Transition Assessment Guidelines

This article introduces the transition assessment guidelines released by the Climate Bond Initiative (CBI), which aim to evaluate the credibility of a company’s transition plan through five indicators.

The Climate Bond Initiative believes that the transition plan is a time limited and traceable strategic roadmap that introduces science-based carbon reduction plans to help market participants invest in net zero activities and promote global net zero. Therefore, determining a reliable transition plan is an important issue that stakeholders need to address.

Related Post: World Economic Forum Releases Asian Net Zero Transition Bond Market Report

Transition Plan Framework

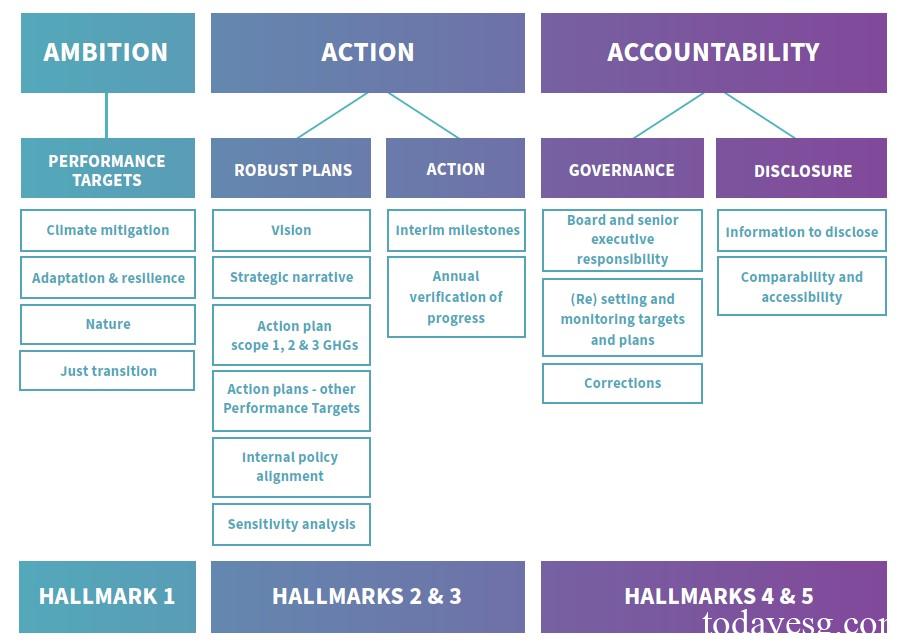

The Climate Bond Initiative believes that corporate transition plans mainly consist of three parts, namely:

- Ambition: Transition Goal.

- Action: A comprehensive transition plan and action plan.

- Accountability: governance, information verification and disclosure.

The Climate Bond Initiative believes that it is difficult for current corporate transition plans to include all the above elements, which may still exist in corporate climate strategy documents, sustainability reports, and sustainable finance frameworks. Stakeholders need to understand the contents of the enterprise transition plan and from which channels relevant information can be found.

Introduction to Transition Assessment Guidelines

The Climate Bond Initiative, in conjunction with the International Capital Market Association (ICMA) and the Task Force on Climate-related Financial Disclosures (TCFD), has developed assessment criteria for the transition framework. These evaluation criteria are the five elements of the enterprise transition framework mentioned above:

- Performance Targets: Enterprises should establish measurable and substantive transition goals, quantify short-term, medium-term, and long-term transition actions, and involve three types of greenhouse gas emission data. These goals need to be consistent with the scientific decarbonization pathway and meet the Paris Agreement’s 1.5-degree Celsius warming target. In addition, companies also need to consider the impact of transition plans on non-climate factors such as biodiversity and pollution prevention, as well as whether the transition process remains fair.

- Robust Plans: Enterprises need to develop comprehensive transition plans to incorporate transition goals into their operations, assets, and business models, listing actions to be taken or currently being taken. Enterprises need to consider reflecting all transition goals in their transition plans and avoid using carbon credits (which should be disclosed separately if used). The enterprise also needs to develop a financial plan that details the impact of the transition plan on assets, liabilities, revenue, and costs, and identifies uncertain factors.

- Action: Enterprises typically set mid-term goals in their transition plans and take actions to achieve these goals. Enterprises need to disclose their mid-term target progress annually and report on it.

- Governance: Enterprise transition plans typically involve multiple departments. Therefore, it is necessary to establish an internal governance structure to ensure the implementation of the transition plan. The board of directors of the enterprise is responsible for formulating and supervising transition plans and conducting regular evaluations to reflect the constantly changing business environment and market development. The board of directors can also consider signing performance targets, establishing necessary monitoring mechanisms, comprehensively grasping the development of enterprise transition, and striving to achieve various goals.

- Information verification and disclosure: Information verification and disclosure are crucial for the credibility of transition plans and can assess net zero progress across different industries, jurisdictions, and globally. Enterprises should use recognized indicators for disclosure and comply with regulatory policy requirements. In addition, companies need to disclose the progress of these goals and whether new adjustment measures have been taken annually. To enhance credibility, companies can invite third-party evaluations, particularly in terms of greenhouse gas emissions.

The Climate Bond Initiative believes that the transition plan is a core tool for achieving the global warming goals of the Paris Agreement, and to ensure the credibility of the transition plan, the above elements must be reflected in the plan. Enterprises need to regularly disclose the progress of their transition plans through standardized information disclosure methods to assist stakeholders in evaluating them.

Reference:

Guidance to Assess Transition Plans

Contact:todayesg@gmail.com