2025 Decarbonization Report

PwC releases 2025 decarbonization report, aimed at analyzing the progress of corporate climate goals and decarbonization actions.

PwC surveys 6895 companies that disclosed information on CDP, with a focus on 4163 listed companies to understand the differences between their committed decarbonization goals and actions.

Related Post: Institutional Investor Climate Change Group Releases Report on Sector Decarbonization Roadmaps

Setting Decarbonization Targets

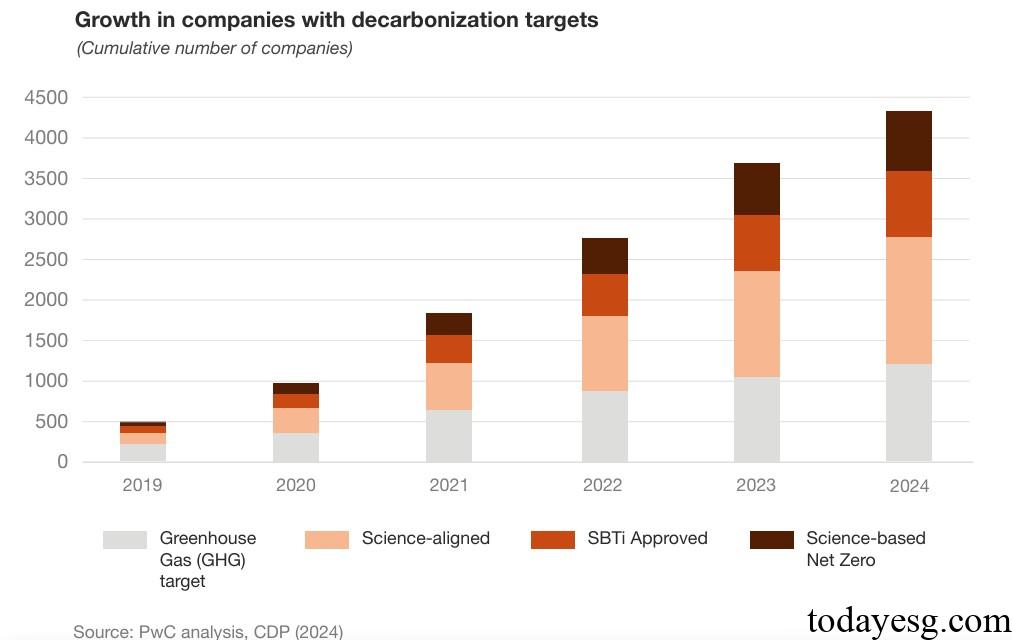

Out of 6895 companies, over 4000 have already made climate commitments, a nine-fold increase compared to five years ago. 37% of companies have set stricter decarbonization targets, and 16% are considering slowing down their targets. More than half of the decarbonization targets are already aligned with the latest climate science, and this proportion is increasing year by year. The number of small and medium-sized enterprises setting decarbonization targets in 2024 is rapidly increasing, with a median revenue of $1.3 billion currently. The median revenue of enterprises setting new decarbonization targets in 2020 is $3.8 billion, indicating that climate commitments are shifting from large enterprises to small and medium-sized enterprises.

From the perspective of Scope 1 and Scope 2, industries with lower carbon emissions have already included most carbon emissions in decarbonization targets, while carbon intensive industries have included 60% of carbon emissions in decarbonization targets. From the perspective of Scope 3, 50% of carbon emissions have been included in decarbonization targets because it is difficult for companies to have an impact on their upstream and downstream carbon emissions. The current Scope 3 targets set by these companies include 24 billion tons of carbon dioxide, while Scope 1 and Scope 2 targets include 6 billion tons of carbon dioxide.

