Natural Capital Investment Report

The World Economic Forum (WEF) releases a report on natural capital investment, aiming to discuss the necessity and feasibility of investing in natural capital, and analyze how to expand natural capital investment from different perspectives.

The Natural Capital Initiative, Biodiversity Credits Initiative, 1000 Ocean Startups, and 1 Trillion Trees Initiative participates in writing the natural capital investment report.

Related Post: Introduction to Natural Capital Valuation in China by Asian Development Bank

Natural Capital and Natural Capital Investment

The term natural capital originates from ecological science and refers to the renewable and non renewable resources in the world, which are crucial for human well-being and socio-economic development. Natural capital is the foundation of socio-economic activities, and over half of the global GDP is moderately or highly dependent on nature. Therefore, natural capital is closely related to economic development. However, in the past development, natural capital has often been underestimated, and its value is not only reflected in commodity prices, but also involves multiple aspects such as climate, water resources, education, culture, etc. These benefits are largely seen as free positive externalities, lacking protection, maintenance, and enhancement measures.

The Economics of Biodiversity suggests that from 1992 to 2014, global natural capital per capita decreased by nearly 40%, while productive capital per capita doubled and human capital per capita increased by 13%. The State of Finance for Nature, released by the United Nations Environment Programme, estimates that the total global funding for negative impacts on nature in 2022 was approximately $7 trillion. By 2030, a nature friendly economy requires an annual investment of $2.7 trillion, but currently the funding gap for natural recovery alone is $342 billion per year.

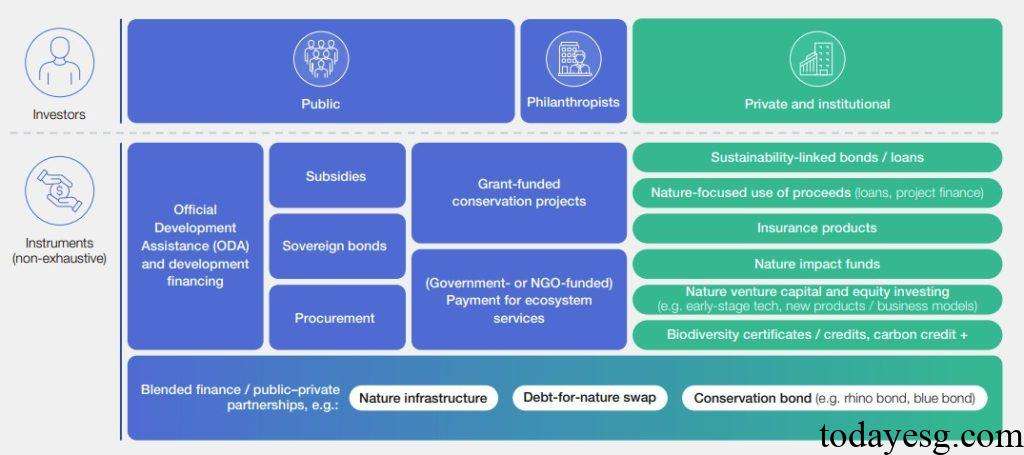

The public sector is the primary investor in natural capital, with governments, multilateral development banks, and other public institutions investing $165 billion annually, accounting for approximately 82% of total investment. During the United Nations Convention of Biodiversity COP 16, multiple countries submitted National Biodiversity Strategies and Action Plans aimed at raising funds for nature conservation. Private funds invested in natural capital are relatively small, with an estimated size of $35 billion by 2023, while the total size of the global equity and bond markets exceeds $10 trillion.

How to Expand Natural Capital Investment

The World Economic Forum proposes several measures to expand natural capital investment:

- Technological Advances: The emergence of new technologies, including the Internet of Things, satellite imagery, artificial intelligence, etc., is providing new investment opportunities for businesses. These technologies have improved the accuracy and efficiency of natural capital monitoring and can help businesses integrate natural data with production.

- Financing Instruments: The emergence of new financing instruments provides investors with more choices, including Nature Asset Companies, natural insurance, and biodiversity credit. These tools, along with their natural capital accounting and valuation methods, help investors convert natural assets into products with continuous returns, and measure their current and future value through accounting methods.

- Business Models: Business models that protect and restore natural capital can attract private investment, including ecotourism, organic food, sustainable forestry. These methods can bring multiple sources of income and ensure the long-term economic feasibility of investing in natural capital. Although these models have differences in commercialization levels, they have effectively combined financial returns and ecological impacts, and supported cooperation among different stakeholders.

- New Investors: The development of technology, financing tools, and business models are bringing new investors to the natural investment value chain. These investors include institutional investors, asset management companies, venture capitalists, etc. They pursue the long-term development value of natural capital and provide financing support for high-quality enterprises in the industry. In 2023, the global venture capital market saw an 18% increase in investment in natural technology and a 27% increase in trading volume, outperforming the average. The emergence of new investors has also brought development to natural capital valuation methods.

Reference:

Investing in Natural Capital: Innovations to Support Financing for Nature

Contact:todayesg@gmail.com