2025 Q2 Global Transition Finance Report

The MSCI Sustainability Institute releases 2025 Q2 Global Transition finance Report, aimed at analyzing the development of transition finance.

MSCI finds that global transition funds grew by 20% last year and currently account for 40% of all climate fund assets. The importance of transition finance has received attention from market participants.

Related Post: MSCI Releases 2025 Q1 Global Transition Finance Report

Transition Finance and Climate Change

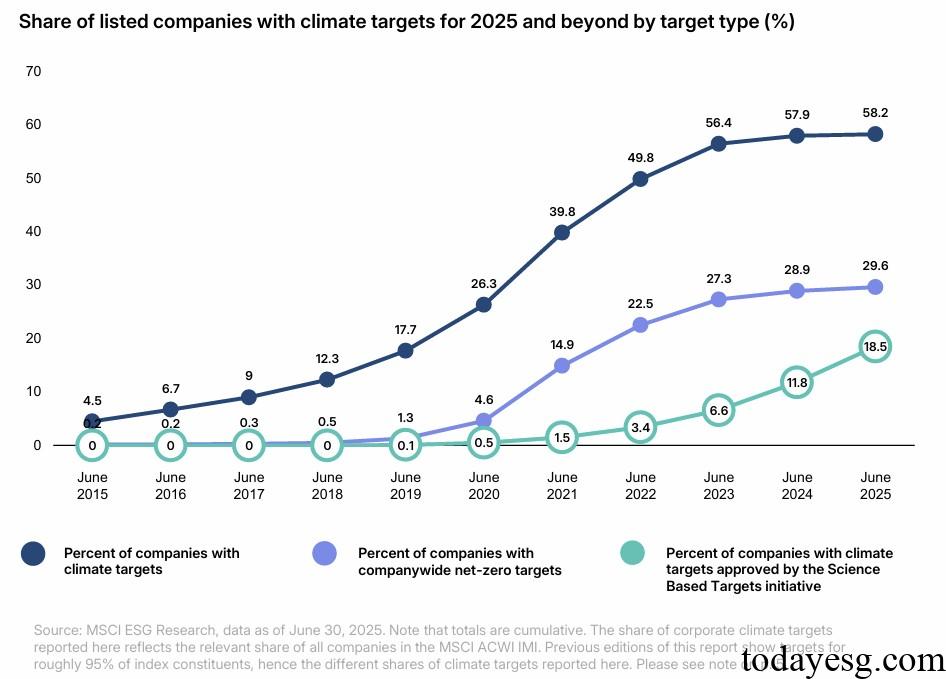

Corporate climate goals are directly related to transition finance, and companies setting these goals require funding to achieve decarbonization of their supply chains. As of June 2025, 18.5% of listed companies worldwide have set climate targets certified by the Science Based Targets Initiative (SBTi), an increase of 6.2 percentage points year-on-year. 30% of companies have set net zero emission targets, and 58% of companies have released climate commitments, both showing slight year-on-year growth. The consumption and communication industries have the highest proportion of setting climate targets.

Setting climate targets has a positive effect on reducing greenhouse gas emissions. Data from 2018 to 2023 shows that Scope 1 carbon emissions of listed companies with climate targets increase by 0.2% annually, while Scope 1 carbon emissions of listed companies without targets increase by 4.3% annually. Companies that have obtained certification from the SBTi for climate goals can reduce their carbon emissions by 0.5% annually. Corporate disclosure of climate data can help investors measure their compliance with climate goals. 76% of listed companies disclose their Scope 1 and Scope 2 carbon emissions, and 53% disclose their Scope 3 carbon emissions.

As of June 2025, the potential global temperature rise for listed companies is 2.7 degrees Celsius, with 12% of listed companies experiencing a temperature rise of no more than 1.5 degrees Celsius and 26% experiencing a temperature rise between 1.5 and 2 degrees Celsius. MSCI believes that the overall global warming target is between 2.6 degrees Celsius and 3.1 degrees Celsius, with energy, materials, and consumer industries having a significant impact on the climate. Transition finance not only needs to consider the total amount of financing, but also the impact of the enterprise on the climate.

