Climate Bonds Resilience Taxonomy

This article introduces the Climate Bonds Resilience Taxonomy, which aims to provide a taxonomy and screening criteria for climate adaptation investments.

The Climate Bonds Initiative believes that the Climate Bonds Resilience Taxonomy is an important extension of the Climate Bonds Taxonomy, which can help issuers, investors, regulators, and other stakeholders identify, validate, and invest in climate adaptation projects.

Related Post: Introduction to the Climate Bonds Taxonomy Released by Climate Bond Initiative

Background of Climate Bonds Resilience Taxonomy

In 2023, the Climate Bonds Initiative released the Climate Bonds Resilience Taxonomy White Paper, which outlines a framework for climate adaptation investment. In February 2024, the Resilience Taxonomy Advisory Group and the Climate Bonds Initiative jointly developed the Climate Bonds Resilience Taxonomy, with assistance from the Inter American Development Bank.

In September 2024, the Climate Bonds Initiative released the first version of the Climate Bonds Resilience Taxonomy, which includes a list of climate resilience investments and temporary screening criteria for evaluation. The Climate Bonds Initiative plans to establish technical working groups for various themes to review and update screening criteria, and consider incorporating them into the sustainable finance taxonomy. The Climate Bonds Initiative believes that taxonomy is a dynamically evolving tool that must be regularly maintained and updated.

Introduction to Climate Bonds Resilience Taxonomy

The Climate Bonds Resilience Taxonomy is a taxonomy in the Climate Bonds Taxonomy to assess activities, assets, and investments that have a significant impact on climate adaptation, in order to promote the development of the climate resilient bond market and mitigate greenwashing risks. The Climate Bonds Resilience Taxonomy system is based on the following core principles to ensure its robustness and applicability:

- Principle 1: Multi-stakeholder approach. The taxonomy fully utilizes the perspectives of stakeholders from different regions, backgrounds, and industries to promote consensus.

- Principle 2: Global Applicability. The taxonomy aims to achieve interoperability through common definitions, principles, and structures, enabling countries to apply it to adaptive strategies.

- Principle 3: Usability and Clarity. The taxonomy considers the needs of financial institutions, enterprises, and investors, and draws on professional knowledge related to climate bonds.

- Principle 4: Granularity. The taxonomy provides detailed activities covering numerous departments to meet the needs of identifying adaptive investments and mitigating greenwashing risks.

- Principle 5: Dynamic. The taxonomy plans to conduct regular reviews and updates to improve its effectiveness.

- Principle 6: Based on science and evidence. The taxonomy is based on literature support and references recognized international climate research.

- Principle 7: Systematic and multi sectoral. The taxonomy considers multiple aspects of society, ecosystems, and economy to provide measures for addressing climate adaptation related issues.

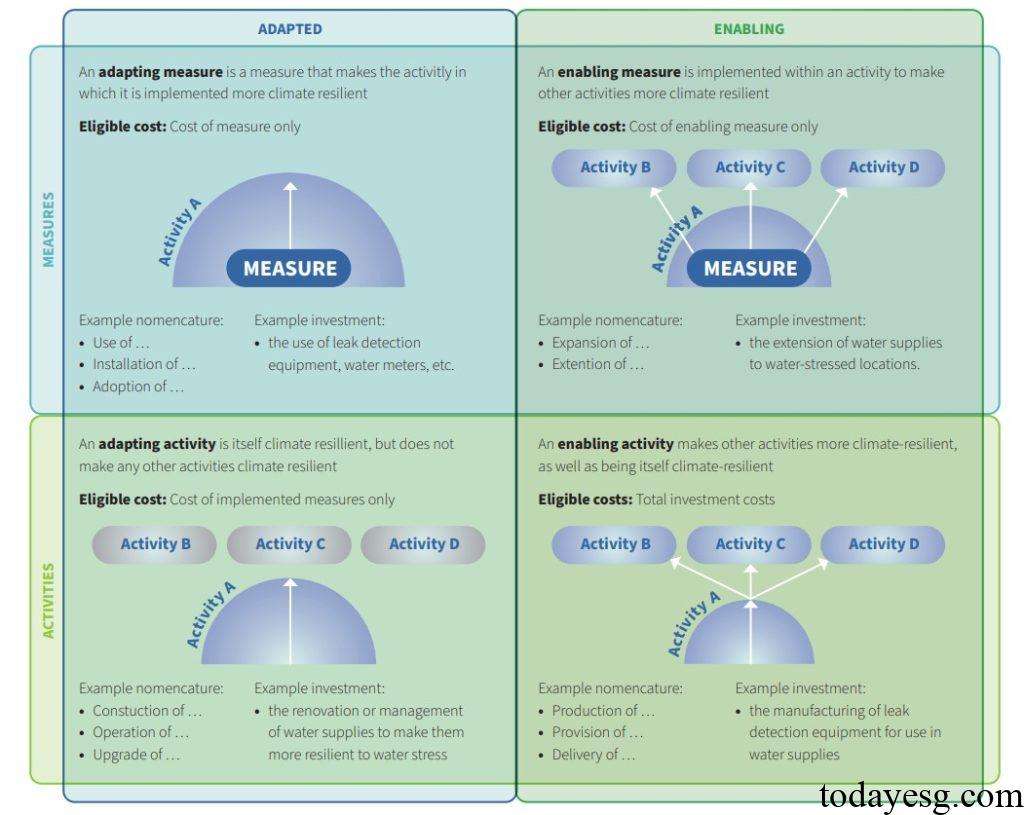

The Climate Bonds Resilience Taxonomy defines two basic types of investments, namely Activity and Measure. Activity refers to the economic activity of delivering goods or services, while measure refers to specific actions in specific assets or activities. The taxonomy is based on the EU Sustainable Finance Taxonomy which divides activities and measures into two categories: adapted and enabling. The specific definition of taxonomy is as follows:

The Climate Bonds Resilience Taxonomy categorizes any investment as one of the above investment types to help users identify synergies between different investments and achieve effective resource allocation. Taking improving the resilience of the water resources industry as an example, investments include:

- Adaptive activities: Establish a water supply system.

- Adaptation measures: Install water leakage detection equipment.

- Enabling activities: Produce water leak detection equipment.

- Enabling measures: Expand water supply networks to water scarce areas.

The Climate Bonds Resilience Taxonomy provides seven climate adaptation themes to help participants identify where adaptive investments are located, including:

- Resilient infrastructure.

- Resilient food systems.

- Resilient cities.

- Resilient social systems.

- Resilient health systems.

- Resilient natural systems.

- Resilient industry and commerce.

Reference:

Climate Bonds Resilience Programme

Contact:todayesg@gmail.com