2025 Global Carbon Credit Market Report

World Bank releases 2025 Global Carbon Credit Market Report, aimed at summarizing the development of the global carbon credit market.

World Bank believes that the connection between the carbon credit market, carbon emissions trading system, and carbon tax is strengthening.

Related Post: MSCI Releases Global Carbon Credit Project Ratings Report

Introduction to Global Carbon Credit Market

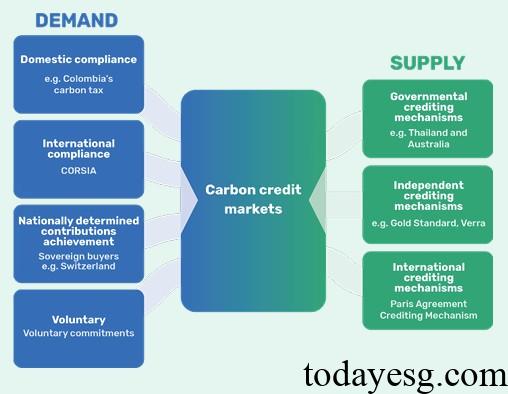

The carbon credit market is the infrastructure for trading carbon credits, which represent the amount of carbon emissions reduced, avoided, or removed. The demand and supply sides of the global carbon credit market have different roles, among which the demand side includes:

- Domestic Compliance: Under the carbon emissions trading system or carbon tax requirements, some companies purchase carbon credits to fulfill their carbon reduction obligations.

- International Compliance: Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA) requires airlines to purchase carbon credits to offset their carbon dioxide emissions.

- Nationally Determined Contribution Achievement: Countries purchase carbon credits in accordance with the Paris Agreement to achieve their Nationally Determined Contribution (NDCs) targets.

- Voluntary: Enterprises purchase carbon credits to achieve net zero emissions targets or other climate commitments. They are not required to use carbon credits.

The supply side includes:

- Government Credit Mechanisms: Carbon credit mechanisms managed by one or more governments, such as the California Compliance Offset Program.

- Independent Credit Mechanisms: Carbon credit mechanisms managed by non-governmental organizations, such as the Verified Carbon Standard published by Verra.

- International Crediting Mechanisms: Carbon credit mechanisms managed by international organizations, such as the Paris Agreement Crediting Mechanism.

Global Carbon Credit Market Development

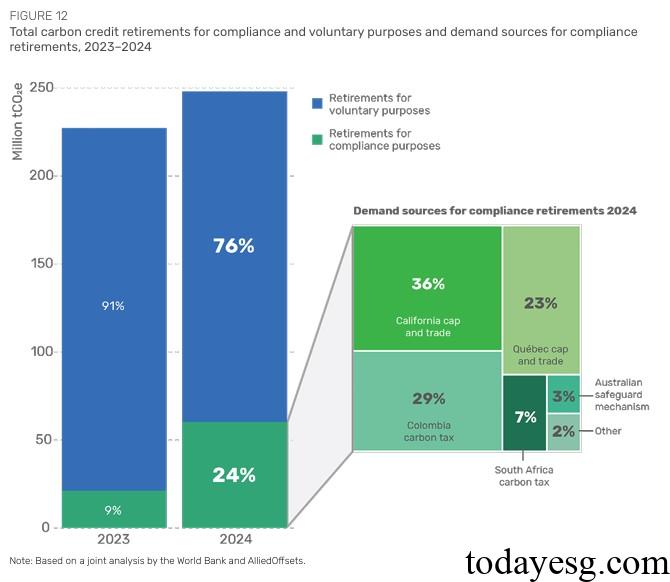

The global use of carbon credits in 2024 has increased by 15% compared to 2023, mainly due to an increase in compliant carbon credit usage (from 9% to 24%), with the California Cap and Trade Program accounting for 36%. Despite a significant increase in compliance requirements for carbon credits, most demand for carbon credits still comes from enterprises, with voluntary purchases accounting for 76%.

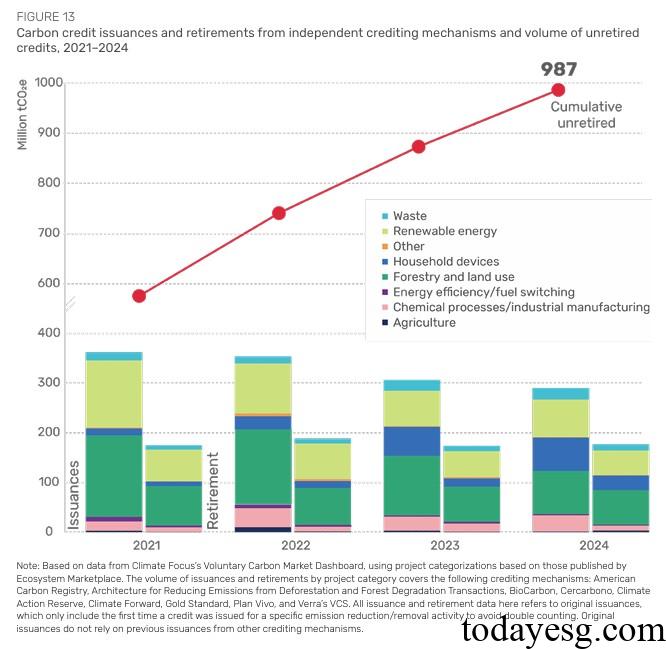

From the analysis of the types of carbon credit projects, in 2024, the market demand side pays more attention to nature-based carbon credit projects (increasing by 25%), which is also due to the increase in supply of related projects. The proportion of carbon credit for renewable energy projects has slightly decreased (nearly one-third), but it still ranks first in terms of supply and demand.

Relationship between Carbon Credit Market and Carbon Pricing Mechanism

The carbon credit market and carbon pricing mechanism can complement each other. About 40% of the implemented carbon pricing mechanisms worldwide (carbon emission trading systems or carbon taxes) allow companies to use carbon credits to fulfill some obligations, to guide the allocation of funds for low-cost carbon reduction projects. For example, some jurisdictions allow companies to offset their carbon emissions liabilities with carbon credits or allow companies to use carbon credits that comply with Article 6 of the Paris Agreement for compliance.

The carbon credit market can also help establish carbon pricing and expand price incentives to industries not covered by carbon pricing mechanisms. However, there is currently no consistent guidance document for the application of corporate carbon credits worldwide. In March 2025, the Science Based Targets Initiative released a revised net zero standard, allowing companies to use carbon credits to achieve short-term and long-term carbon emission targets.

The International Organization for Standardization is also developing international standards for net zero accounting, and jurisdictions such as the European Union and the United Kingdom are also developing relevant guidelines. At present, most regulatory policies are relatively cautious, focusing on the environmental impact of using carbon credits and transparency of information disclosure.

Reference: