Short-term Climate Scenarios

The Network for Greening the Financial System (NGFS) releases its first short-term climate scenario, aimed at analyzing the short-term impact of climate change on financial stability.

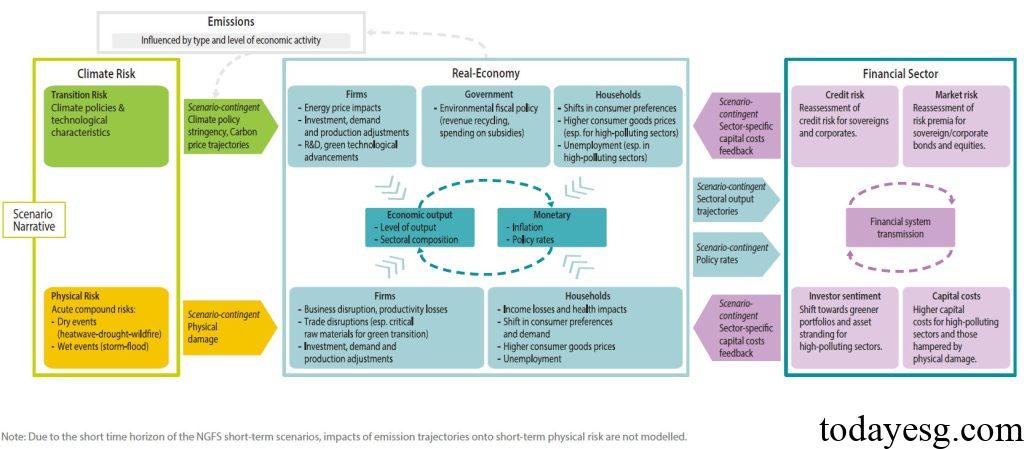

The NGFS believes that short-term climate scenarios explore how climate policies, extreme weather, and economic development interact to help central banks and regulatory agencies understand climate related risks.

Related Post: Introduction to the Application of Climate Scenario Analysis in Financial Industry

Introduction to Short-term Climate Scenarios

The short-term climate scenario released by the NGFS is the world’s first tool that focuses on short-term climate risks. It focuses on climate policies (transition risks), extreme weather (physical risks), and macro financial development, providing a supplement to long-term scenarios. The characteristics of short-term climate scenarios include:

- Reflect the complex interplay between climate risks and business cycles: Scenarios incorporate climate policies, extreme weather, and economic sectors to improve the accuracy of climate risk analysis.

- Focus on climate risks within a specific time frame: Scenarios focus on climate risks over the next five years, which have high value for stress testing, risk assessment of the financial industry.

- Provide detailed financial and industry models: Scenarios include many financial variables and industry data predictions, with a wide range of applications.

- Incorporate composite climate physical risks: Scenarios consider multiple transmission channels for the impact of extreme weather events, improving accuracy.

Short-term climate scenarios can be divided into the following types:

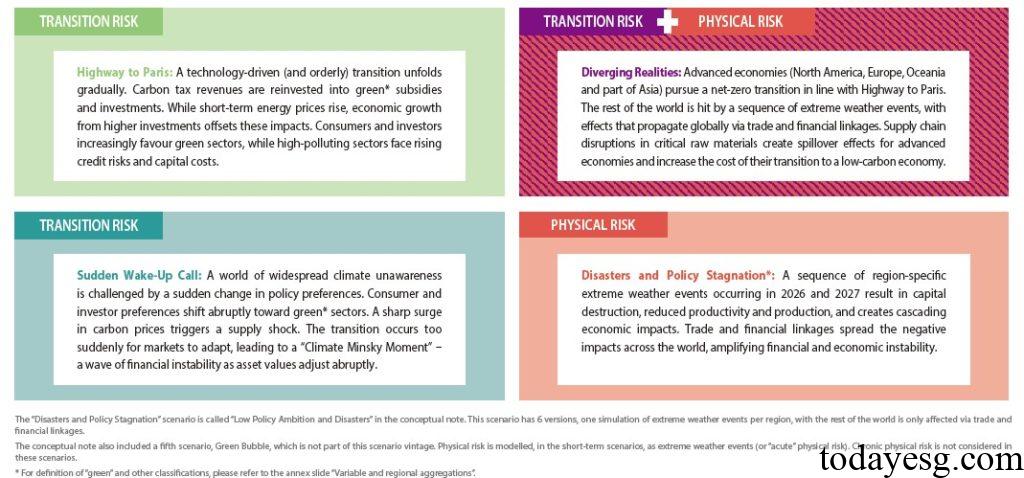

- Disasters and Policy Stagnation: Focus solely on physical risks. In this scenario, a series of extreme weather events that occur in the future will lead to a decrease in productivity and financial losses and affect financial stability.

- Highway to Paris: Focus only on transition risks. In this scenario, green subsidies and investments continue to increase, and consumers and investors are more inclined towards green industries, while high polluting industries are facing pressure from rising costs.

- Sudden Wake-Up Call: Focus only on transition risks. In this scenario, green policies suddenly develop rapidly, and the market is unable to adapt, leading to asset value adjustments and economic fluctuations.

- Diverging Realities: Simultaneously focus on physical risks and transitional risks. In this scenario, developed economies invest heavily in transition economies, while other economies experience financial stability impacts due to extreme weather conditions. The supply chain pressures of these economies generate spillover effects, affecting the low-carbon transition of developed economies.

How to Use Short-term Climate Scenarios

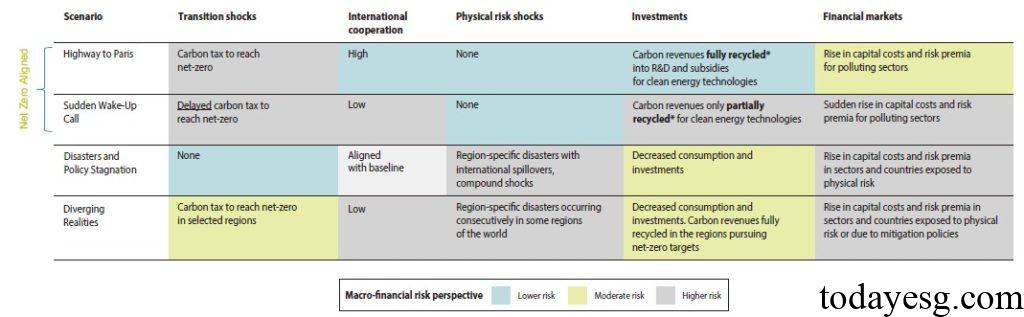

The NGFS provides different input variables for each scenario, such as transition shocks, international cooperation, physical risk shocks, investments, and financial markets. These input variables determine the development of scenario analysis. In terms of output variables, each scenario provides three types of output results, namely:

- Climate and Energy: Carbon Prices, Greenhouse Gas Emissions, and Electricity Production.

- Macroeconomics: GDP, consumption, imports and exports, investment, population, price levels, and monetary policy interest rates.

- Financial risk: Cost of funds and financial asset prices.

The NGFS believes that users of short-term scenarios should carefully consider comparing them with long-term scenarios, as there are significant differences in assumptions, variables, models. For example, in terms of physical risks, short-term scenarios are based on the impact of extreme weather events that occur in specific years. Long term scenarios are based on physical risks at the jurisdictional level and linked to long-term climate change factors.

Reference:

NGFS Short-term Climate Scenarios for Central Banks and Supervisors