2024 China Sustainable Bond Market Report

The Climate Bonds Initiative (CBI) releases 2024 China Sustainable Bond Market Report, which aims to summarize the development of China’s green, social, sustainable development bonds and sustainability-linked bonds.

The Climate Bonds Initiative believes that the total issuance scale of global sustainable bonds in 2024 is 40.1 trillion CNY, of which China’s total issuance scale of sustainable bonds is 4 trillion CNY, ranking third.

Related Post: Climate Bond Initiative Releases 2024 Global Sustainable Bond Market Report

China Sustainable Bond Market Development

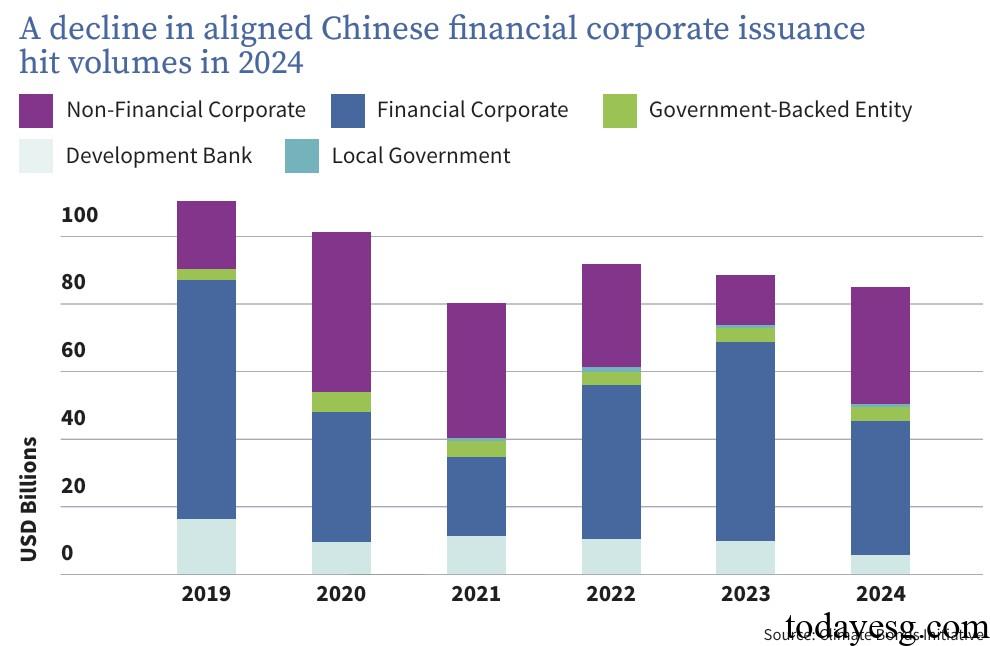

The scale of sustainable bond issuance in China in 2024 is 605.59 billion CNY, a decrease of 4% compared to 2023 (629.06 billion CNY). The reason for the decline is the decrease in the issuance of sustainable bonds by financial institutions, from 420.04 billion CNY in 2023 to 279.19 billion CNY in 2024. 59% of sustainable bonds meet the measurement standards of the Climate Bonds Initiative, reflecting investors’ increasing emphasis on the quality and transparency of sustainable bonds.

China Green Bond Market Development

The issuance scale of China’s green bonds in 2024 is 493.3 billion CNY, a decrease of 18% compared to 2023 (601.98 billion CNY). The reasons for the decrease include the decline in the issuance scale of financial institutions and the update of green bond measurement standards. The issuance scale of green bonds by financial institutions is 245.5 billion CNY, a year-on-year decrease of 41%. The issuance scale of green bonds by non-financial institutions is 182.65 billion CNY, a year-on-year increase of 84%. After the change in green building measurement standards, the proportion of green bonds that meet the definition of the Climate Bonds Initiative in 2024 is 60.7%, a slight decrease from 2023 (62.8%).