Transition Finance and Climate Fund

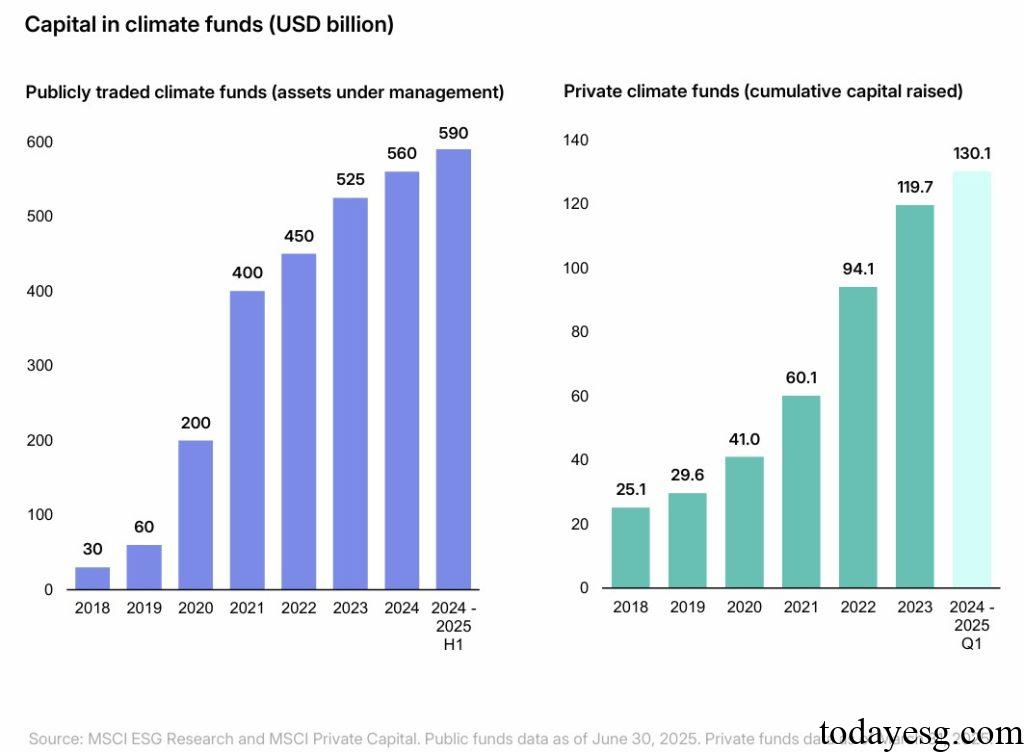

Investors are continuing to pay attention to the energy transition and decarbonization opportunities brought by climate funds. As of June 2025, the total size of climate funds in the public market reached $590 billion, a 20-fold increase in seven years. As of March 2025, the size of climate funds in the private market is $130 billion. The main investment directions of these climate funds are utility industry, industries, and information technology industry. The main sources of funding for the climate funds are Europe (60%), Asia (26%), and the United States (8%), with funding primarily directed towards United States (60%), Europe (25%), and Asia (13%).

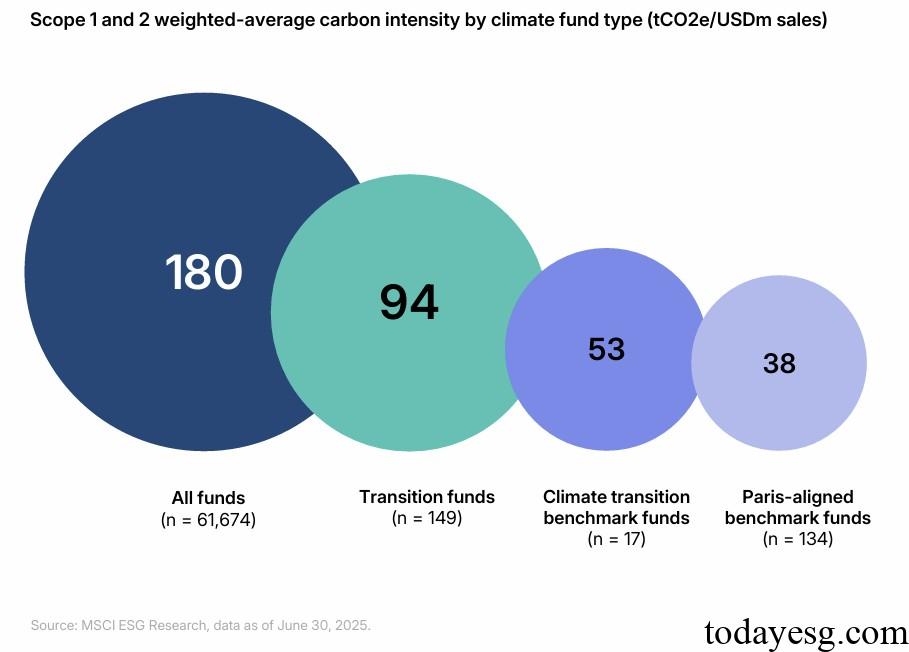

Transition finance focuses on carbon intensive industries and encourages long-term decarbonization, rather than excluding high carbon emission assets to achieve portfolio decarbonization. The carbon emission intensity of the transition fund is 2.5 times that of the Paris-Alignment Benchmark Fund, but still half of the carbon emission intensity of all funds. The carbon emission intensity of the Climate Transition Benchmark Fund is between that of the Transition Fund and the Paris-Alignment Benchmark Fund.

Reference: