ESG Negative Screening Rules

The Shenzhen Stock Exchange announces the inclusion of ESG negative screening rules in ChiNext Index, aimed at reducing the probability of significant risk events occurring in the index constitutes.

The ESG negative screening rules are based on the CNI ESG rating, and stocks rated below B will be excluded from the ChiNext Index.

Related Post: Shanghai Stock Exchange Includes ESG Ratings in SSE 180 Index

Introduction to CNI ESG Rating System

The ESG rating system of CNI is divided into three dimensions: environmental, social, and governance, with the following themes:

- Environment: resource utilization, climate change, pollution and waste management, ecological protection, environmental opportunities.

- Society: employees, suppliers, products and customers, social contributions.

- Governance: shareholder governance, senior management, ESG governance, risk management, information disclosure, and governance anomalies.

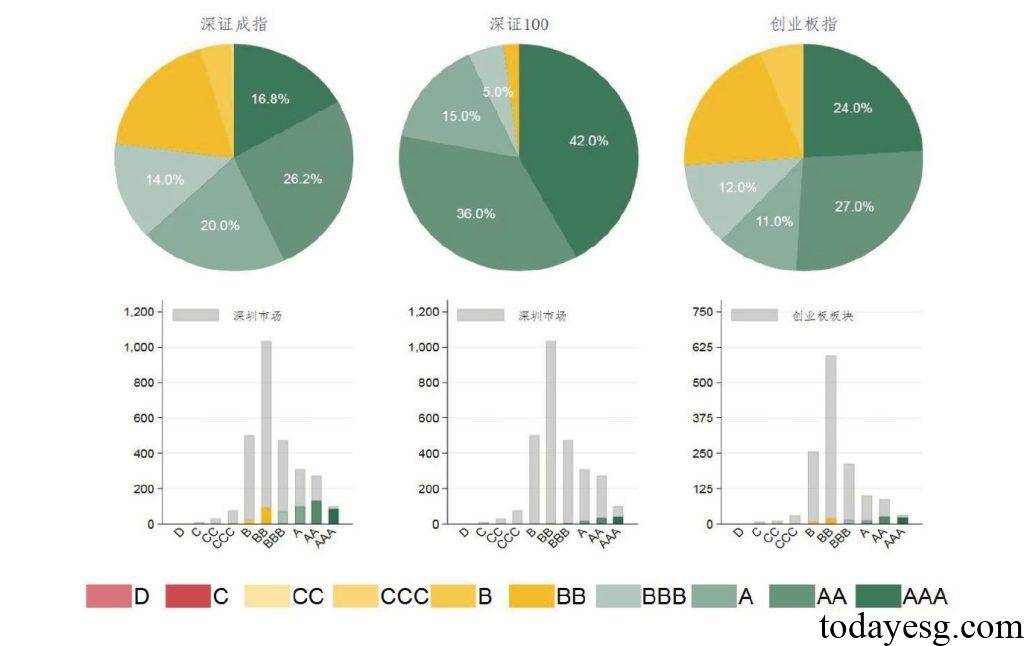

ESG rating system has set more than 220 indicators in 34 areas. For a listed company, the CNI ESG rating system first calculates its scores in different areas, then obtains scores for different themes, and finally calculates the weighted ESG total score. The system selects from the ten categories of AAA, AA, A, BBB, BB, BB, B, CCC, CC, C, and D based on the relative level of ESG scores of listed companies across all listed companies. The CNI ESG rating system is adjusted quarterly and may be subject to temporary adjustments due to material ESG risks.

ESG Rating in ChiNext Index Constitutes

The CNI 2024 Q4 ESG Quarterly Report shows that 3.59% of the market has an ESG rating below B level, with the Shenzhen Component Index, Shenzhen 100 Index, and ChiNext Index all having a rating of B level or above. For the constituents of the ChiNext Index, the proportions of AAA, AA, A, and BBB are 24%, 27%, 11%, and 12%, respectively. 71% of the constituent stocks of the ChiNext Index have formulated carbon emission management policies, and 22% have formulated biodiversity conservation policies.

Based on the current ESG rating analysis, the 100 constituents of the ChiNext Index will not be affected by negative screening rules now, and the proportion of stocks below B-level in the entire market is also very small. If there are material ESG risks leading to a rating downgrade, existing constituent stocks may be excluded from the ChiNext Index, and investors need to pay more attention to the constituent stocks rated BB and B (26).

Reference:

Shenzhen Stock Exchange Proposes ESG Negative Screening Rule for ChiNext Index