Achieving Decarbonization Targets

Scope 1 and Scope 2 Decarbonization Targets

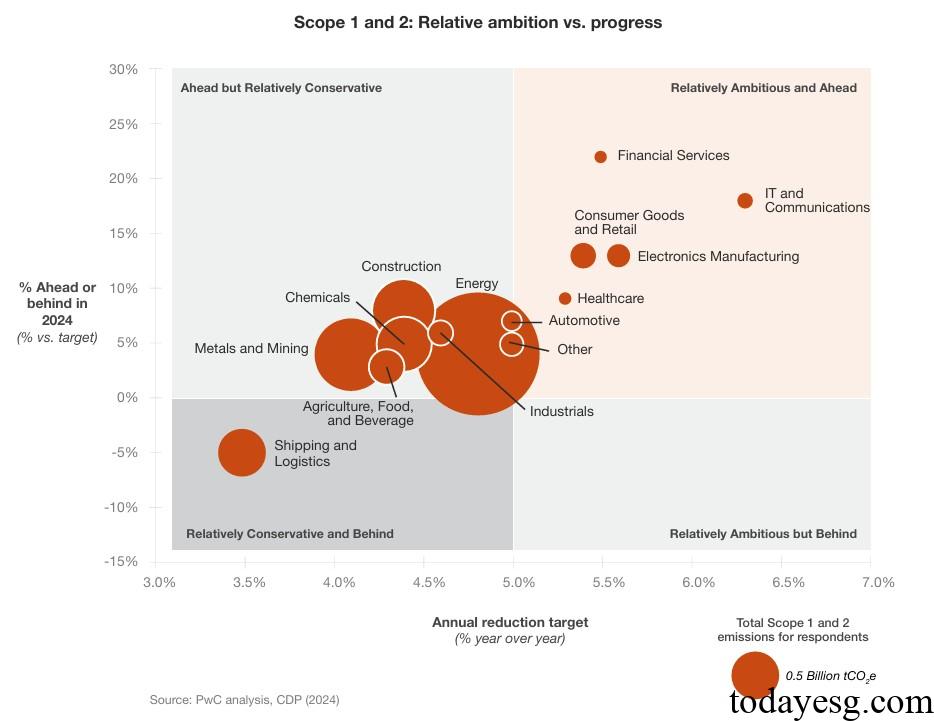

Based on scientific foundations, carbon emission targets require companies to reduce their carbon emissions by 6% annually starting from 2023, to achieve the neutrality carbon emission target by 2030. PwC finds that 67% of companies are achieving their carbon reduction targets as planned, with an average reduction of 6% in Scope 1 and 12% in Scope 2. This demonstrates the importance of low-carbon electricity in decarbonizing enterprises, however, excessive reliance on low-carbon electricity may result in cost pressures in the future. From industrial perspective, companies that have set stricter carbon reduction targets are more likely to achieve their goals in decarbonization actions and have a higher probability of being in a leading position.

Scope 3 Decarbonization Targets

54% of enterprises are achieving their carbon reduction targets as planned, an increase of 4 percentage points compared to last year. More than 80% of enterprises achieve emission reduction by reducing product carbon emissions, that is, reducing downstream supply chain carbon emissions. The proportion of enterprises implementing decarbonization actions for upstream supply chain activities such as purchasing products and services is relatively low. Compared to Scope 1 and Scope 2 decarbonization targets, Scope 3 decarbonization target still has a lot of room for development.

Accelerate Decarbonization Progress

PwC finds that companies that are progressing smoothly towards decarbonization goals typically have the following characteristics:

- Governance structure: Incorporate decarbonization goals into policies such as the board of directors, strategy, and risk management.

- Fund allocation: Incorporate more climate transition funds into capital expenditures and operating expenditures.

- Stakeholder collaboration: Work with suppliers, customers, investors to reduce carbon emissions.

- Product sustainability: Reduce Scope 3 carbon emissions through product design and innovation.

After accelerating decarbonization progress, companies may gain the following advantages:

- Revenue growth: Increased product premium, increase market share, and meet sustainable preferences.

- Cost reduction: Reduce energy consumption, waste, and production costs.

- Risk reduction: Reduce the long-term costs of climate change mitigation and adaptation.

Reference: