also provided environmental product infrastructure such as carbon offset trading platforms (13), green contracts (5), and carbon allowance trading platforms (5).

Reference:

World Federation of Exchanges 11th Sustainability Survey

ESG Advertisements Contact:todayesg@gmail.com