2024 Green Bonds Allocation and Impact Report

The EU releases 2024 Green Bonds Allocation and Impact Report, which aims to analyze the issuance, use, and climate impact of EU green bonds.

The EU Green Bond Program was established in 2021 and is currently one of the largest green bond programs in the world, playing a role in European green financing and global green transition.

Related Post: European Securities and Markets Authority Releases Consultation Paper on European Green Bond Regulation

Green Bond Issuance and Distribution

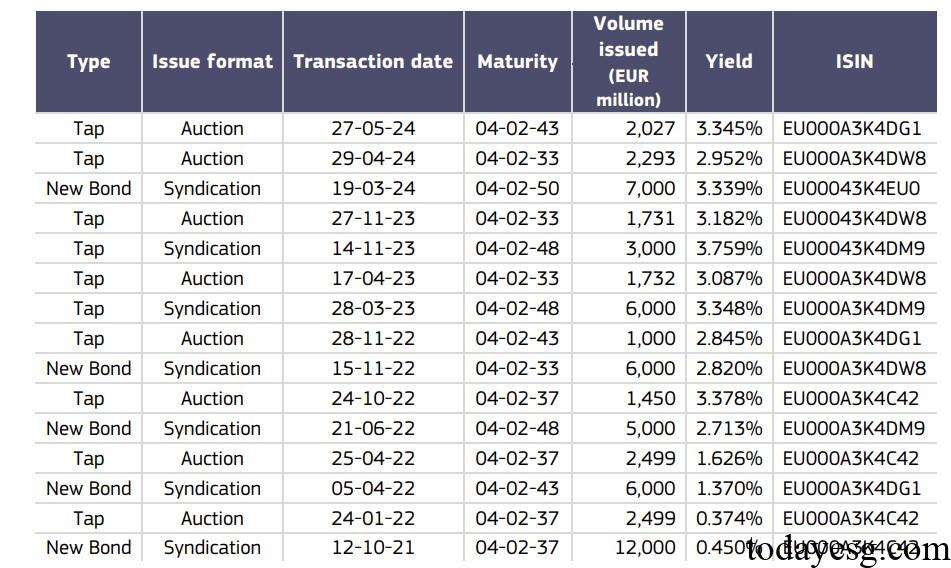

As of August 2024, the European Union has issued 60.2 billion euros of green bonds, an increase of 36.2% compared to last year. These green bonds are based on the Next Generation EU Green Bond Framework, which is consistent with the Green Bond Principles published by the International Capital Market Association (ICMA). The funds raised from green bonds are mainly used for the Recovery and Resilience Plans of EU member states, in which at least 37% of the funds must be used for sustainable investments to address climate change.

The expenditure on EU green bonds is expected to increase rapidly in 2024. As of August 2023, 14 EU member states have received a grant of 21 billion euros. As of August 2024, 19 EU member states have received a grant of 44 billion euros. The main directions of these expenditures are energy efficiency (42%), clean transportation (34%), and clean energy (9%). At present, the undistributed proceeds of green bonds are 16.2 billion euros, and these undistributed proceeds will continue to be invested in projects in member countries in the future.

Green Bond Alignment and Climate Impact

The EU has disclosed the alignment of green bond expenditures with the EU Taxonomy in its Green Bonds Allocation and Impact Report. Of the 44 billion euros in green bond expenditures, 54% are consistent with the EU Taxonomy, an increase of 8 percentage points compared to 2023. 44% are partially consistent with the EU Taxonomy, while the remaining 2% are not covered by the taxonomy or do not meet the standards.

According to the green bond framework, the EU needs to disclose the impact of green bonds. The current green bond eligibility project will reduce the EU’s carbon dioxide emissions by 54.7 million tons in 2026 (44.2 million tons in 2023). Among these projects, clean energy (21.77 million tons), clean transportation (20.44 million tons), and energy efficiency (6.02 million tons) account for a relatively large proportion. Nature conservation (650000 tons) accounts for a relatively small proportion, as it was included in the assessment for the first time this year. In order to achieve the 2050 climate neutrality goal, the EU needs to invest in all project categories, rather than determining by measuring the efficiency of carbon reduction.

EU green bonds will not provide refinancing for completed projects, and the climate impact generated by investment projects may only be realized after the project is completed, so the current carbon reduction measurement results may be lower than the actual situation. Based on the current progress, the actual carbon reduction impact of green bonds is 1.48 million tons of carbon dioxide per year (220000 tons in 2023). These actual impacts mainly come from energy efficiency (820000 tons) and clean transportation (660000 tons). The current actual carbon reduction effect is 2.7% of the climate impact of all projects, and it is expected that the carbon reduction effect will continue to increase as the projects are completed.

Future Development of Green Bond Report

The EU believes that there are certain limitations in the Green Bonds Allocation and Impact Report. For example, projects that have a positive impact on climate, such as water resource conservation and nature conservation, may not be measured by greenhouse gas emission reduction indicators, which leads to the underestimation of their contribution to the climate. Some climate change adaptation measures and climate risk management measures have not been included in the measurement scope, which can also lead to underestimation of the actual carbon reduction effect.

In addition, some qualitative information, although reflecting positive climate effects, has not been included in greenhouse gas calculations. Green bonds contain a total of 2096 targets, but only 510 provide quantitative data. The EU plans to continue measuring the actual impact of green bonds until all returns are fully distributed.

Reference:

EU Continues to be a Global Leader on Sustainable Finance

Contact:todayesg@gmail.com