Climate Vulnerability Assessment Framework

The Financial Stability Board (FSB) releases a climate vulnerability assessment framework aimed at providing a method for assessing climate related vulnerabilities in the financial system.

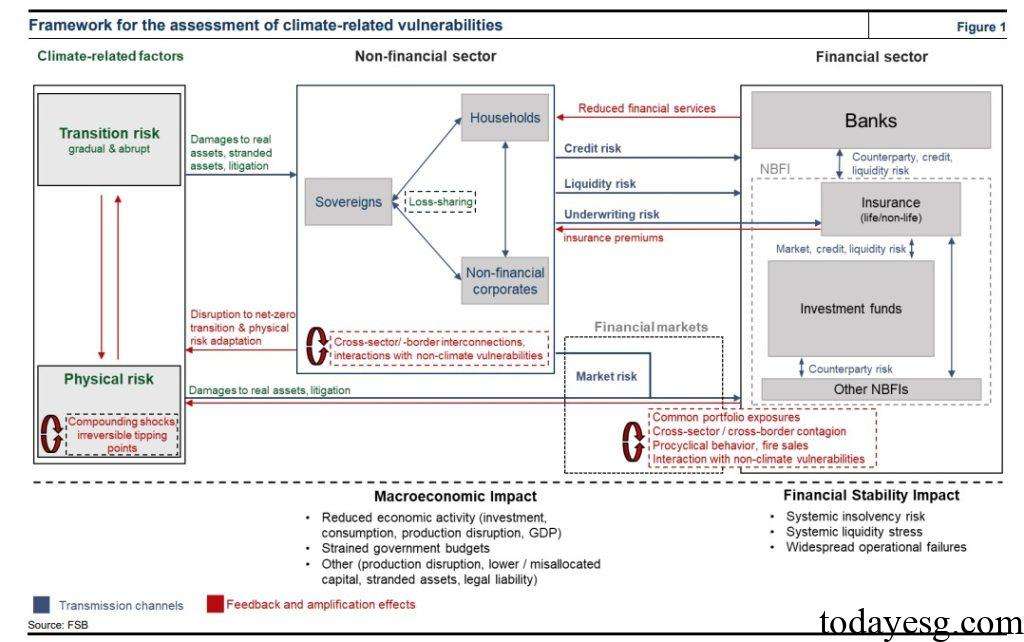

The Financial Stability Board believes that climate vulnerability may affect the financial system through various transmission channels and amplification mechanisms, and the uncertainty, nonlinearity, and spillover effects of climate shocks will make assessments more complex.

Related Post: IIGCC Releases Report on Physical Climate Risk Assessment Methodology

Background of Climate Vulnerability Assessment

Climate change may pose risks to financial stability, and regulatory agencies in various countries are taking measures to include climate related financial risks in their assessments. Financial risks caused by climate shocks may arise through traditional channels, such as credit risk, market risk, and liquidity risk. Traditional micro and macro prudential methods often rely on information such as risk exposure and historical loss experience, while the complexity of climate shocks may lead to a decline in the effectiveness of existing assessment methods.

Climate vulnerability assessment is part of the 2021 Climate Roadmap developed by the Financial Stability Board. The Financial Stability Board has collaborated with the Network for Greening the Financial System to conduct climate scenario analysis and financial risk related researches, and to identify, monitor, and evaluate climate impacts from a forward-looking perspective.

Introduction to Climate Vulnerability Assessment Framework

Climate vulnerability assessment aims to evaluate climate related vulnerabilities and analyze the relationship between specific types of climate vulnerability and jurisdictions from a global and cross sectoral perspective. Climate shocks may be transmitted to the real economy and financial system through transition risks and physical risks, leading to financial losses. The transmission channels for climate shocks include:

- Credit risk: The ability of counterparties affected by climate shocks to fulfill their obligations may decrease.

- Market risk: Market participants incorporate climate risk into pricing, leading to increased market volatility.

- Liquidity risk: Counterparties withdrawing funds from financial institutions with significant climate risk.

- Underwriting risk: Insurance companies face guarantee risks in the face of climate shocks.

Due to the business cooperation between financial institutions and the joint actions of investors, climate shocks may gradually amplify in the financial system. For example, when climate shocks affect asset prices, investors’ redemption demand increases, and funds’ ability to repay credit in banks decreases, the impact of climate shocks will expand from market risk to credit risk. Based on the above analysis, the Financial Stability Board has proposed a climate vulnerability assessment framework from three perspectives: climate factors, non-financial sectors, and financial sectors.

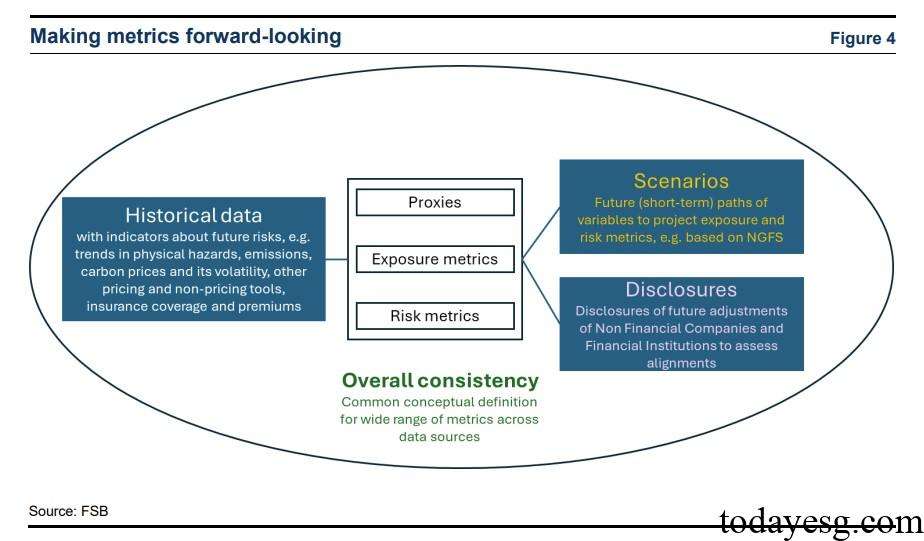

To assess climate vulnerability, the Financial Stability Board has developed an analysis toolkit that includes three types of indicators:

- Proxies: Provide early signals about transformation risks and physical risks. These indicators include the likelihood and potential size of risk occurrence, as well as the difference between expected and actual carbon emissions.

- Exposure metrics: Provide information on the transmission of climate risk factors to both non-financial and financial sectors. These indicators are based on the combination of information from the three parties.

- Risk metrics: Based on proxy and exposure metrics, quantify the impact of climate shocks on finance. These indicators include the sensitivity of investment portfolios to climate factors, valuation, leverage, and liquidity.

The Financial Stability Board plans to select a series of specific indicators based on the relevance and foresight of financial stability analysis to assist regulatory agencies in assessing climate vulnerability. These indicators will be based on climate scenario analysis and information provided by climate information disclosure, considering differences between different jurisdictions. The Financial Stability Board will continue to review and prioritize indicators in the future to enhance their practicality in practice.

Reference:

Assessment of Climate-related Vulnerabilities: Analytical Framework and Toolkit