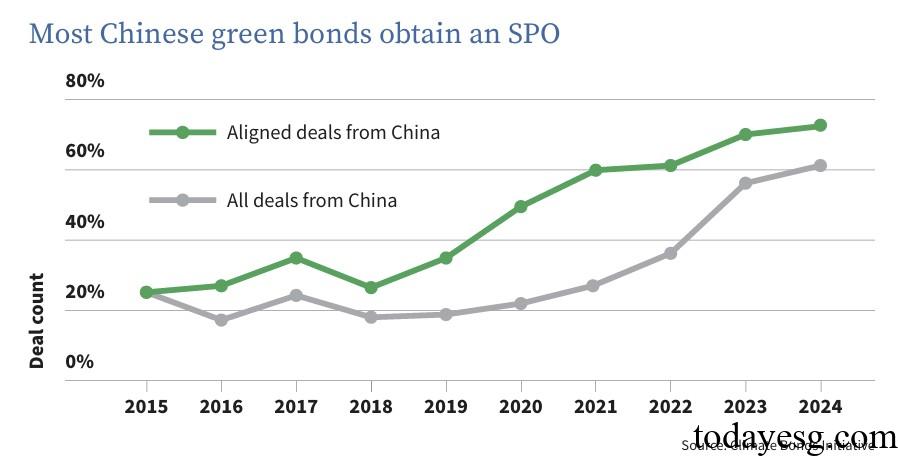

Most of China’s green bonds have short to medium term maturities, with 90% of bonds having maturities of less than five years, and only six bonds having maturities exceeding 20 years. The main purpose of raising funds for green bonds is low-carbon energy (52%) and low-carbon transportation (30%). The second party opinions (SPO) in the green bond market are continuing to develop, with 61% of bonds already having second party opinions, which is nearly three times higher than ten years ago. The application of second party opinions will improve the credibility of issuer information and enhance investor confidence.

China Social Bond Market Development

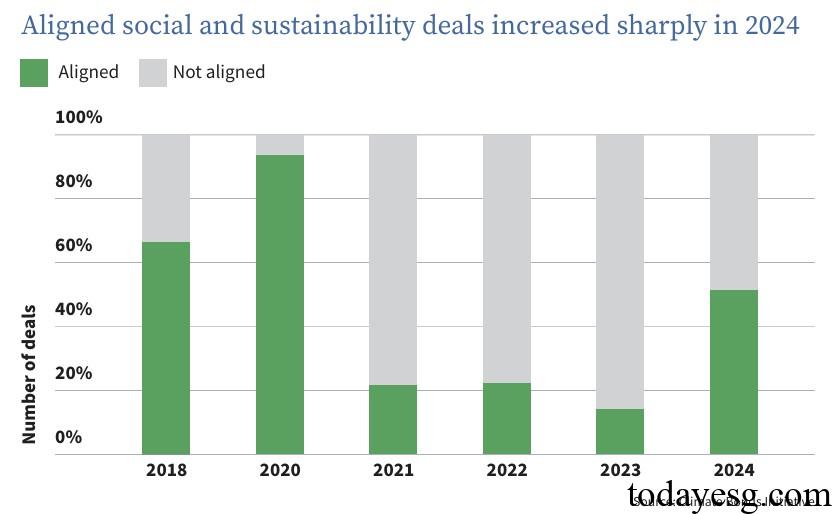

The scale of China’s social bond issuance in 2024 is 17.89 billion CNY, a fivefold increase compared to 2023 (3.58 billion CNY). The reasons for the growth include increased social responsibility financing and improved consistency between social bond standards and international standards. In 2024, the proportion of social bonds that meet the standards of the Climate Bonds Initiative will exceed 40%, which is twice as high as 2023. Among them, the proportion of social bonds issued in offshore markets that meet the standards is 94%, and the proportion of social bonds issued in onshore markets that meet the standards is 6%.

