Report on Transition Plan and Financial Stability

The Financial Stability Board (FSB) releases a report on transition plan and financial stability, aimed at analyzing the importance of transition plans for financial stability.

The Financial Stability Board believes that transition plans are tools for businesses to articulate climate related risk strategies and management, which regulatory agencies can use to assess climate related financial risks and measure financial stability.

Related Post: IOSCO Releases Report on Transition Plan Disclosures

Relationship between Transition Plan and Financial Stability

In 2023, the Network for Greening the Financial System (NGFS) distinguishes between transition planning and transition plans, stating that transition plans are external outputs of a company’s transition planning, providing stakeholders with a company’s transition strategy.

The transition plan can provide regulatory agencies with a long-term and forward-looking perspective on climate-related financial risks. During the implementation of the transition plan, companies may experience changes in climate related financial risks, which are closely related to their industry and region, and may have spillover effects in the financial system, affecting financial stability. The transition plan may have an impact on financial stability in the following aspects:

- Managing climate related risks: Financial institutions can obtain forward-looking information from transition plans to support their own risk management processes and reduce financial risks associated with net zero transition.

- Providing investment decision information: Transition plans can provide information for transition financing, reduce information asymmetry between enterprises and financial institutions, and improve the business efficiency of financial institutions.

- Monitoring macro transition risks: Regulatory agencies can assess the impact of climate risks through scenario analysis in transition plans and summarize the transition plans of multiple enterprises to systematically identify and evaluate important macro transition risks.

Application of Transition Plan by Regulators

Regulatory agencies can use transition plans to gain a detailed understanding of a company’s climate risk management methods in the short, medium, and long term, as well as an analysis of the company’s transition scenarios and paths. The investigation of its members by the Financial Stability Board shows that regulatory agencies mainly apply transition plans in the following areas:

- Strategic tools for adjusting and adapting enterprise business models.

- Risk management tools for measuring and monitoring climate related financial risks.

- Sources of information for stakeholders to assess risk exposure.

There are differences in the requirements for enterprises to develop transition plans in different jurisdictions. The European Union requires large banks and insurance companies to develop and implement transition plans in the Corporate Sustainability Due Diligence Directive (CSDDD). The Monetary Authority of Singapore has released consultation documents on transition plans for banks, insurance companies, and asset management companies.

Challenges in the Application of Transition Plan

The Financial Stability Board believes that the current regulatory authorities’ application of transition plans in financial stability is still in the early stages, and regulatory authorities need to consider the following aspects:

The purpose of formulating and disclosing transition plans by enterprises has low relevance to financial stability: Most transition plans are mainly related to the company’s business activities and may not include information for financial stability monitoring and macro prudential policies.

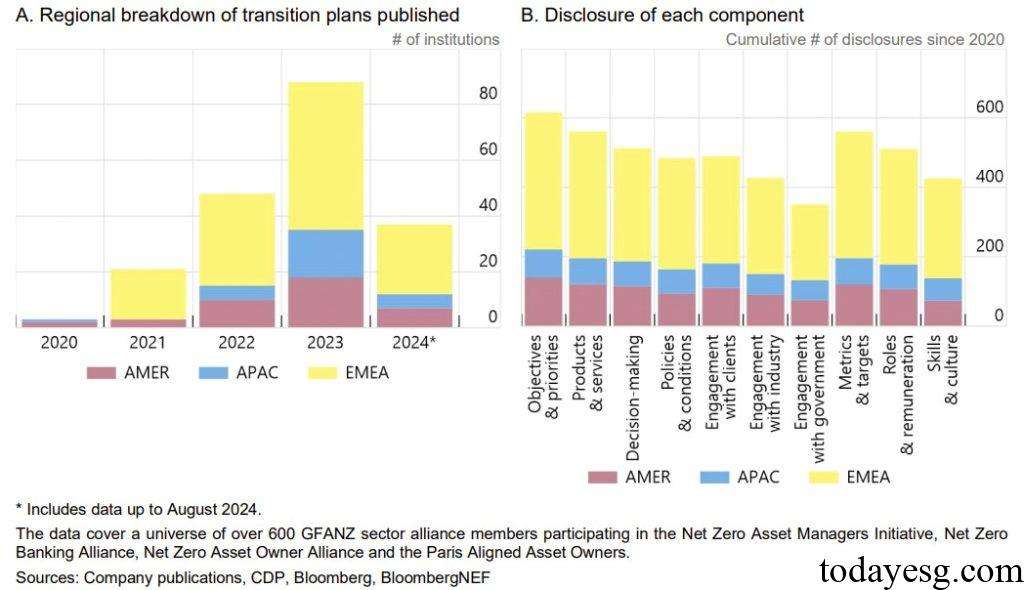

There are significant differences in the format, content, and methods of transition plans: Many jurisdictions do not require companies to disclose transition plans, nor do they issue consistent frameworks, and the role of transition plans in information aggregation and comparison is limited.

The credibility of the transition plan needs improvement: Transition plan is a strategic and forward-looking document of the enterprise, and its information may change with the development of the enterprise. The credibility of a verified transition plan is higher.

Reference:

Relevance of Transition Plans for Financial Stability

Contact:todayesg@gmail.com