GRI Sustainability Taxonomy

The Global Reporting Initiative (GRI) releases a sustainability taxonomy aimed at establishing a digital framework for sustainable information disclosure and improving information utilization efficiency.

The Global Reporting Initiative believes that International Sustainability Standards Board (ISSB) standards and the EU Corporate Sustainability Reporting Directive (CSRD) have already been disclosed using the Extensible Business Reporting Language (XBRL), and the sustainability taxonomy will adopt a similar format to provide comprehensive, accurate, and reliable data.

Related Post: Introduction to Global Sustainable Finance Taxonomy

Introduction to GRI Sustainability Taxonomy

The Global Reporting Initiative’s sustainability taxonomy includes universal standards, thematic standards, and industry standards, and is based on a systematic evaluation to ensure that the standard architecture and content are reflected in the taxonomy system and eliminate information duplication. The sustainability taxonomy aims to record and represent information in digital format based on an extensible business reporting language, characterized by:

- Ensure that data is presented in a machine-readable format while retaining the characteristics of a human readable format.

- The elements of the taxonomy only include the necessary elements of the three criteria.

- The taxonomy structure will establish the correspondence between elements and requirements.

The relationships between most elements in the sustainability taxonomy are defined by a hierarchical structure and arranged in a logical order in the form of a list. The information in the taxonomy includes the Legal Entity Identifier, company identification code, whether it refers to the Global Reporting Initiative standards, and the industry standards it adopts.

The sustainable information disclosed by enterprises will be stored in different rows and columns and grouped according to specific disclosure requirements of different standards. These methods can efficiently obtain sustainable information, reduce the burden on businesses, and enhance the usability of taxonomy for stakeholders.

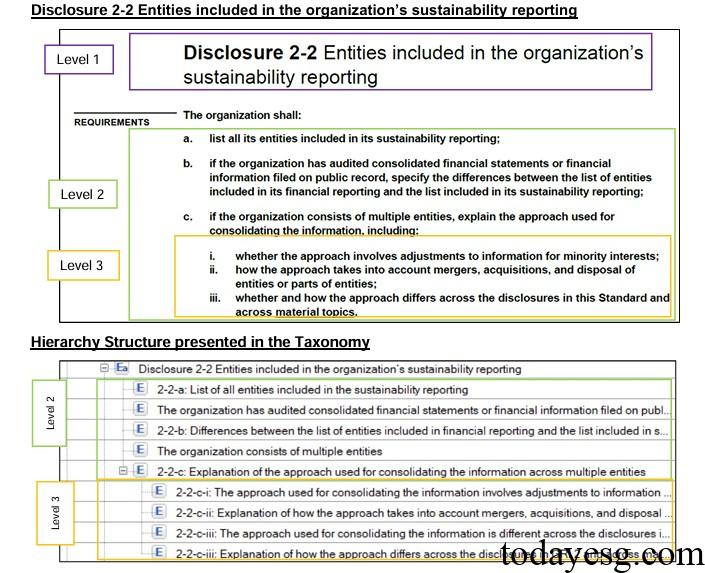

In terms of granularity of information disclosure, the sustainability taxonomy adopts three hierarchical structures, namely the first level representing all disclosures, the second level identified using letter tags, and the third level marked using Roman numeral tags. Machine readable information will be concentrated at the second and third levels and comprehensively cover data points of the three standards. These methods will help users effectively browse taxonomy and establish connections with specific information disclosures.

The sustainability taxonomy also provides multiple validation rules to ensure the correctness of numbers and symbols and provides two categories of errors and warnings for these validation signals for companies to modify. Global Reporting Initiative is developing training courses to provide guidance for businesses on applying sustainability taxonomy. Enterprises can also apply validation tools this year to verify whether their sustainability reports comply with the taxonomy.

Reference: