Global Equitable Transition Report

The World Economic Forum (WEF) releases the global equitable transition report, aimed at helping jurisdictions develop policies that fairly distribute the costs and benefits of climate action and promote equitable transition.

The World Economic Forum believes that the challenges faced by equitable transition are directly related to the income level and development stage of each country. Because of limited transition tools, frameworks, and data, jurisdictions may not be able to accurately measure the socio-economic impact of climate action. As part of the Equitable Transition Initiative, the report will provide jurisdictions with an operational framework for green transition to address climate change.

Related Post: COP28 Releases Net Zero Transition Charter

Introduction to Equitable Transition

Equitable transition is a key action to address climate change and control temperatures within the Paris Agreement’s warming targets. However, existing climate actions may widen economic disparities and slow down the transition process. As various jurisdictions initiate climate action, the allocation of costs and benefits of climate policies has become a focus. The implementation of environmental taxes has led to an increase in the cost of living, and the closure of carbon intensive industries has affected the job market. Global fossil fuel subsidies reach $620 billion in 2023. If subsidies are reduced, the economic pressure faced by low-income groups will significantly increase.

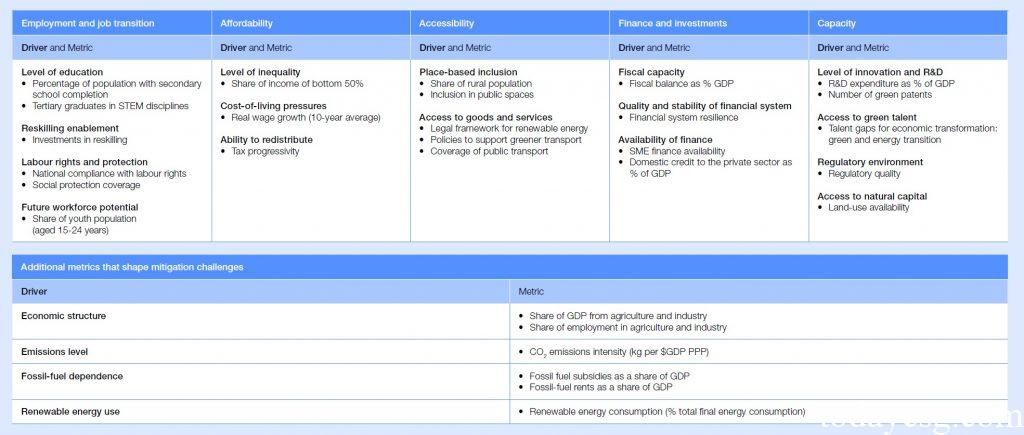

Despite the global recognition of the injustice of the current transition, there are still shortcomings in assessing and understanding the social impact of climate action. Some of the existing indicators are used to evaluate green transition, such as Nationally Determined Contributions, while others are used to evaluate social outcomes, such as the United Nations Sustainable Development Goals. However, there are few indicators that simultaneously address both. The lack of these indicators has made measuring the fairness of climate transition a market challenge. In addition, the differences in economy, system, population, and geography among different jurisdictions also make it difficult to establish a globally applicable framework for fair transition.

Equitable Transition and Economic Equity Risks

The World Economic Forum, based on the Executive Opinion Survey, analyzed the economic equity risks during the transition process. Economic equity risk refers to the risk of negative impacts of transition on enterprises, labor force, and economy, including reduced employment, increased burden of goods and services, and decreased financing. Some common economic equity risks brought about by transition are as follows:

- Employment reduction: green agriculture, fossil fuel substitution, green heavy industry.

- Increased burden of goods and services: green agriculture, green transportation, and fossil fuel substitution.

- Decreased financing: green infrastructure, green transportation, low-carbon energy.

- Lack of green talent, technology, and raw materials: green infrastructure, circular economy, green heavy industry.

The survey by the World Economic Forum indicates that different green transitions may generate different economic equity risks, and jurisdictions should consider how to address these economic equity risks when implementing transitions.

Classification of Equitable Transition in Jurisdictions

Although different jurisdictions face different situations of equitable transition, there are still some commonalities. Based on the K-means clustering method and 29 economic, social, and economic indicators, the World Economic Forum categorizes global jurisdictions into six categories and summarizes the opportunities and challenges that each category may face. These categories include:

- Inclusive Green Adopters: These jurisdictions are mainly located in Western Europe, with relatively high incomes, a service-oriented economy, and carbon emission intensity lower than the global average. Their advantages lie in the high level of labor education, wide coverage of public services, and strong research capabilities. Their challenges lie in an aging workforce, relatively slow growth rates, and uneven investment within the region. Such jurisdictions need to cultivate green labor force in a equitable transition, while also considering investment in transition between urban and non urban areas.

- Emerging Green Adopters: These jurisdictions are mainly located in Central and Eastern Europe, where the economy is primarily industrial and transitioning towards high value-added service industries. Their advantages lie in the high education level of the labor force, high income level, and mature regulatory framework. Their challenges lie in the large scale of traditional industries, limited financial capacity, and a lack of green professionals. Such jurisdictions need to consider how to balance the economy and employment of traditional industries.

- Fossil Fuel Exporters: These jurisdictions are mainly located in the Middle East and Central Asia, and their economies rely heavily on fossil fuel exports. Their advantages lie in sufficient financial resources and a solid industrial foundation. Their challenge lies in high fossil fuel subsidies and limited industrial diversification. Such jurisdictions need to consider how to balance the development of pillar industries and emerging industries, as well as enhance the professional level of the workforce.

- Growth Economies: These jurisdictions are mainly located in Central and South America, where the economy is at a middle-income level and has a high demand for energy. Their advantages lie in high economic vitality and abundant labor force. Their challenges lie in insufficient social security, lack of green technology, and low investment in research and development. Such jurisdictions need to consider how to ensure that vulnerable groups receive fair and inclusive assistance, as well as improve the application of green technologies.

- Frontier Economics: These jurisdictions are mainly located in Africa, with lower carbon emissions and a focus on economic development. Their advantages lie in good economic growth prospects and abundant labor force. Their challenge lies in limited financing capacity and inadequate infrastructure. Such jurisdictions need to cultivate workforce and consider the early application of sustainable technologies to promote green economic development.

- Green Developers: These jurisdictions are mainly located in East Asia and North America, with large economies, high carbon emissions, and 85% of global green patents. Their advantages lie in abundant funds and advanced green technology. Their challenge lies in the abundance of carbon intensive industries and green subsidies. Such jurisdictions need to cultivate green talents and balance the development of traditional and green industries.

Reference:

Accelerating an Equitable Transition: A Data-Driven Approach

Contact:todayesg@gmail.com