Report on Net Zero Transition Financing

The World Economic Forum (WEF) releases a report on net zero transition financing, aiming to provide solutions for global net zero transition financing.

The World Economic Forum believes that net zero transition financing is closely related to funding, business cases, public policies, and other aspects. Solving the problem of net zero transition financing requires cooperation among various stakeholders.

Related Post: Global Sustainable Investment Alliance Releases Report on Climate Action Financing

Current Situation of Net Zero Transition Financing

The Climate Policy Initiative predicts that global climate financing demand will reach $9 trillion by 2030, with funding for climate change mitigation exceeding $8.4 trillion annually. Currently, the annual global investment in this area is $1.2 trillion. The United Nations Environment Programme predicts that the funding gap for climate change adaptation in developing countries in the next decade will be $215 billion to $387 billion, which is 10 to 18 times the current global financing scale. The climate financing demand in developing countries will reach $2.4 trillion by 2030.

Transportation, energy, construction, industry, and agriculture are the most important industries to achieve the global net zero goal, but there is a gap between the net zero investment of these industries and the financing scale required by 2030 and 2050. Taking the transportation industry as an example, the net zero investment scale from 2019 to 2020 was 95.9 billion US dollars, the required investment scale for 2030 is 2.5 trillion US dollars, and the required investment scale for 2050 is 3.2 trillion US dollars, which is 25-32 times the current investment scale.

The World Economic Forum believes that various factors lead to funding gaps in net zero transition financing. The private sector has a lower willingness to invest funds in climate projects due to uncertain returns and insufficient policy support. Some investors prioritize short-term returns and pay less attention to long-term sustainable development goals. Although some countries have set Nationally Determined Contributions, there is a lack of specific plans and energy transition strategies to achieve these goals. Some climate projects also lack clear feasibility studies and are difficult to obtain funding support.

There is a significant net zero financing gap between developing and developed countries. Developing countries need $3 trillion annually by 2030 to achieve sustainable development goals, of which $2 trillion will be raised domestically and the remaining $1 trillion will come from international aid, foreign direct investment, and multilateral bank loans.

How to Narrow Net Zero Transition Financing Gap

In order to narrow the net zero transition financing gap, the World Economic Forum provides the following recommendations:

Policy Intervention

- Concessional finance and incentives: Provide more competitive net present value and internal rate of return for climate projects by lowering interest rates or extending repayment periods, thereby encouraging private sector investment.

- Subsidies and grants: Reduce the funding costs of climate projects, address market inefficiencies, and focus on the long-term financial capabilities of enterprises to avoid market distortions.

- Regulatory reforms: Create the necessary framework for net zero financing, strengthen climate related financial disclosure requirements, encourage green investment, and reduce compliance costs for enterprises.

Market Instruments

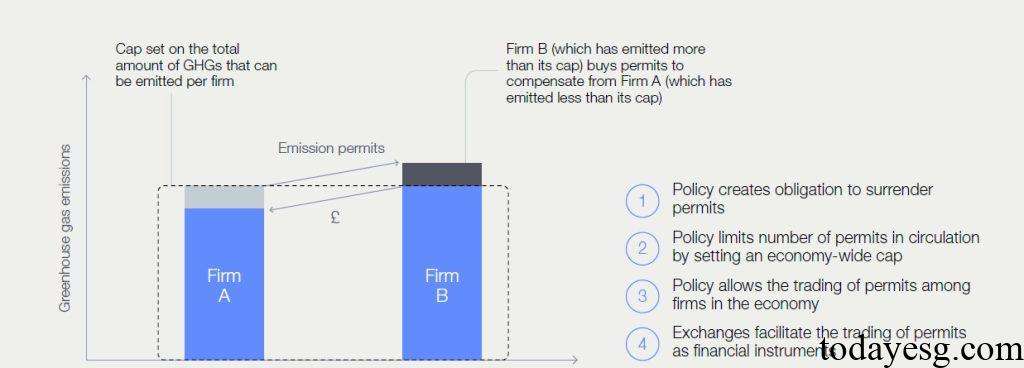

- Incentive-based market instruments: Use carbon taxes, cap and trade systems, baseline and credit schemes to change the preferences of businesses and consumers, encouraging the market to choose low-carbon products and technologies.

- Performance-based finance mechanisms: Link financial rewards to measurable climate goals to encourage businesses to improve efficiency, innovation, and investment.

- Sustainable debt instruments: Provide financing support to enterprises based on green bonds, social bonds, and sustainable bonds.

- Sustainable investment funds: Incorporate ESG factors into the investment process to provide financial support for sustainable projects.

Hybrid Mechanism

- Blended finance: Combine public and private funds to reduce project risks and attract private investment, suitable for developing countries.

- Public-private partnerships: Combine the public and private sectors to promote risk sharing, resource optimization, and enhance project feasibility.

- Feed-in tariffs: Provide long-term payment guarantees for renewable energy producers and encourage clean energy investment.

- Feebates: Provide discounts to low-carbon products to encourage businesses and consumers to make sustainable choices.

- Insurance and risk-sharing: Reduce financial risks of climate investments and increase investor confidence.

Reference:

Bridging the Gap: How to Finance the Net-Zero Transition

Contact:todayesg@gmail.com