2025 Global Climate Finance Report

The Climate Policy Initiative (CPI) releases 2025 Global Climate Finance Report, which aims to summarize global climate finance information from 2018 to 2023.

The Climate Policy Initiative believes that climate finance data can help track progress in climate action, build investor confidence, and promote climate action. This report extracts consistent and comparable information from a large amount of non-standardized data.

Related Post: Climate Policy Initiative Releases Global Climate Finance Report

Global Climate Finance Trends

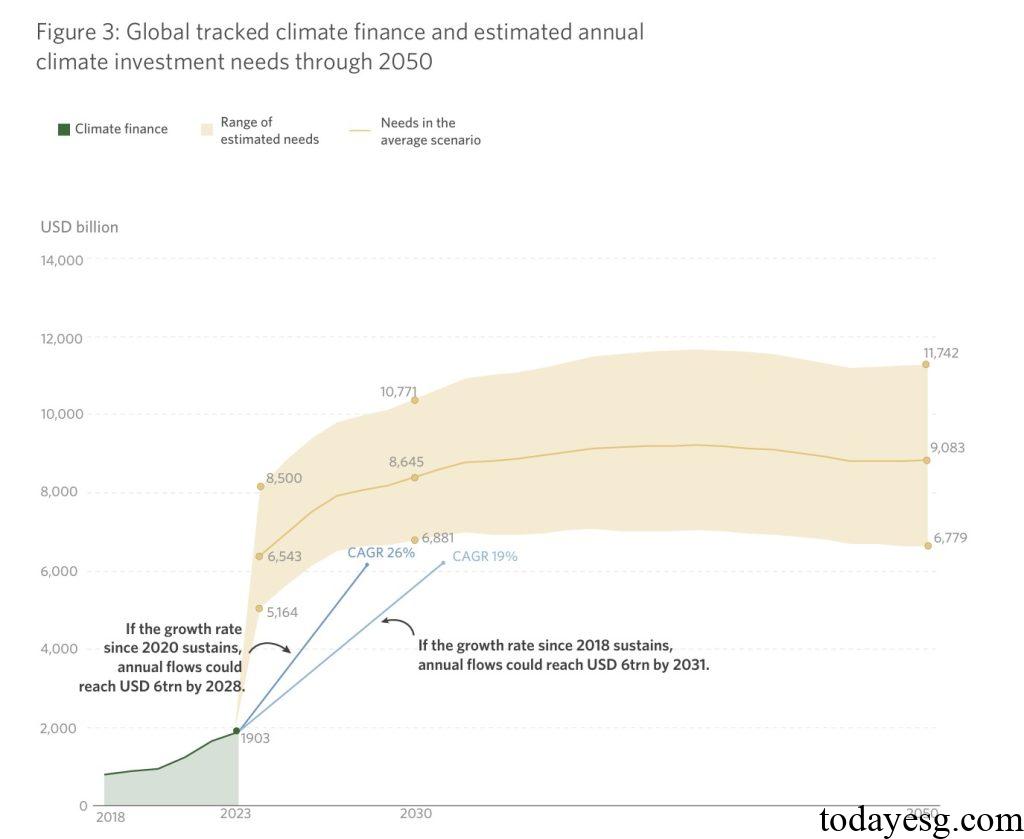

The global climate finance scale reaches $1.9 trillion in 2023, an increase of 15% compared to 2022. This growth mainly comes from the renewable energy sector and clean transportation sector, as well as improvements in climate finance measurements. The average annual growth rate of global climate finance from 2018 to 2023 is 19%, with an average growth rate of 8% before 2020 and 26% after 2020. Despite the significant acceleration of climate finance growth, the market still needs more funds to achieve climate goals.

From 2024 to 2030, the world needs at least $6.3 trillion in climate finance annually. Based on the current growth rate of 19%, the scale of climate finance will reach $6 trillion by 2030. If calculated at a growth rate of 26%, it can be achieved by 2028. However, if calculated with a warming target of 1.5 degrees Celsius, the world will need $9.2 trillion in climate finance annually from 2031 to 2050, and $7.1 trillion annually from 2024 to 2030. The global climate funding gap in 2023 will be between $4.4 trillion and $8 trillion per year, and this challenge will mainly come from funding allocation rather than funding shortages.

Climate Policy Initiative predicts that the global climate finance scale will exceed $2 trillion for the first time in 2024, with a year-on-year growth rate of 8%, lower than 2023. The high-interest rate environment may increase the cost of capital-intensive climate solutions, and the decline in fossil energy prices may compete with renewable energy. There is a shortage of infrastructure supply required for renewable energy, and the International Energy Agency (IEA) believes that 1650 GW of solar and wind energy is waiting to be connected.

Global Climate Finance Development

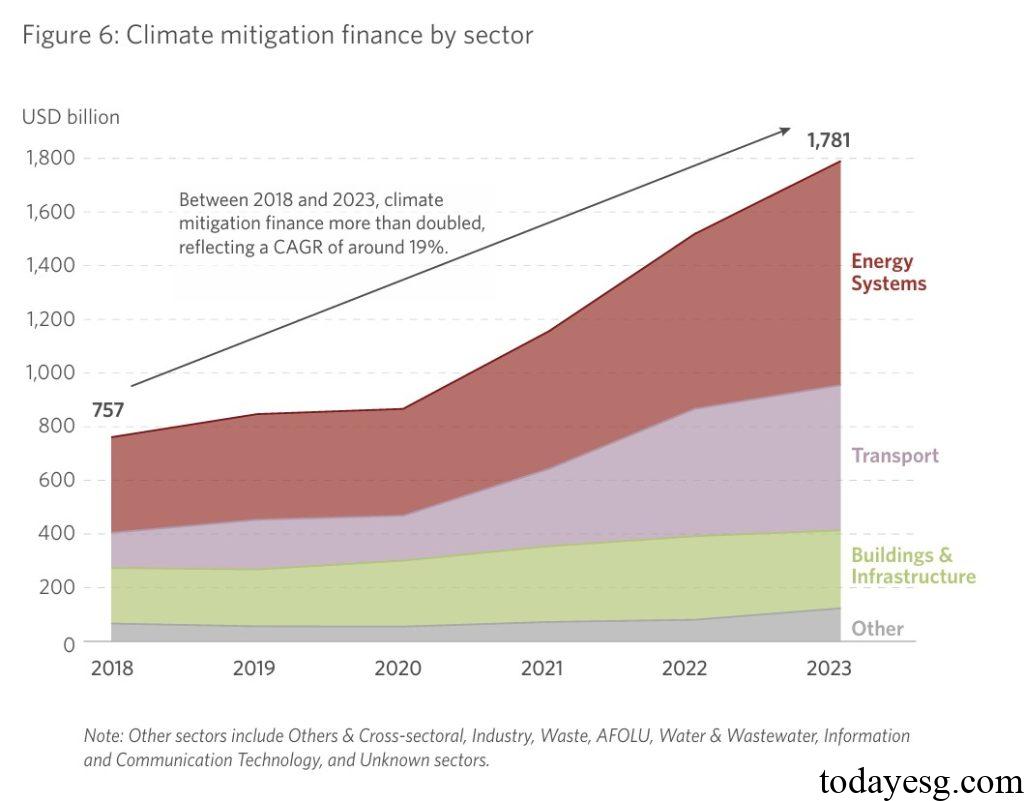

From 2018 to 2023, climate mitigation funding increased from $757 billion to $1.78 trillion, with an average annual growth rate of 19%. In 2023, over 75% of climate mitigation funds are invested in the energy and transportation sectors, mainly driven by the photovoltaic, wind energy, and new energy vehicle industries. The scale of climate mitigation funding in the energy sector in 2023 is $831 billion, an increase of 234% compared to 2018. The scale of climate mitigation funding in the transportation sector is 539 billion US dollars, an increase of 311% compared to 2018. However, these two areas still need to be further expanded by 2.5 times to meet the climate finance needs from 2024 to 2030.

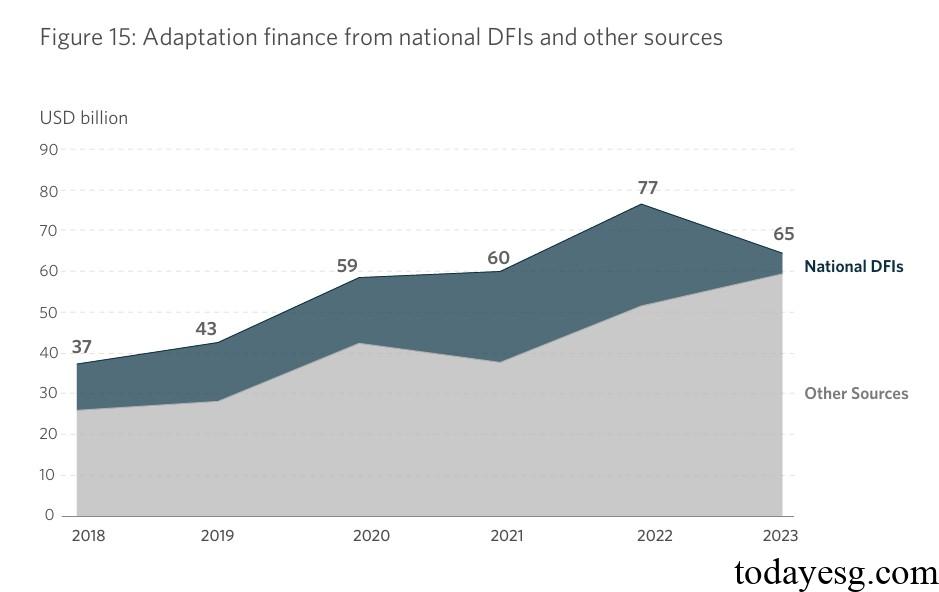

From 2018 to 2023, climate adaptation funding increased from $37 billion to $65 billion, with a peak of $77 billion in 2022. The decline in funding scale in 2023 may come from updated calculation methods, but the growth in green bond issuance scale has filled some of the gaps. The scale of climate adaptation funding for emerging markets and developing economies in 2023 is $46 billion, while the annual funding requirement from 2024 to 2030 is $222 billion. Climate adaptation funds are mainly invested in the water resources industry (22.3 billion US dollars) and agriculture (6.5 billion US dollars).

Dual benefit investment (pursuing both climate mitigation and climate adaptation) reaches $58 billion in 2023, doubling compared to 2018. Agriculture and water resources account for 74% of all dual benefit investments, primarily aimed at reducing carbon emissions, improving food security, and protecting biodiversity.

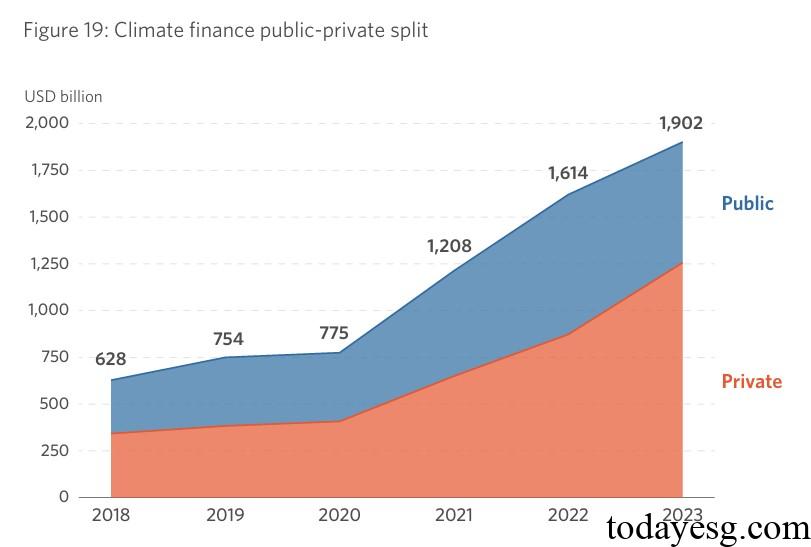

From the perspective of public and private financing, the private financing scale is $1.26 trillion, which is the first time since 2018 that public financing is lower than private financing. The growth rate of private financing from 2018 to 2023 is 30%, while the growth rate of public financing is 18%. The proportion of debt financing and equity financing in private financing is almost equal, while the proportion of debt financing in public financing is higher (61%), the proportion of equity financing is lower (19%), and the rest is preferential financing (20%).

Reference: