Global Climate Related Financing Development

This article introduces the development of global climate related financing based on financial assets.

The Organization for Economic Co-operation and Development (OECD) released the Review on Aligning Finance with Climate Goals, which measures global climate related financing development from multiple dimensions, and financial assets is an important dimension.

Related Post: Global Climate Related Financing Development Based on Real Economy

Global Climate Related Financing Based on Financial Assets

OECD believes that financial assets (listed stocks, unlisted stocks, corporate bonds, sovereign bonds, loans, etc.) are important tools for climate related financing, and their stock and issuance can reflect the development of climate related financing. Due to differences in data points provided by different financial assets, some financing that is inconsistent with climate goals may exist. The OECD analyzes climate related financing data for the following asset classes:

Corporate Equity

The total equity value of listed companies in the low-carbon energy sector in 2022 is approximately $3.7 trillion, while the total equity value of listed companies in the fossil fuel sector is approximately $9.6 trillion, accounting for 4% and 10% of the total global stock market value, respectively. From 2021 to 2023, the total equity value of listed companies in the fossil fuel sector increased, while the total equity value of listed companies in the low-carbon energy sector decreased. The reason for this change may be that traditional energy prices continued to rise during this period.

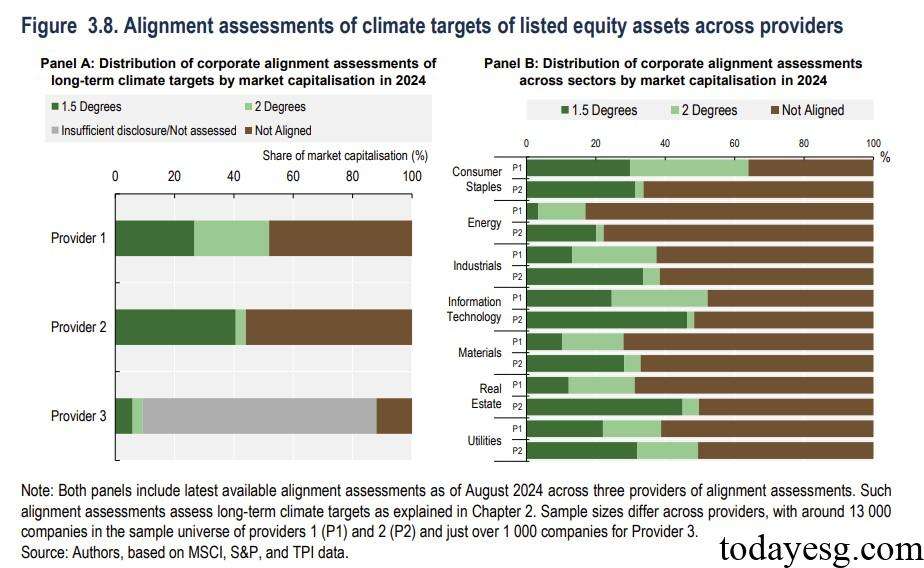

The evaluation results based on the equity of listed companies and long-term climate goals show that there are significant differences in the data provided by the three data providers, with data from two providers indicating that 50% of companies do not meet the warming target. From an industry perspective, a high proportion of companies in the essential consumer goods, information technology, and energy industries meet the warming target.

The progress of private equity in climate related financing is relatively slow. In 2022, the total size of the global private equity market was 7.6 trillion US dollars, but only 0.01 trillion US dollars were invested in renewable energy and 0.2 trillion US dollars were invested in climate technology. The OECD estimates that 98% of private equity investments cannot measure their climate alignment.

Corporate Debt

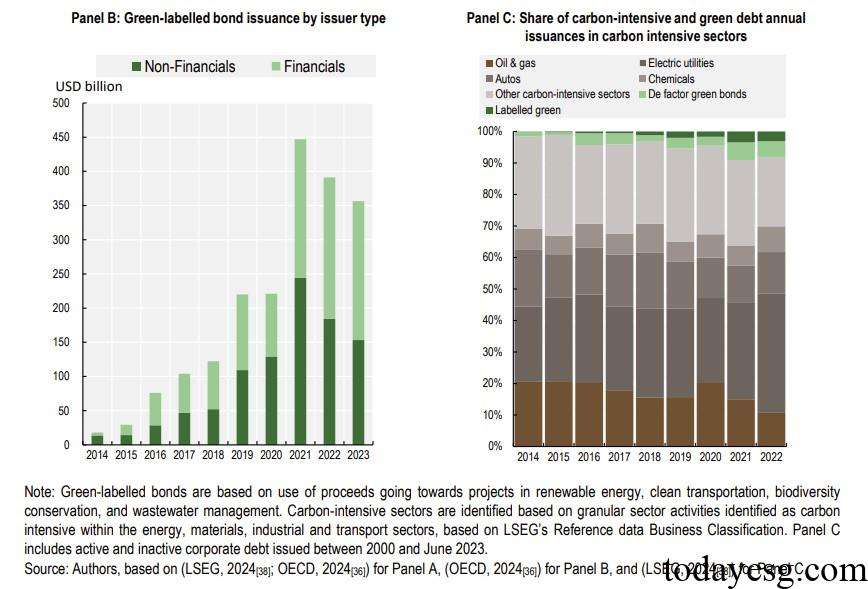

The total size of global corporate bonds in 2023 is $34 trillion, of which the total size of green bonds is $1.6 trillion and the total size of carbon intensive industry bonds is $1.7 trillion. If considering all corporate debt securities such as bonds and commercial paper, the total size of carbon intensive industry bonds in 2023 is $5.5 trillion. Among all corporate bonds issued from 2000 to 2023, the proportion of carbon intensive bonds is about 35%, and the share of carbon intensive bonds issued by developing countries has increased from 4% to 41%.

The global issuance of green bonds continues to increase, from $0.02 trillion in 2015 to $0.36 trillion in 2023. These bonds mainly provide funding for alternative energy, energy efficiency, and green building projects. The proportion of green bonds in sustainable bonds exceeds 90%. Some carbon intensive industries are also issuing green bonds, with 7% of all bonds issued by carbon intensive industries in 2022 classified as green bonds, mainly concentrated in the power utility industry and automobile manufacturing industry.

Corporate loans are an important financial asset category, but their data is relatively insufficient. The global issuance of green loans has increased from $0.02 trillion in 2020 to $0.20 trillion in 2023, of which 84% is issued by the energy and utility industries.

Sovereign Debt

The total size of global sovereign bonds in 2024 is $64 trillion, of which the total size of sovereign green bonds is $0.4 trillion. Considering government support entities and multilateral financial institutions, the total size of green bonds is $1.29 trillion. The number of green bonds issued annually by the public sector has increased to $0.25 trillion from 2014 to 2021. The climate impact measurement methods for sovereign bonds are still under research.

Reference: