2024 Q3 Sustainable Bond Market Report

Climate Bonds Initiative (CBI) releases 2024 Q3 Sustainable Bond Market Report, aimed at analyzing the development of the global sustainable bond market.

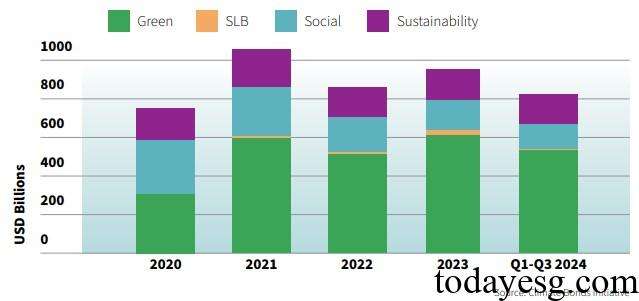

As of the third quarter of 2024, the total amount of global Green, Social, Sustainability, and Sustainability Linked Bonds (GSS+ bonds) has reached $5.4 trillion, of which $818.2 billion are issued in 2024, an increase of 11% compared to last year.

Related Post: Climate Bond Initiative Releases 2024 H1 Sustainable Bond Market Report

Overview of Global Sustainable Bond Market

The global sustainable bond market is worth $5.4 trillion, with the United States ($749.5 billion), France ($562.3 billion), and China ($528.1 billion) having larger issuance volumes. From the perspective of bond classification, green bonds (62%) and social bonds (19%) continue to dominate, with the total size of social bonds exceeding $1 trillion for the first time, reaching $1.1 trillion. The total size of sustainable bonds is $956.5 billion, accounting for 18% of the total. The total size of sustainable development linked bonds is 55.4 billion USD, accounting for 1% of the total. From the perspective of issuing currencies, the euro (40%), the US dollar (30%), and the Chinese yuan (8%) occupy the top three positions.

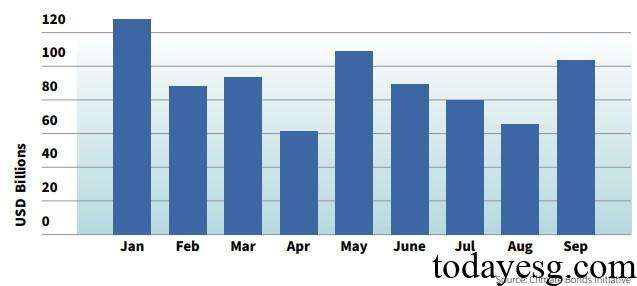

The global issuance scale of sustainable bonds in the third quarter of 2024 is $248.7 billion, an increase of 19% compared to the third quarter of 2023. This growth is mainly due to the increase in the issuance scale of development banks. In the third quarter, the issuance scale of development banks was 52.9 billion USD, an increase of 120% compared to the third quarter of 2023. In the first nine months of 2024, the monthly issuance scale in January, May, and September all exceeded $100 billion, with January being the month with the largest issuance scale in 2024.

Global Sustainable Bond Market Highlights

Green bonds

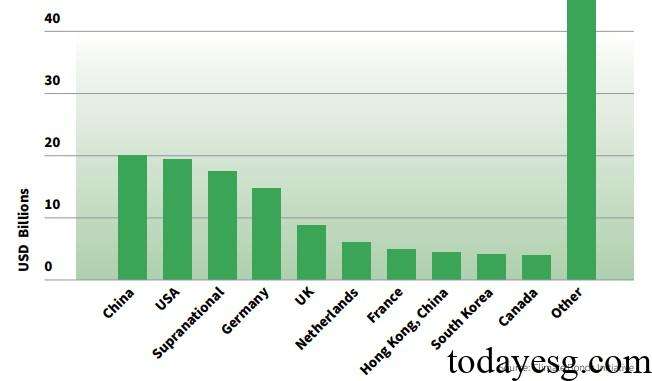

As of September 2024, the total size of global green bonds is $3.4 trillion, accounting for 62% of the total. The annual issuance of green bonds in the first three quarters of 2024 reached $535 billion, an increase of 13% compared to 2023. The issuance of green bonds in the third quarter reached 149 billion USD, an increase of 19% compared to 2023, with the EUR (44%), USD (23%), and CNY (12%) being the main issuing currencies.

China has the largest issuance scale, with a total of 113 issuances and a total size of 20 billion USD. The United States has the highest number of issuances, reaching 356 with a total size of $19.4 billion. The largest single issuance of green bonds comes from the European Investment Bank, with an issuance size of $9.6 billion.

Social bonds

As of September 2024, the total size of global social bonds is $1.1 trillion, accounting for 19% of the total. The issuance of social bonds in the first three quarters of 2024 was 123.6 billion USD. The issuance of social bonds in the third quarter reached 42.3 billion USD, an increase of 12% compared to 2023, with the largest issuance of US dollar bonds reaching 18.6 billion USD.

Sustainable bonds

As of September 2024, the total size of global sustainable bonds is $956.5 billion, accounting for 18% of the total. It is expected that the total size of global sustainable bonds will exceed $1 trillion by the end of 2024. The issuance of sustainable bonds in the first three quarters of 2024 was $152.2 billion, an increase of 23% compared to 2023. The issuance of sustainable bonds in the third quarter was $54.9 billion, an increase of 48% compared to 2023, with the World Bank being the largest issuer of sustainable bonds with an issuance scale of $31.1 billion.

Sustainability linked bonds

As of September 2024, the total size of global sustainability linked bonds was 55.4 billion USD, accounting for 1% of the total. The issuance of sustainability linked bonds in the first three quarters of 2024 was 6.9 billion USD, a decrease of 61% compared to 2023. The issuance of sustainability linked bonds in the third quarter was $2.4 billion, involving five transactions.

Sustainable sovereign bonds

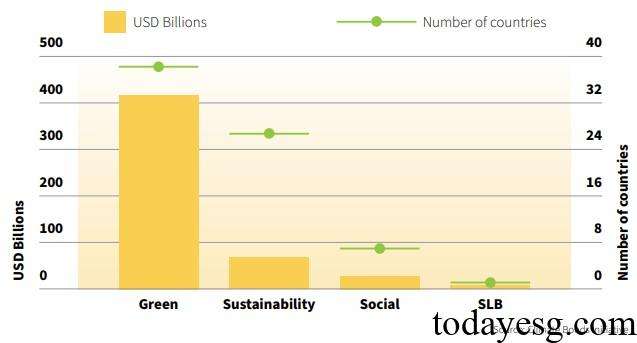

As of September 2024, the total size of sustainable sovereign bonds is $630.5 billion, with 554 transactions from 58 countries. The issuance of sustainable sovereign bonds in the third quarter of 2024 was 33.4 billion USD, an increase of 45% compared to 2023. The themes of sustainable sovereign bonds include green bonds ($540.2 billion) and sustainable bonds ($82.4 billion).

Reference:

Sustainable Debt Market Summary Q3 2024

Contact:todayesg@gmail.com