IFRS Sustainability Disclosure Taxonomy

The International Sustainability Standards Board (ISSB) releases the IFRS Sustainability Disclosure Taxonomy to help investors effectively analyze and compare sustainable disclosures.

The IFRS Sustainability Disclosure Taxonomy is based on the General Requirements for Disclosure of Sustainability-related Financial Information (IFRS S1) and Climate-related Sustainability Disclosure Standards (IFRS S2) launched by the ISSB last year. The taxonomy will be consistent with the IFRS Accounting Taxonomy for companies to use in sustainable information disclosures.

Related Post: ISSB Releases Preview of the Inaugural Jurisdictional Guide for the Adoption of ISSB Standards

Introduction to IFRS Sustainability Disclosure Taxonomy

The IFRS Sustainability Disclosure Taxonomy can help companies and investors communicate. Companies can use the taxonomy to mark sustainable disclosure information in to provide investors with comprehensive digital financial reports, making it easier for investors to digitally search, extract and compare sustainable information from different companies.

The IFRS Sustainability Disclosure Taxonomy uses eXtensible Business Reporting Language (XBRL). XBRL is an information exchange standard used between financial report preparers and users. The IFRS Sustainability Disclosure Taxonomy consists of a set of electronic XBRL files. The company fills in the sustainable disclosure information into the corresponding location of the file, and the computer can read it for relevant stakeholders who are interested about them.

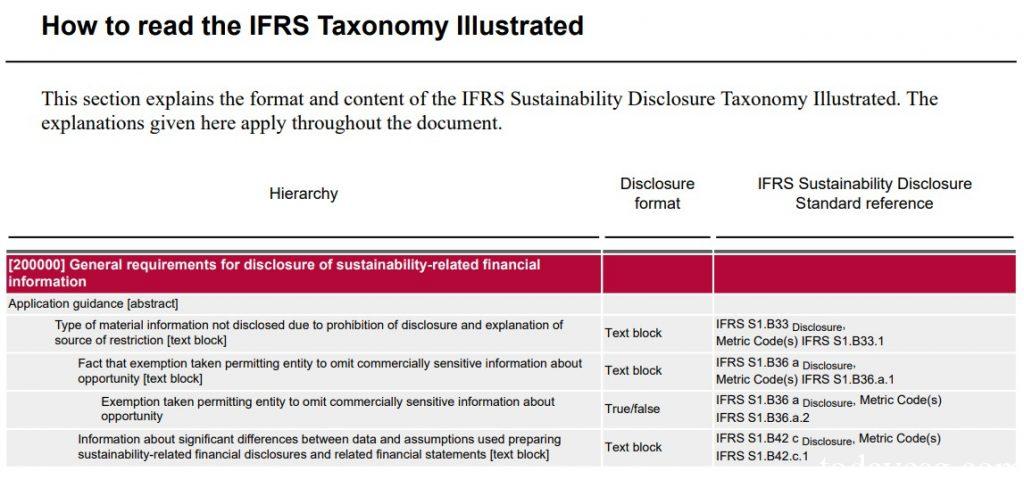

To facilitate the market’s understanding and application, the ISSB provides a detailed taxonomy demonstration with three columns. The first column is Hierarchy, which represents the groups of different elements of the taxonomy and the disclosure points within each group. The second column is Disclosure Format, which is the text, date, currency, percentage and other information filled in by the company. The third column is the IFRS Sustainability Disclosure Standard Reference, which provides the location of disclosure points in IFRS S1 and IFRS S2.

XBRL has been used in companies to communicate with audit departments, regulators and investors. It can help stakeholders quickly and accurately locate the company’s financial information. ISSB believes that as many jurisdictions around the world are considering adopting ISSB standards, Sustainability Disclosure Taxonomy can improve market efficiency and help investors to compare information between different jurisdictions. In the future, ISSB will continue to take measures to improve the interoperability of the Sustainability Disclosure Taxonomy with other taxonomies.

Reference:

IFRS – ISSB Publishes Its Digital Sustainability Taxonomy

Contact:todayesg@gmail.com