Nature risk and Financial Risk

This article introduces the relationship between nature risk and financial risk, and nature risk is being understood by the market as a material financial risk.

The global economy is closely related to natural conditions, which provide the foundation for economic growth. However, the current rate of natural decline is also the fastest in history. Nature risks have brought risks to the global economy and financial system. More than half of the world’s GDP (over $58 trillion) relies on nature, but less than 1% of enterprises understand the impact of nature on their business activities.

Related Post: The Relationship between Climate Change and Financial Stability

Nature Risk and Global Biodiversity Framework

2022 COP15 released the Global Biodiversity Framework, aimed at curbing and reversing the trend of global biodiversity loss by 2030, and addressing an annual funding gap of $700 billion. The global biodiversity framework has set the following long-term goals:

- Goal 1: Protect and restore ecosystems and species and maintain genetic diversity.

- Goal 2: Maintain and enhance the contribution of nature to humanity through sustainable use and management of biodiversity.

- Goal 3: Share biodiversity benefits fairly and justly with indigenous peoples and local communities.

- Goal 4: Ensure sufficient measures to address the biodiversity financing gap and coordinate funding to achieve the 2050 vision.

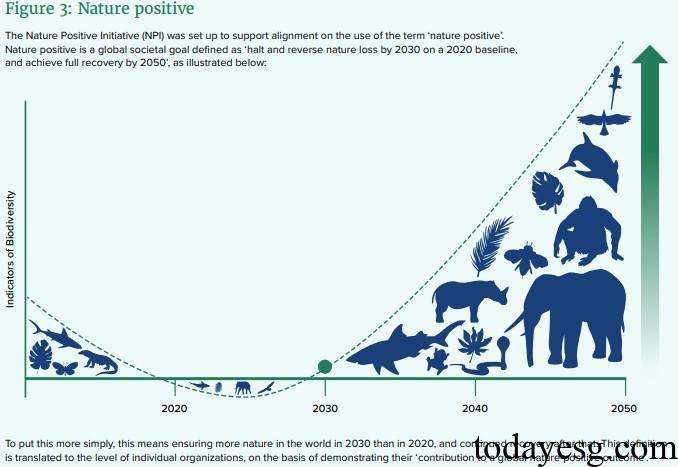

Based on the global biodiversity framework, stakeholders have proposed the concept of the Nature Positive Initiative. Nature positive refers to using 2020 as a benchmark to curb and reverse natural loss by 2030 and fully restore nature by 2050.

Relationship between Nature risk and Financial Risk

Under the influence of the global biodiversity framework and Nature Positive Initiative, enterprises need to consider the role of nature in regulatory agencies, investors, technology, markets, and other areas, and identify, manage, and adapt to nature related risks and opportunities. Enterprises that handle nature risks correctly can gain more advantages in challenges, while failing to cope with nature risks may lead to changes in factors such as supply chain, value, and cost, ultimately affecting the financial performance of the enterprise. Therefore, nature risk can be regarded as a material financial risk, which comes from the following aspects:

- Policymakers: Policymakers are reversing biodiversity loss, promoting positive activities in nature, and increasing transparency in corporate nature related disclosures by issuing nature related laws.

- Investors: Investors are demanding that companies provide more natural related information and invest more funds in nature-based solutions and sustainable business opportunities.

- Standard setters: Standard setters are issuing disclosure standards for nature related information to establish a regionally and globally consistent framework for nature information disclosure.

- Consumers: Consumers are realizing the importance of natural positive products and prefer sustainable goods and services, which may change to pattern of enterprises.

- Employees: Employees are considering the sustainable performance of the company in their long-term career development to seek good prospects.

After realizing the relationship between nature risks and financial risks, companies can incorporate them into accounting processes such as financial reporting to manage and capture these risks and opportunities. The Taskforce on Nature-related Financial Disclosures (TNFD), as the global standard setter for corporate natural information disclosure, has issued recommendations for nature related information disclosure. The European Sustainability Reporting Standards (ESRS) also require companies to disclose substantive natural matters.

The International Sustainability Standards Board (ISSB) is also developing global disclosure standards for biodiversity and ecosystems. Although the research progress on nature risks in the sustainable field is relatively backward compared to climate risks, considering the complex relationship between climate and nature, stakeholders will have a better understanding of the relationship between nature risk and financial risk.

Reference:

Why Nature Matters to Accountants

ESG Advertisements Contact:todayesg@gmail.com