Sovereign Bond Transition Report

The Climate Bonds Initiative (CBI) releases a report on sovereign bond transition, aimed at providing recommendations for sovereign bond transition financing.

The Climate Bond Initiative believes that there is a total of $65 trillion in sovereign bonds worldwide, and in the background of increasing climate risk regulatory requirements, sovereign countries climate actions can help achieve long-term fiscal sustainability.

Related Post: OECD Releases Report on Climate Transition Bond Market

Introduction to Sovereign Transition Plan

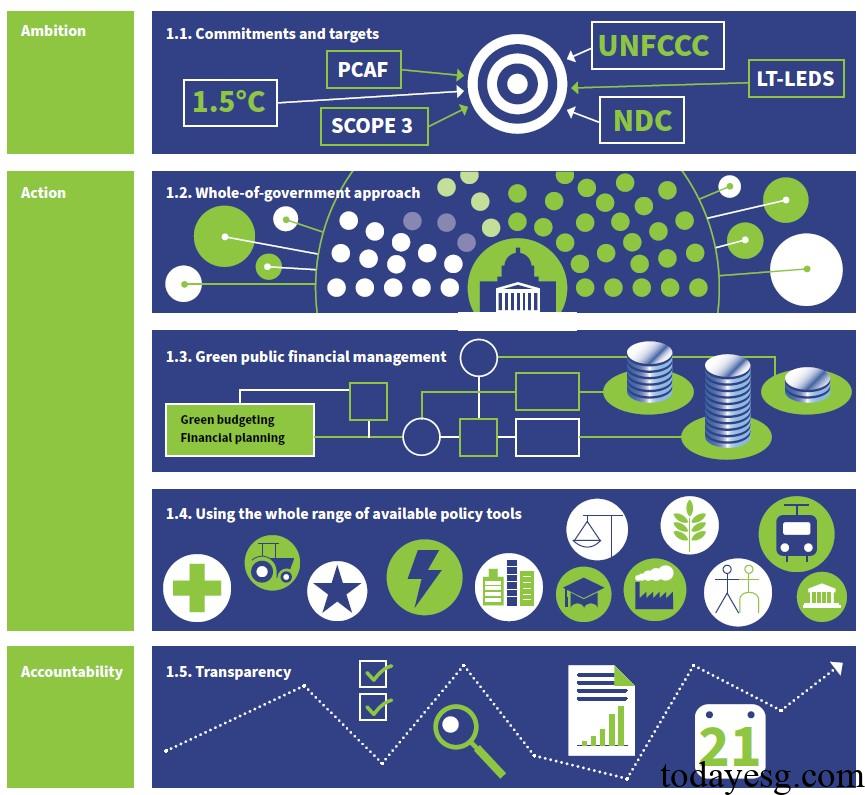

The sovereign transition plan includes the following elements:

- Targets and commitments: The Nationally Determined Contributions (NDC) formulated by each country reflect their commitment to transition planning, but they have not yet achieved the expected warming target of the Paris Agreement. Sovereign countries need to continue adjusting their greenhouse gas scope, industries, deadlines, and strive to enhance resilience and achieve fair transition.

- Whole of government approach: Consistent, credible, and effective transition planning requires the participation of each department in policy formulation and implementation, as well as strengthened coordination and communication. These departments not only need to include key industries such as electricity, transportation, and industry, but also need to establish responsibility and supervision processes.

- Green public financial management: The public green financial management process can incorporate transition planning into existing planning, budgeting, and monitoring processes, increasing opportunities for transition investment. In the green budget approach, the climate impact of various policies will be comprehensively measured and considered in the funding allocation process.

- Use of the whole range of policy tools: Sovereign countries can apply financial, market, monetary, and international policies to ensure the progress of transition planning. Green taxonomy and transition taxonomy can also identify projects that have a positive impact on the climate, help develop sovereign green bond frameworks, and encourage private sector investment.

- Transparency: Improve transparency is a way for investors to build confidence and support financing. Sovereign countries can disclose the development of green public finance management, ensure the quality of green budget reports, and seek third-party audits.

Role of Sovereign Bonds in Transition

Green and sustainable sovereign bonds are the core tools of transition financing. These bonds usually have long maturities, reducing the impact of interest rate changes on sovereign countries. As of the first half of 2025, the Climate Bond Initiative has recorded 70 sustainable sovereign bond transactions with a total size of $733.1 billion, but only 1% of the total sovereign bond size. 80% of global sustainable sovereign bonds in 2024 are green sovereign bonds, followed by sustainability-linked sovereign bonds.

Sustainable sovereign bonds are more attractive to investors than traditional bonds, which usually receive a green premium. The issuance of these bonds by emerging market economies can attract more overseas funds and reduce the financing gap for transition. Sustainability-linked sovereign bonds are also a commonly used tool, which can demonstrate the transition commitment of sovereign countries and be linked to overall climate goals. These bonds can also help issuers obtain funds when specific use of proceeds cannot be determined.

Reference: