Asia Climate Risk Regulatory Policy Report

The United Nations Environment Programme Finance Initiative (UNEP FI) releases a report on Asia climate risk regulatory policy, aimed at analyzing the climate risk regulatory frameworks in Asian jurisdictions.

Asia plays a crucial role in mitigating and adapting to global climate change, accounting for 60% of global greenhouse gas emissions and 70% of the world’s population affected by climate change, such as rising sea levels.

Related Post: Asia Investor Group on Climate Change Releases 2025 Climate Transition Report

Background of Climate Risk Regulatory Policy

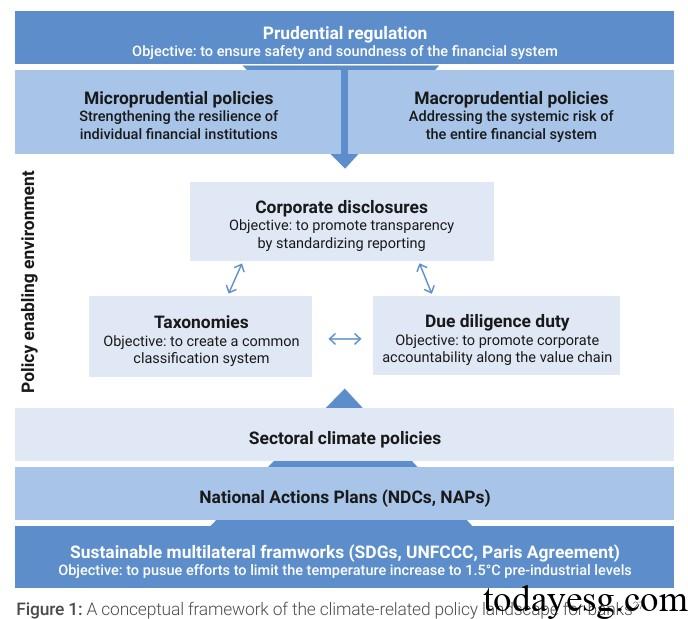

The Network for Greening the Financial System (NGFS) believes that climate related risks are the source of financial risks, and central banks and regulatory agencies should ensure that the financial system has the resilience to withstand these risks. The NGFS has released climate scenarios to assist financial institutions in assessing climate physical and transition risks. The Basel Committee has also released a framework for disclosing climate-related financial risks in the banking industry, helping banks disclose climate change risks and opportunities.

Asian jurisdictions have recognized the impact of climate change on financial risks, and traditional central bank responsibilities typically include price stability and economic growth. Some central banks are incorporating climate risks into their regulatory frameworks. For example, the People’s Bank of China has issued policy documents to support the development of green finance, while the Monetary Authority of Singapore has mentioned sustainable growth in its responsibilities.

Macro Prudential Climate-related Regulation

Climate-related macroprudential regulation focuses on the stability of the financial system, and actions taken by Asian central banks include:

- China: The People’s Bank of China conducted climate stress tests with 23 banks in 2021, including the power, steel and cement industries. In 2022, the People’s Bank of China and 19 banks conducted climate stress tests again, including eight high carbon emission industries, with a focus on the impact of rising carbon emission costs.

- Hong Kong, China: The Hong Kong Monetary Authority (HKMA) has incorporated climate risk into its macroprudential toolbox, with 20 banks included in the pilot program in 2021 and 46 banks included in the pilot program in 2023.

- Singapore: The Monetary Authority of Singapore (MAS) conducted its first climate stress test in 2018 and began conducting industry wide stress tests using long-term climate scenarios in 2022, with the results included in the annual financial stability assessment.

- South Korea: The Bank of Korea conducted climate stress tests based on the green finance network transition path scenario in 2021 and release a joint climate stress test with the Korea Supervisory Service in 2025.

- Japan: The Financial Services Agency (FSA) and the Bank of Japan began applying climate scenario analysis in 2021 and conducted analysis using short-term scenarios in 2024.

- Australia: The Australian Prudential Regulation Authority conducted a Climate Vulnerability Assessment in 2021.

Micro Prudential Climate-related Regulation

Climate-related micro prudential regulation focuses on the risks faced by individual financial institutions, and actions taken by Asian central banks include:

- China: The People’s Bank of China released green finance documents in 2024, reduced the carbon intensity of financial institutions’ asset organizations, and proposed ESG integration requirements. The People’s Bank of China also plans to adjust stress testing methods based on climate-related risks.

- Hong Kong, China: The Hong Kong Monetary Authority released the Climate Risk Management Regulatory Policy Manual in 2021 and conducted climate risk stress tests to measure the physical and transition risks of financial institutions.

- Singapore: The Monetary Authority of Singapore released the Guidelines on Environmental Risk Management in 2022 and set requirements for financial institution transformation plans.

- South Korea: The Financial Supervisory Authority of South Korea released climate related risk management guidelines for the financial sector in 2021.

- Japan: The Financial Services Agency of Japan released mandatory sustainability disclosure rules for listed companies in 2023.

- Australia: The Australian Prudential Regulation Authority supports the Taskforce on Climate-related Financial Disclosures (TCFD) as a best practice, requiring financial institutions to mandate the disclosure of climate information starting from 2025.

- New Zealand: The Financial Markets Authority of New Zealand has released a scenario analysis information sheet, requiring companies to conduct and disclose scenario analysis.

Reference:

Climate-related Risks in Financial Regulation and Supervision in APAC