China Sustainable Development Bond Market Development

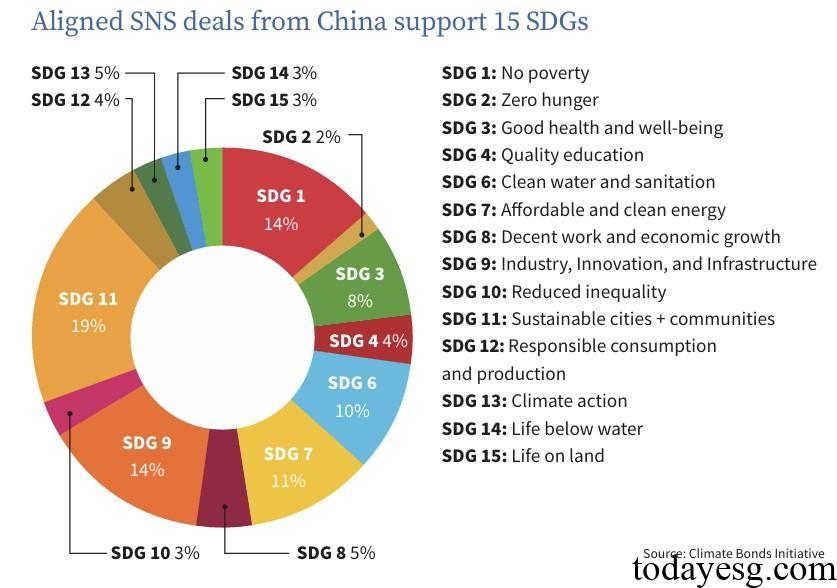

The scale of China’s sustainable development bond issuance in 2024 is 9.44 billion CNY, an increase of 313% compared to 2023 (2.29 billion CNY). The fundraising purposes of sustainable development bonds are mainly for infrastructure projects (62%) and healthcare (5%). From the analysis of the United Nations Sustainable Development Goals (UN SDGs), sustainable development bonds mainly support SDG 11 Sustainable Cities and Communities, SDG 9 Industry, Innovation and Infrastructure, and SDG 1 No Poverty, accounting for 19%, 14%, and 14% respectively.

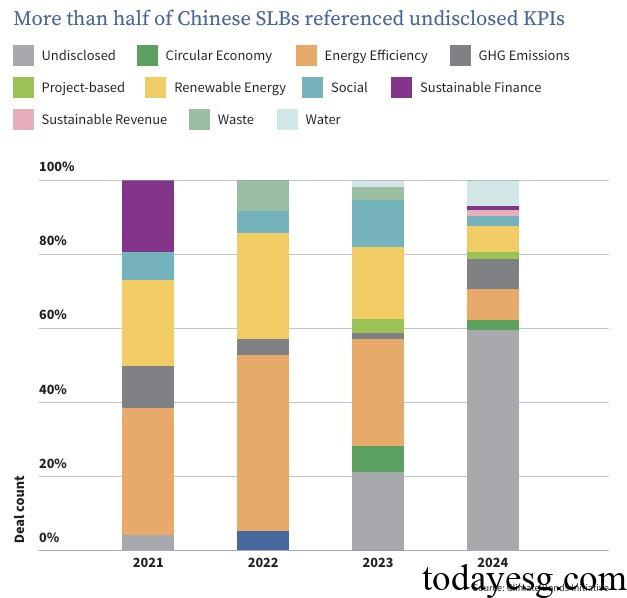

The issuance scale of China’s sustainable development linked bonds in 2024 is 50.83 billion CNY, an increase of 25% compared to 2023 (40.86 billion CNY), while the global issuance scale has decreased by 38%. As of the end of 2024, China has issued a total of 213 sustainable development linked bonds, with a total issuance scale of 198.23 billion CNY, ranking third in the world. More than half of the sustainable development linked bonds have not disclosed Key Performance Indicators (KPI), so the number of bonds that meet the standards of the Climate Bonds Initiative is relatively small.

Reference: