Climate Adaptation and Physical Risk Model

The Government of Singapore Investment Corporation (GIC) releases a report on climate adaptation and physical risk model, aiming to incorporate climate adaptation analysis into physical risk model.

The World Meteorological Organization predicts that climate change has caused over $4.3 trillion in economic losses over the past fifty years, and investors need to accurately quantify the financial impact of climate physical risks on assets.

Related Post: IIGCC Releases Report on Physical Climate Risk Assessment Methodology

Transmission Pathways of Climate Physical Risks

Climate change leads to an increase in the severity, duration, and frequency of climate events, resulting in negative impacts on assets. The transmission pathways of these impacts include:

- Revenue loss caused by business interruption.

- Additional operating expenses, such as higher cooling costs in a warming environment.

- Capital expenditures incurred for clearing, repairing, and replacing assets.

Impact of of Climate Physical Risks on Assets

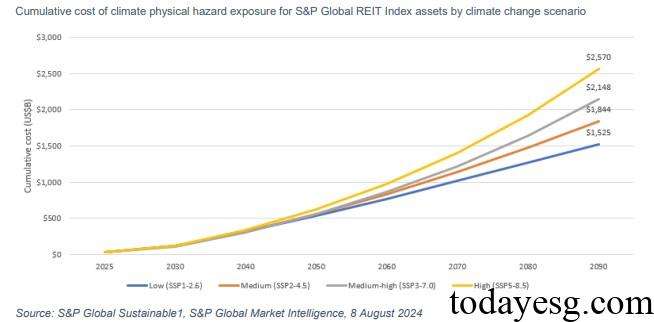

In order to assess the physical risks caused by climate change, the GIC and S&P conduct a study on the risk reduction ability of climate adaptation measures on the real estate assets owned by the constituents of the S&P Global REIT Index. This analysis refers to the SSP3-7.0 climate change scenario released by the Intergovernmental Panel on Climate Change (IPCC), which predicts temperatures higher than those implied by the current Nationally Determined Contributions (NDCs). The impact of climate physical risks on assets varies under different climate change scenarios, with higher predicted temperatures indicating greater effects.

In the absence of climate adaptation measures, the cumulative excess cost of real estate assets may reach $110 billion by 2030, $310 billion by 2040, and $559 billion by 2050. Although the actual cost of physical risks will not be directly converted into asset impairment, the cumulative excess costs by 2050 still account for 26% to 28% of the current total value of real estate assets. Extreme high temperatures will become a more common climate risk factor, involving 89% of the index’s constituent stock assets. Other climate risk factors include drought (67%), tropical cyclones (38%), and water resource pressure (29%).

Impact of Climate Adaption Measure on Physical Risks

Climate adaptation measures can reduce physical risks to assets, thereby helping investors manage the financial impacts of climate change. The GIC predicts that global physical disasters will increase in the next 25 years, and the benefits of implementing climate adaptation measures outweigh the costs if started as soon as possible. Implementing climate adaptation measures by 2050 can reduce cumulative excess costs by $45 billion, including a 5% reduction in the cost of extreme heat and a 59% reduction in the cost of water resource pressure.

According to calculations by the GIC and S&P, investing $1 in flood control measures can save $3.55, and investing $1 in green houses can save $7.45. The global green housing market demand may reach $726 billion by 2050, creating profits for companies providing relevant climate adaptation solutions. Although these investments bring high returns, relying solely on these measures cannot eliminate the impact of most climate physical risks. In addition to investors investing in climate adaptation measures, public institutions also need to increase infrastructure investment or take more proactive climate adaptation actions. These actions can enhance the ability to withstand the physical risks of climate change.

Although the scope and complexity of climate risk assessment models are constantly expanding, considering climate adaptation measures remains a key development direction for the models. The GIC plans to focus on marginal adaptation cost curve of the model in specific regions, providing investors with more valuable insights in the future.

Reference: