Green Portfolios Tail Risk Report

The CFA Institute Research & Policy Center releases a report on green portfolios tail risk, aimed at analyzing the differences between tail risk of stock investment portfolios that apply green standards and traditional investment portfolios.

This report uses indicators such as ESG, environmental value, and carbon emission scores to screen investment portfolios, and finds that in most cases, the tail risk of green investment portfolios is like that of traditional investment portfolios, and even greater at specific times. The research results indicate that green investment portfolios do not reduce tail risk.

Related Post: CFA Institute Releases Report on the Impact of Climate Signals on Portfolio Risk and Return

Green Portfolios Tail Risk Background

Among 1000 ESG investment papers from 2015 to 2020, 58% believed that ESG factors were positively correlated with corporate financial performance, while only 8% believed that ESG factors were negatively correlated with corporate financial performance. Although companies with higher ESG scores are less exposed to climate risk, the relationship between these companies and financial tail risk is still unclear. Some studies suggest that prioritizing ESG standards can lead to a decrease in the average market value of securities in investment portfolios, and securities with smaller average market values have greater volatility, resulting in increased tail risk in ESG based investment portfolios. Some studies suggest that companies with higher ESG scores have lower market risks.

This report uses Value at Risk (VaR) to assess the tail risk of an investment portfolio, which measures the minimum loss of the portfolio given the asset return period and the probability of a given event occurring. The report uses three green indicators to construct a green investment portfolio, namely ESG score, environmental score, and carbon emissions score. The report selects securities from markets such as the United States, the United Kingdom, and the European Union, and uses green data provided by the London Stock Exchange.

Green Portfolios Tail Risk Result

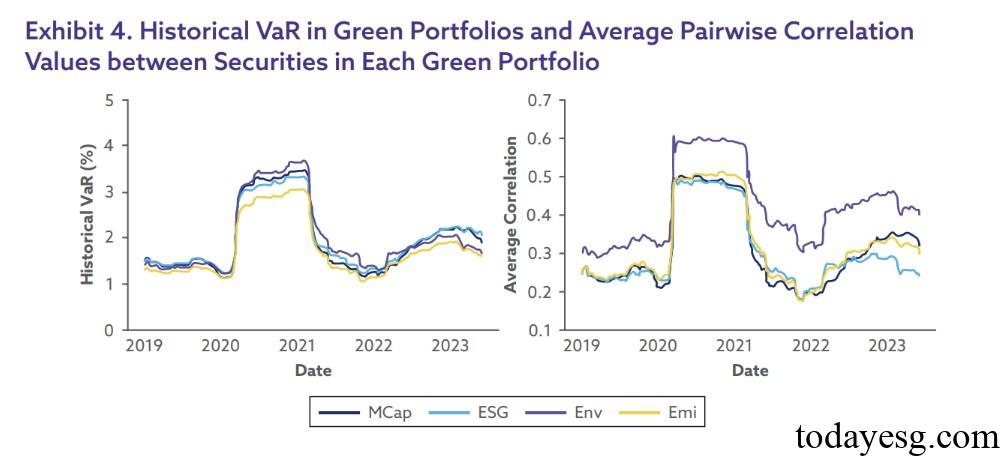

Based on data from 2019 to 2023, this report establishes a benchmark investment portfolio and three green investment portfolios and calculates their historical changes in value at risk. During the research period, the risk value of all investment portfolios fluctuated between 1% and 4%, with the highest risk value occurring between 2020 and 2021. From a correlation perspective, the correlation of environmental investment portfolios (Env) is significantly higher, as the proportion of securities in specific industries is higher. In the case of severe market fluctuations, the likelihood of environmental investment portfolio losses is also higher than other investment portfolios. In contrast, investment portfolios constructed using carbon emission scores (Emi) have lower value at risk during both stable and volatile market periods.

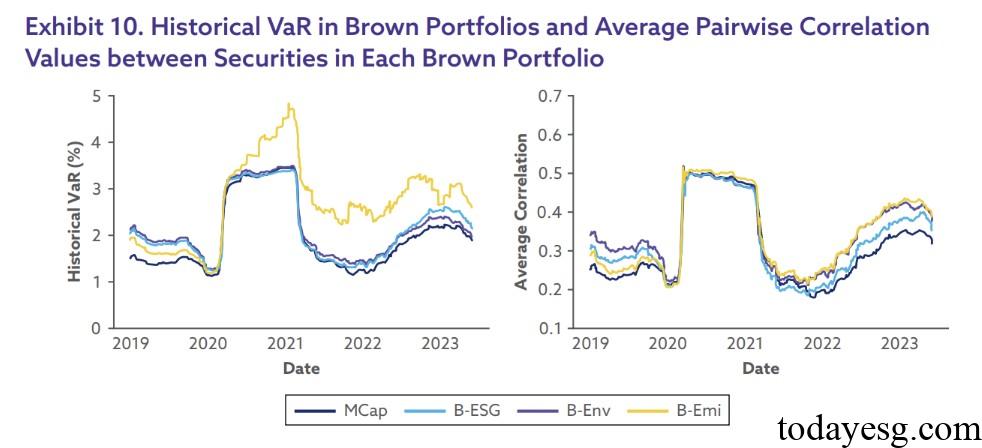

In sensitivity analysis, the report studies in two directions: one is to control the specific number of securities in the investment portfolio and the industry in which the securities are located, and the other is to construct a brown investment portfolio based on the minimum green indicator. In direction one, the risk of traditional investment portfolios is basically the same as that of ESG investment portfolios, while the risk value change of constrained green investment portfolios is higher than previous studies. In direction two, the risk of the carbon emission investment portfolio is significantly higher than that of other investment portfolios, while the risk of the benchmark investment portfolio is in the middle of the other two green investment portfolios.

Reference: