Framework for Nature-related Financial Risks for Central Banks

The Network for Greening the Financial System (NGFS) releases the framework for nature-related financial risks for central banks, aimed at providing guidance for central banks to address nature-related financial risks.

NGFS believes that there is a complex relationship between nature and climate, and policies to address climate change and natural degradation need to be combined in order to effectively manage financial risks. NGFS has released guidelines to assist central banks in identifying and assessing climate related financial risks.

Related Post: NGFS Releases Second Edition of Guide on Climate-related Disclosure for Central Banks

Introduction to Nature-related Financial Risks

The impact of nature on the economy is crucial, as it can provide important resources such as food, energy, air, and water. However, due to the development of human society exceeding the capacity of nature to provide resources, natural degradation is increasing. The 2022 Kunming Montreal Global Biodiversity Framework aims to curb and reverse natural degradation.

NGFS believes that nature-related financial risks may have significant impacts on the macro economy, and if the market fails to consider, mitigate, and adapt to these impacts, it may affect financial stability. In order to effectively address these risks, NGFS has established a Task Force on Biodiversity Loss and Nature-related Risks, aimed at developing a framework for nature-related financial risks to guide central bank actions.

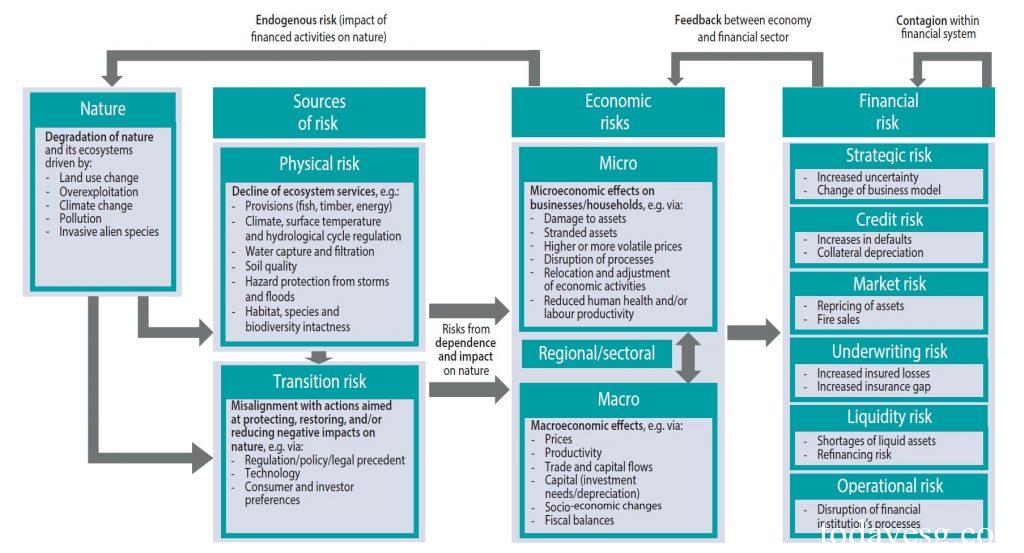

NGFS classifies natural risks into physical risks and transition risks. Physical risks stem from natural degradation and loss of ecosystem services, while transition risks stem from the market’s inability to effectively protect and restore natural systems. These two types of risks may affect economic activities and transform into financial risks, which can have adverse effects on individual financial institutions and the entire financial system. These financial risks include credit risk, market risk, liquidity risk, and operational risk. Nature-related financial risks are very similar to climate-related financial risks, and their impact is equally worthy of market participants’ attention.

Introduction to Framework for Nature-related Financial Risks for Central Banks

NGFS, based on its understanding of nature-related financial risks, releases a framework for nature-related financial risks to assist central banks in identifying and assessing natural-related financial risks that are crucial to the economy and financial system. Due to different regulatory requirements for central banks in different jurisdictions, the framework only adopts a principle based approach without detailed regulations. The framework is divided into three phases, namely:

Phase 1: Identify nature-related physical risks and transition risks. The central bank needs to analyze nature-related risks, which may have a material impact on specific industries. Central bank needs to consider which industries have a high degree of dependence on nature and whether these industries have a direct or indirect relationship with nature. At the same time, the central bank also needs to consider the impact of climate change on nature-related risks, as well as which climate change actions may lead to natural risks.

Phase 2: Measure nature-related economic risks. Nature-related physical risks and transition risks may lead to economic risks, and the central bank needs to assess these economic risks. For example, natural risks may have an impact on businesses and individuals that rely on ecosystems for their livelihoods, leading to additional costs in economic processes such as pricing, production, investment, and trade. The central bank needs to consider the sensitivity and adaptability of the economic system to natural risk shocks, as well as whether there are alternative choices.

Phase 3: Evaluate the risks faced by the financial system. The central bank needs to assess the impact of nature-related risks on the financial system, which may lead to collateral impairment, decreased corporate profitability, etc., thereby affecting individual financial institutions. These impacts may pose risks to the entire financial system. In addition to nature-related risks, central bank can also consider taking actions to have positive impacts on nature.

In order to help central banks understand the nature-related financial risk framework, NGFS also provides some case studies. Central banks can also obtain further guidance from the NGFS Technical Document on Nature Scenarios released by NGFS. These information will encourage central banks to identify, assess, and take action to address the material economic and financial risks arising from nature and climate change.

Reference:

NGFS Publishes the Second Edition of its Guide on Climate-related Disclosure for Central Banks