2025 Corporate Sustainability Report

The Organization for Economic Co-operation and Development (OECD) releases 2025 Corporate Sustainability Report, which aims to summarize the characteristics and trends of corporate sustainability.

This report uses sustainable disclosure information from 12900 companies worldwide, which account for 91% of the total global market value.

Related Post: Harvard University Releases 2025 Corporate Sustainability Report

2025 Corporate Sustainability Report Analysis

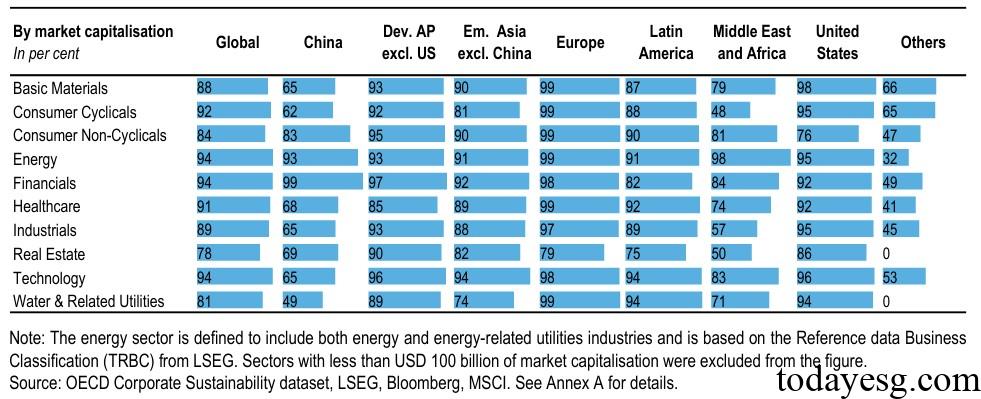

Corporate sustainable action can identify and respond to environmental and social trends. In 2024, a total of 12900 companies (91% of the total market value) globally disclosed sustainable development information, an increase from 9600 companies (86% of the total market value) in 2022. From an industry perspective, energy companies have the highest disclosure rate (accounting for 94% of the industry market value), while real estate companies have the lowest disclosure rate (accounting for 78% of the industry market value). In terms of carbon emission categories, 88% of companies disclosed Scope 1 and Scope 2, and 76% disclosed Scope 3. Among the companies that disclose sustainable information, 42% seek sustainable audits, of which 56% seek limited audits, 17% seek reasonable audits, and over half of sustainable audits are completed by auditing firms.

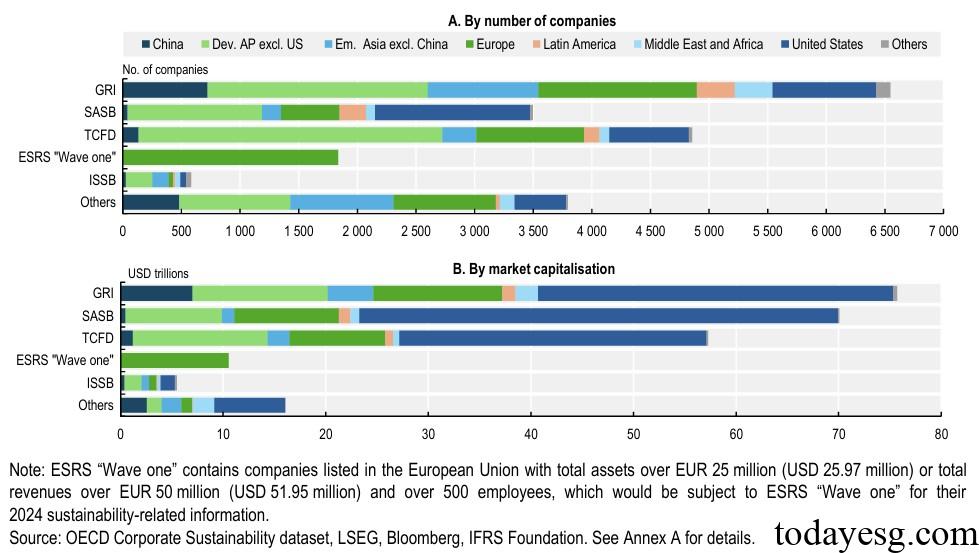

In terms of sustainable disclosure frameworks adopted by enterprises, the top three frameworks globally are the Global Reporting Initiative (GRI) standards (6500 adopted), the Taskforce on Climate-related Financial Disclosures (TCFD) recommendations (4800 adopted), and the Sustainability Accounting Standards Board (SASB) standards (3500 adopted). 581 companies have adopted IFRS S1 and IFRS S2 published by the International Sustainability Standards Board (ISSB).

In terms of corporate sustainable governance, two-thirds of the board of directors are responsible for overseeing sustainable development risks, with 70% responsible for overseeing climate related matters, up from 53% in 2022. Among companies that adopt variable compensation, nearly 70% link executive compensation to sustainable development factors, up from 60% in 2022. 86% of companies have disclosed their shareholder engagement policies, such as how shareholders can ask management questions or present proposals at shareholder meetings.

The OECD believes that enterprises still need more sustainable actions to comply with the OECD Principles of Corporate Governance and the Guidelines for Multinational Enterprises for Responsible Business Conduct. To improve the consistency and reliability of sustainable information, companies can apply the International Standard on Sustainability Assurance (ISSA 5000), and jurisdictions can enhance the interoperability of different disclosure frameworks to reduce compliance costs for companies.

Reference: