Central Bank Climate Scenario Analysis Guidelines

The Network for Greening the Financial System (NGFS) updates central bank climate scenario analysis guidelines, aiming to provide central banks with more refined and accurate climate scenario analysis tools.

In 2020, the NGFS released the first edition of the Central Bank Climate Scenario Analysis Guidelines, which reflects the progress of climate scenario analysis in terms of methods, data, models, and regulatory practices.

Related Post: NGFS Releases First Short-term Climate Scenarios

Introduction to Central Bank Climate Scenario Analysis Guidelines

The central bank’s climate scenario analysis guidelines include the following parts:

Step 1: Clarify goals, material risks, and stakeholders

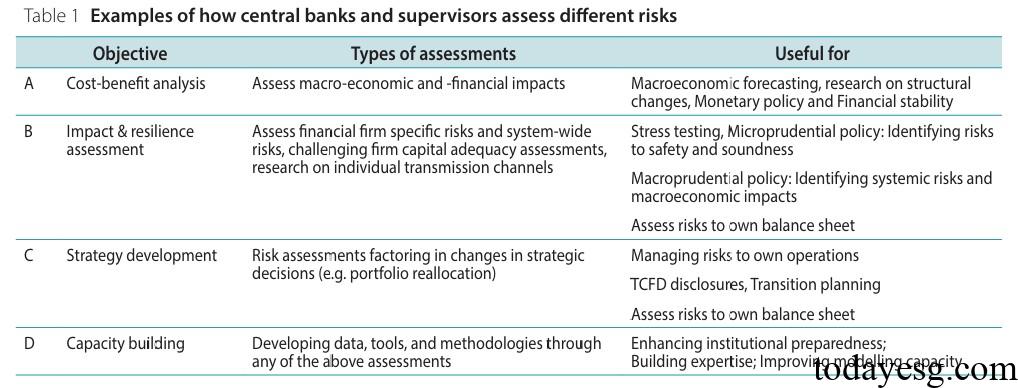

Users first need to consider the objectives of scenario analysis, such as cost-benefit analysis, impact and resilience assessment, strategic development, and capacity building. Central banks need to consider how to incorporate scenario analysis into existing risk assessment processes and focus on material risk factors. Users can use the short-term and long-term scenario files published by the NGFS to understand climate risk drivers and their impacts and confirm which types of risks will be included in the assessment. Common risks include climate physical risks, climate transition risks, macroeconomic risks, and macro financial risks.

Users also need to consider how stakeholders can participate in scenario analysis, with common stakeholders including:

- Financial institutions: Provide data and methods for scenario analysis and can also directly participate in the scenario analysis process.

- Regulatory agencies: The results of scenario analysis can help regulatory agencies develop domestic and international standards.

- Public: Scenario analysis can provide information for the public to consider climate change risks and response measures.

- Academic community: Scenario analysis helps to conduct research on the impacts of climate change.

Step 2: Select relevant scenarios

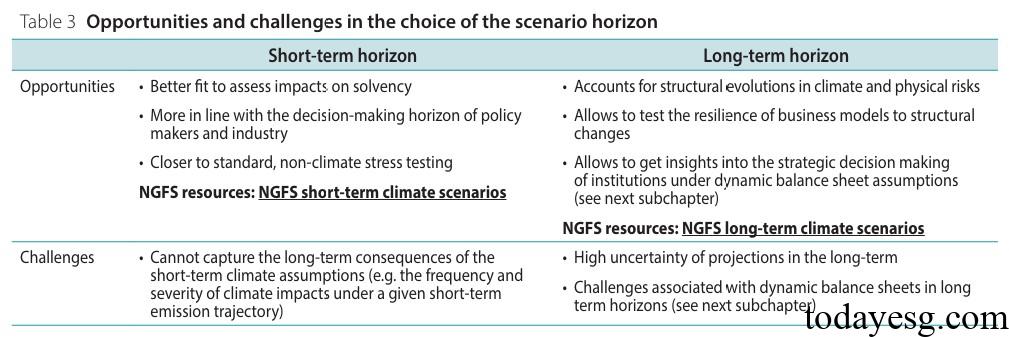

The central bank needs to choose the scenarios provided by the NGFS, which can be divided into short-term and long-term scenarios. Short term scenarios can provide a detailed and dynamic assessment of recent shocks, while long-term scenarios demonstrate the direction of systemic risks in the coming decades. In terms of climate scenario assumptions, the central bank needs to determine factors such as socio-economic background, technological updates, climate policies, carbon prices, and consumer preferences. Users can also generate new scenarios based on their own characteristics.

Step 3: Use situational assessments to evaluate economic impacts and financial risks

A key aspect of climate scenarios is assessing the economic impacts of climate risks, including short-term effects on GDP and inflation rates, as well as long-term effects on demand for consumption, investment, trade, and more. The economic impacts of climate change are transmitted through transition risks and physical risks. In assessing financial risks, users need to pay attention to the coverage of scenario analysis (banks, asset management companies, asset owners, insurance companies, infrastructure, etc.), financial risks (credit risk, market risk, liquidity risk, underwriting risk, etc.), and products (stocks, bonds, derivatives, collateral, etc.).

Step 4: Communicate and apply the results

Users can disclose qualitative and quantitative information about scenario analysis, its impact on financial variables, regulatory indicators, and macroeconomic variables, as well as key assumptions and sensitivity analysis. All disclosures must select a benchmark and specify the information users to be disclosed. These disclosures can be sent out as follow-up research and used in the process of central bank climate risk management and monetary policy operations, helping to formulate macro and micro prudential policies.

Reference:

Guide to Climate Scenario Analysis for Central Banks and Supervisors