Sustainable Investment Asset Owner Survey

FTSE Russell releases 2024 Sustainable Investment Asset Owner Survey, aimed at analyzing asset owners’ views on sustainable investment and identifying trends and market opportunities.

FTSE Russell believes that although asset owners have different goals, priorities, and considerations, they are more optimistic about sustainable investment and consider it a core component of their investment strategy. With the standardization of sustainable investment data and methods, asset owners’ confidence in sustainable investment is constantly increasing.

Related Post: Morningstar Releases Asset Owner ESG Survey Report

Asset Owners’ Views on Sustainable Investment Regulation

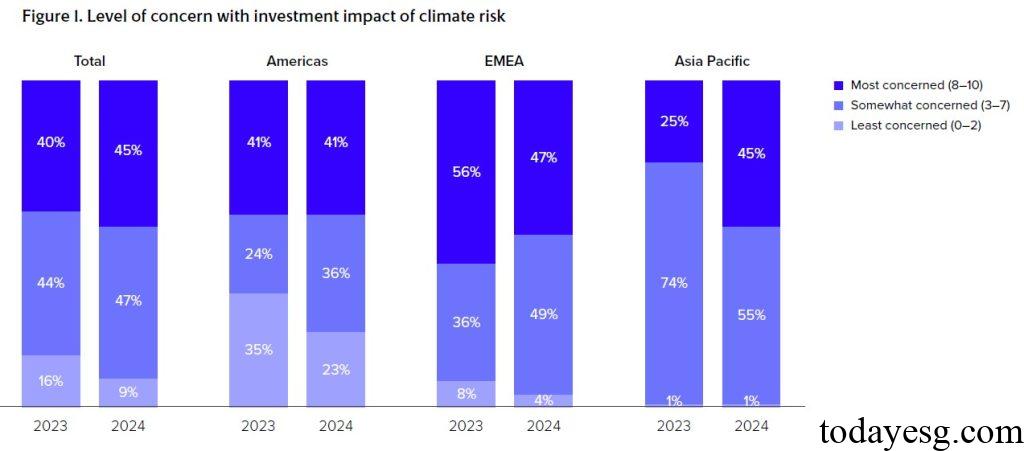

The impact risk such as climate change is constantly increasing, with 91% of respondents being very concerned about the investment impact of climate risks, an increase of 7 percentage points compared to last year. From a regional perspective, Europe (96%), Asia (90%), and Americas (77%) rank high, with only 1% of asset owners in Asia not concerned about climate risk.

With the release of sustainable investment regulations, 55% of respondents indicates that they have increased the number of regulatory personnel responsible for ESG and sustainable investments, with the Americas (79%), Asia (51%), and Europe (41%) ranking high. Asset owners have expressed relatively positive views on sustainable investment regulations, believing that these regulations will help them achieve their sustainable investment goals. Only 11% of respondents believe that regulations are obstacles in investment, compared to 29% last year.

The regulation for sustainable investment brings many changes for asset managers, with 28% of respondents changing their investment portfolios and 34% modifying the names of sustainable funds. These changes are related to the management scale. For example, among asset owners with AUM over $10 billion, 41% adjust their investment portfolios to meet regulatory requirements, while only 16% of asset owners with AUM of less than $10 billion adjust their investment portfolios.

Despite the impact of sustainable investment regulations on investment portfolios, 90% of respondents believe that these policies will help them achieve sustainable goals, an increase of 15 percentage points compared to 2023. In the classification of regulations, sustainable investment (52%), ESG data and ratings (51%), and ESG reporting standards (49%) have the most significant positive effects on sustainable investment. Switzerland (73%), Europe (72%), the United States (67%), the United Kingdom (67%), and Canada (66%) rank high in terms of satisfaction with regulations among asset owners.

Asset Owners’ Views on Sustainable Investment Data

The development of sustainable investment requires more reliable data as a foundation. In terms of the challenges of current sustainable investment data, 51% of respondents believe that these data cannot align with their investment portfolio, 43% believe that data gaps need to be addressed, and 41% believe that ESG ratings lack transparency. In terms of data standardization, asset owners believe more comprehensive and consistent sustainable disclosure will help with their investment decisions.

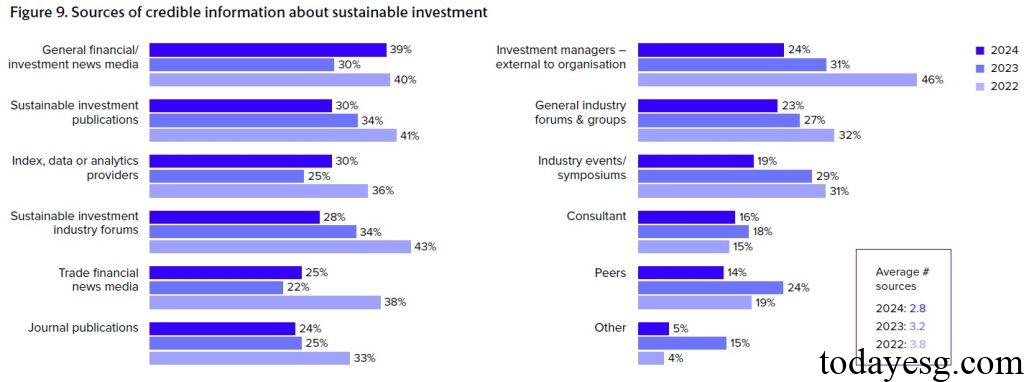

In terms of information sources, investment media (39%), sustainable investment publications (30%), data providers (30%), and sustainable investment forums (28%) rank high. 24% of asset owners rely on external asset managers to provide sustainable information, a decrease of 8 percentage points compared to last year. In terms of the types of sustainable investment data, respondents are more concerned with raw data (36%) and rating data (36%), while preferences for these two types of data vary in different regions.

Asset Owners’ Views on Sustainable Investment Method

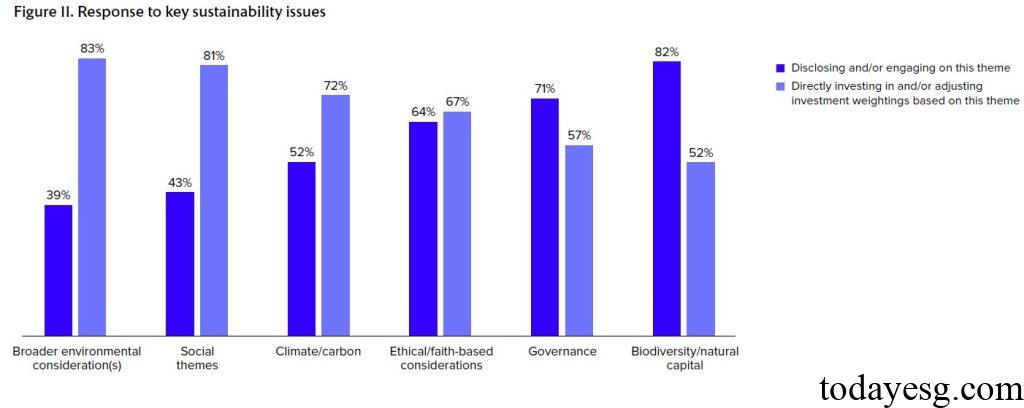

Asset owners have adopted different approaches to sustainable investment themes. In directly investment and adjusting investment weightings, the proportion of environment (83%), society (81%), climate (72%), governance (57%), and biodiversity (52%) decrease from high to low. In disclosing and engaging, biodiversity (82%), governance (71%), climate (52%), society (43%), and environment (39%) decrease from high to low. These differences stem from resource constraints in sustainable investment assessments.

An important change in sustainable investment in 2024 is that the proportion of passive investment exceeds that of active investment. The proportion of implementing both investment methods in 2023 is 73%, while this year 73% of asset owners choose passive investment in sustainable investment methods, and 61% of asset owners choose active investment. This difference indicates that the market’s allocation of passive investment strategies is constantly increasing.

Reference:

Sustainable Investment Asset Owner Survey 2024

Contact:todayesg@gmail.com