Global Biodiversity Fund Report

Sustainalytics releases a report on global biodiversity funds, aimed at analyzing the development trends of these funds, as well as their investment returns and asset allocation.

Sustainalytics believes that the market is recognizing the economic risks brought by biodiversity loss, and the World Economic Forum has also listed biodiversity loss as an important risk factor for the next decade. It is crucial for stakeholders to reverse the current situation.

Related Post: Fitch Releases a Report on Biodiversity and ESG

Global Biodiversity Fund Development

Sustainalytics uses the Morningstar Direct database to determine whether a fund is a biodiversity fund. These funds typically use key terms in their names, such as biodiversity and natural capital, and some funds invest in both biodiversity and climate themes simultaneously. Sustainalytics divides biodiversity funds into three categories based on their investment objectives and exposures:

- Risk-oriented: The fund invests in companies that can reduce biodiversity risks by minimizing negative impacts on biodiversity in their operations and supply chains.

- Solutions-focused: The fund invests in companies that can provide protection for biodiversity and have products or services that have a positive impact on biodiversity.

- Mixed: Funds possess both risk-oriented and solution-focused characteristics.

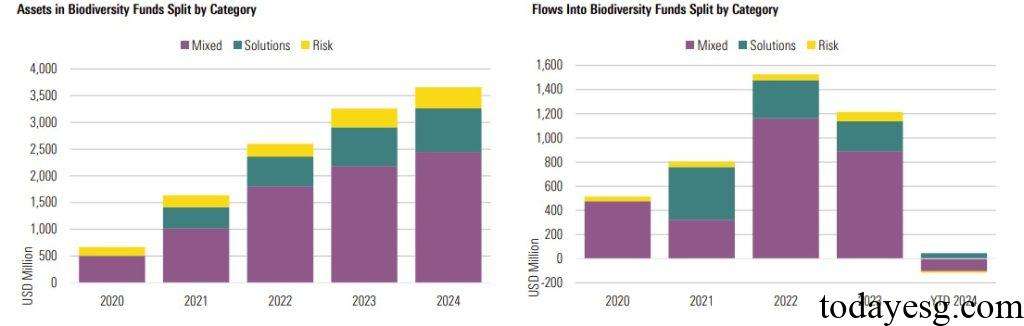

Sustainalytics studies the development trend of the global biodiversity fund based on the above classification. As of September 2024, the total size of the global biodiversity fund is 3.7 billion USD, significantly smaller than the total size of the climate fund (530 billion USD). Since 2020, the biodiversity fund has received a net inflow of over $1 billion and recorded a net outflow of funds this year (only solution-focused funds have received a net inflow of funds).

Sustainalytics identifies a total of 34 biodiversity funds, of which 24 are actively managed funds with an asset management scale of $1.8 billion, accounting for 48% of the total scale. Among the 24 actively managed funds, 14 are solution-focused, 6 are risk-oriented, and 4 are mixed. Most biodiversity funds have been issued in the past three years, with 12 and 11 issued in 2022 and 2023 respectively. This year, a total of 3 funds has been launched.

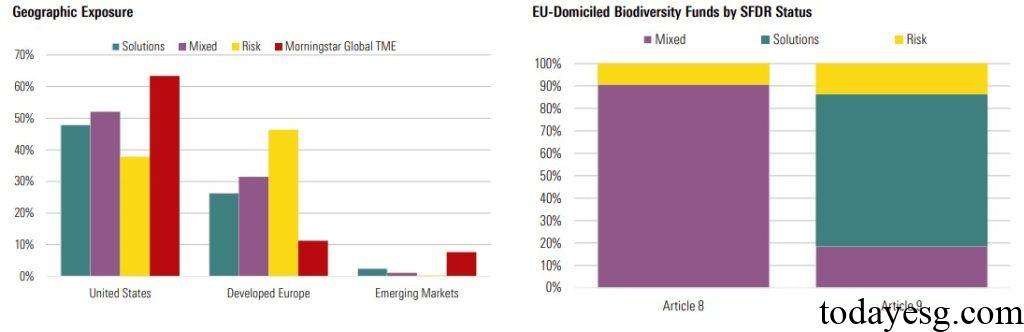

All biodiversity funds are registered in Europe, and their investment scope mainly comes from the United States and Europe, where companies typically have more policies to address biodiversity loss. According to the Sustainable Finance Disclosure Regulation (SFDR), these funds are classified into 15 Article 8 funds and 18 Article 9 funds. Article 8 funds focus on mixed models, while Article 9 funds focus on solution-focused models.

Global Biodiversity Fund Performance

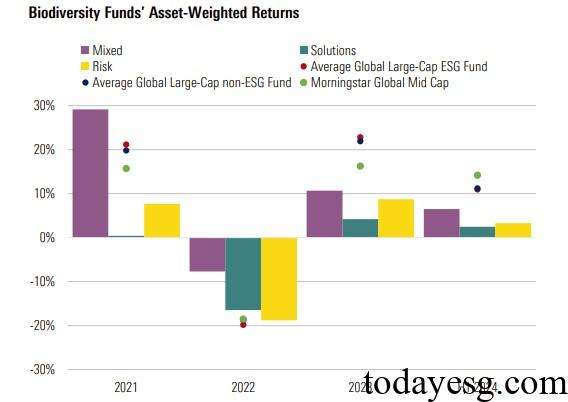

Since 2021, the average performance of global biodiversity funds has been lower than that of global large stock ESG funds, partly due to the higher fees of biodiversity funds. In 2022, biodiversity funds performed better than ESG funds, demonstrating stronger market resilience. Mixed funds usually perform the best, while risk-oriented funds have greater fluctuations in returns.

In terms of biodiversity conservation policies, 30% of invested companies have already formulated this policy. In terms of biodiversity project quality, 41% are rated as strong or very strong. In terms of deforestation policy, 37% have already formulated this policy. Most biodiversity funds invest less in fossil fuels than the global average (10%), with lowest exposure in solution-focused funds. One third of biodiversity funds have higher than average participation in carbon solutions.

Sustainalytics believes that the three biodiversity funds provide asset opportunities for different investors. Risk-oriented funds are suitable for investors who want to protect their investment portfolios from the impact of biodiversity. Solution-focused funds are suitable for investors with high-risk appetite and a desire to achieve excess returns. Hybrid funds are suitable for investors who want to seek a balance between these funds.

Reference:

The Landscape of Biodiversity and Natural Capital Funds Report

Contact:todayesg@gmail.com