Multilateral Development Bank Climate Finance Report

The European Investment Bank (EIB) releases the 2023 Multilateral Development Bank Climate Finance report, which aims to summarize the global climate finance situation of multilateral development banks.

The report is jointly written by ten multilateral development banks from different regions, which plan to provide at least $65 billion in climate finance globally annually, including $50 billion in climate finance for low- and middle-income economies, as well as $40 billion in climate finance for the private sector annually.

Related Post: Climate Policy Initiative Releases Global Climate Finance Report

Different Types of Climate Finance

Climate finance of multilateral development banks is mainly divided into three different categories, namely:

- Funds for adapting to climate change: These funds are mainly used to reduce the risks brought by climate change and improve climate adaptation capabilities. The projects invested by these funds need to elaborate on the background of climate change and declare that the projects will address climate vulnerability issues in order to establish a clear and direct relationship with climate change adaptation projects.

- Funding for mitigating climate change: These funds aim to reduce, avoid, and limit greenhouse gas emissions to mitigate climate change and achieve the global warming goals of the Paris Agreement. These funds are invested in projects with negative or very low emissions, transition projects, and promotion projects, measured by greenhouse gas emission reductions.

- Climate co-financing: Climate co-financing aims to track the amount of funds simultaneously invested by both the public and private sectors in providing climate finance through multilateral banks. Climate co-financing includes Private Indirect Mobilization, Private Direct Mobilization, and Public Co-finance.

Climate Finance in Low- and Middle-income Economies

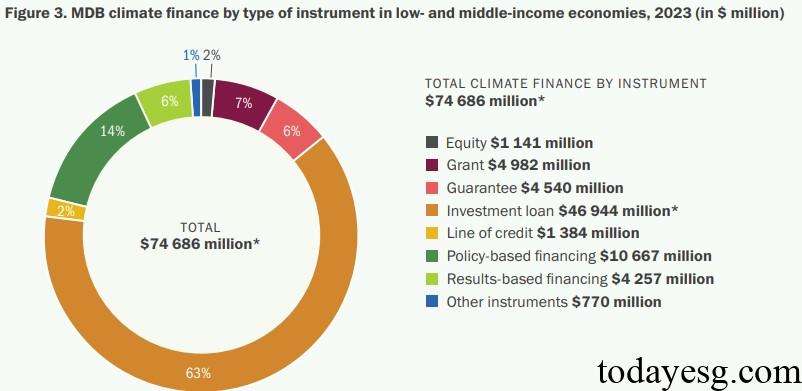

In 2023, global multilateral development banks provided $74.7 billion in funding to low- and middle-income economies, of which $24.7 billion was allocated for climate change adaptation projects and $50 billion for climate change mitigation projects. The funds come from the self owned accounts of multilateral development banks ($70.6 billion) and external resources managed by them ($4.1 billion). External resources include climate finance funds funded by bilateral institutions, such as the Global Environment Facility and the Green Climate Fund.

Among ten multilateral development banks, the World Bank has the largest climate finance scale, reaching $37.3 billion, of which $12.5 billion is used for climate change adaptation projects and $24.8 billion is used for climate change mitigation projects. In terms of recipients of climate finance, the public sector received $29.7 billion and the private sector received $7.6 billion. Among all climate finance projects, investment loans ($46.9 billion), policy financing ($10.7 billion), and grants ($5 billion) account for the highest proportion.

In terms of climate co-financing, the financing scale for low- and middle-income economies in 2023 is $68.8 billion, of which $50.1 billion is for climate change adaptation projects and $18.7 billion is for climate change mitigation projects. The scale of climate co-financing provided by the private sector is $28.6 billion, while the scale of financing provided by the public sector is $40.2 billion.

Climate Finance in High-income Economies

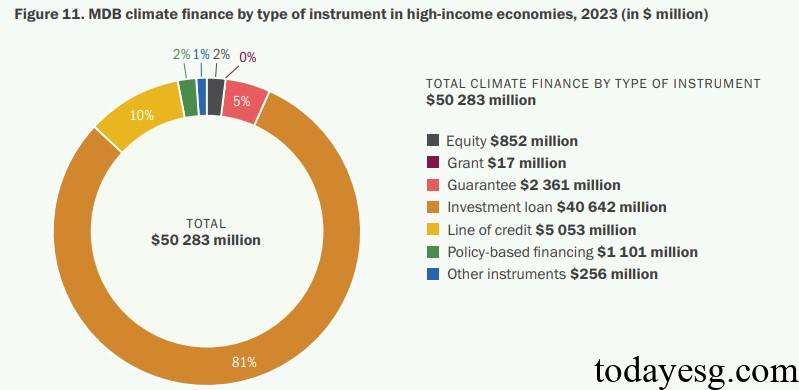

In 2023, global multilateral development banks provided $50.3 billion in funding to high-income economies, including $3 billion for climate change adaptation projects and $47.3 billion for climate change mitigation projects. The funds come from the self owned accounts of multilateral development banks ($49.8 billion) and external resources managed by them ($500 million). The proportion of investment in climate change mitigation in high-income economies (94%) is significantly higher than that in low- and middle-income economies (67%).

Among the ten multilateral development banks, the European Investment Bank has the largest climate finance scale, reaching $37.3 billion, of which $2.2 billion is used for climate change adaptation projects and $39.9 billion is used for climate change mitigation projects. In terms of recipients of climate finance, the public sector received $23.5 billion and the private sector received $18.5 billion. Among all climate finance projects, investment loans ($40.6 billion), credit financing ($5.1 billion), and guaranteed loans ($2.4 billion) account for the highest proportion.

In terms of climate co-financing, the financing scale of high-income economies in 2023 is $103 billion, of which $3.1 billion is for climate change adaptation projects and $99.9 billion is for climate change mitigation projects. The scale of climate co-financing provided by the private sector is 7$2.7 billion, while the scale of financing provided by the public sector is $30.3 billion.

Reference:

2023 Joint Report on Multilateral Development Banks’ Climate Finance