2025 Institutional Investor ESG Survey Report

BNP Paribas releases 2025 Institutional Investor ESG Survey report, aimed at analyzing the views of asset owners and managers on ESG and sustainable investment.

BNP Paribas surveys 420 institutional investors from 29 jurisdictions, with Europe, the Americas, and Asia accounting for 50%, 24%, and 26%, respectively.

Related Post: EY Releases 2024 Institutional Investor Sustainability Survey

Institutional Investor ESG Classification

BNP Paribas divides institutional investors into three categories based on six dimensions to reflect their ESG characteristics. These dimensions include investment methods, investment objectives, priorities, budget allocation, indicators, and future development. Based on different dimensions of feature calculation scores, institutional investors can be divided into Followers, Steady Performers, and Pacesetters, accounting for 27%, 54%, and 19% respectively.

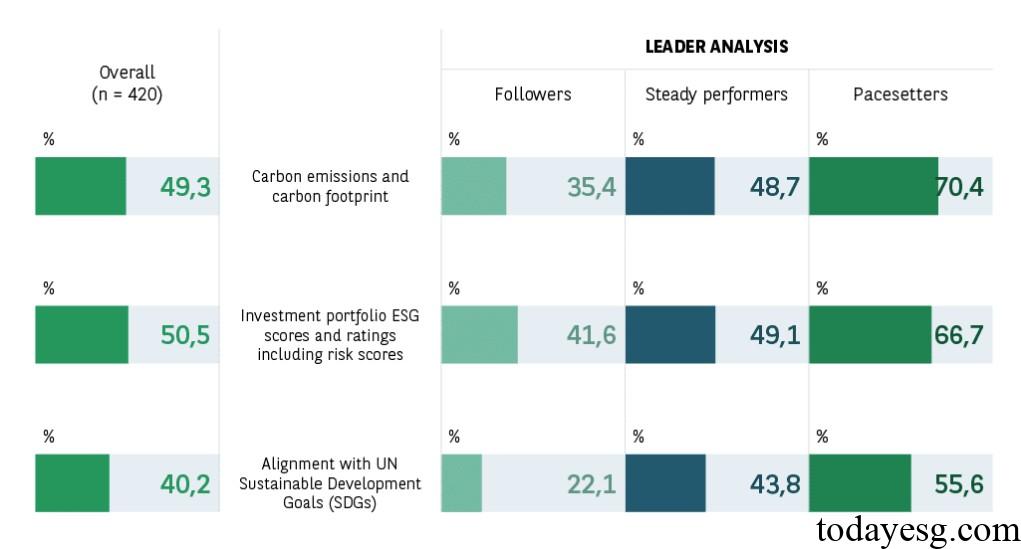

There are differences in attitudes towards sustainable investment and ESG among different categories of institutional investors. In terms of the most important elements of sustainable investment, pacesetters place greater emphasis on their own sustainable goals, while steady performers value external sustainable goals more. In terms of measuring ESG progress, the proportion of pacesetters using carbon emission data, portfolio ESG ratings, and UN Sustainable Development Goals (UNSDG) is significantly higher than the other two categories. In investment decision-making, pacesetters use more ESG investment methods and track more indicators.

Institutional Investor ESG Investment

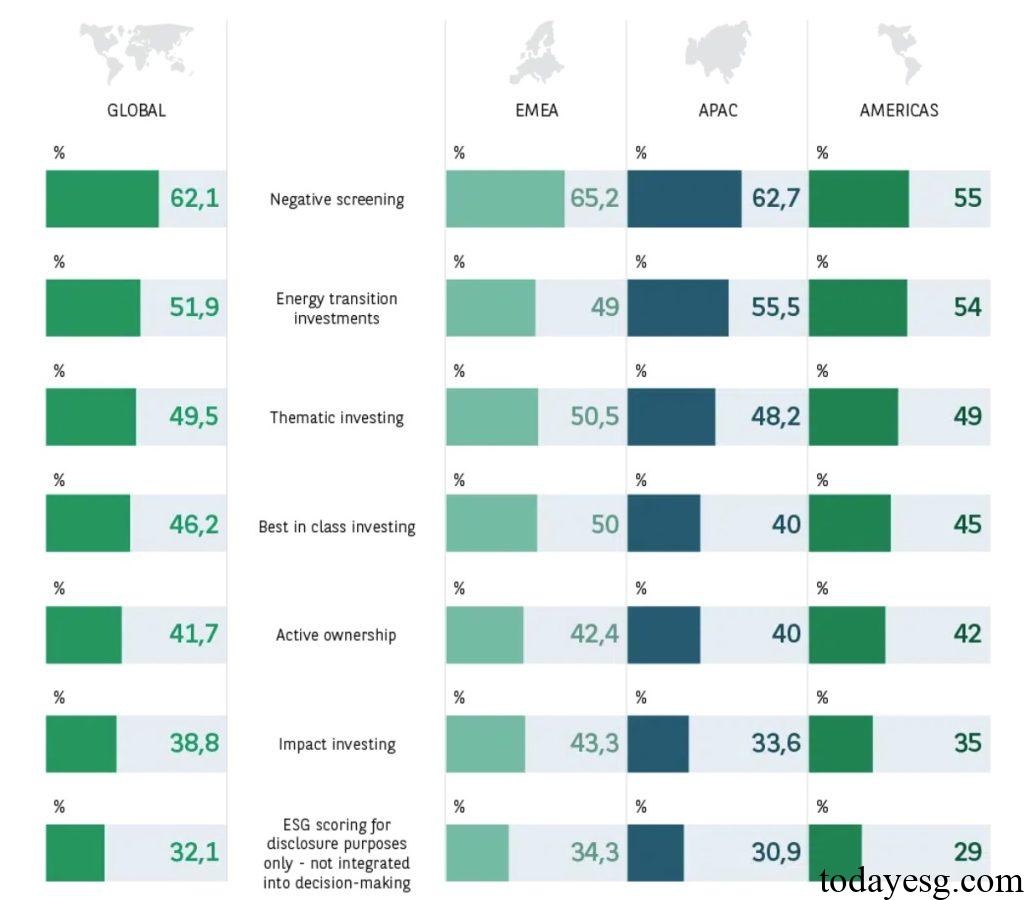

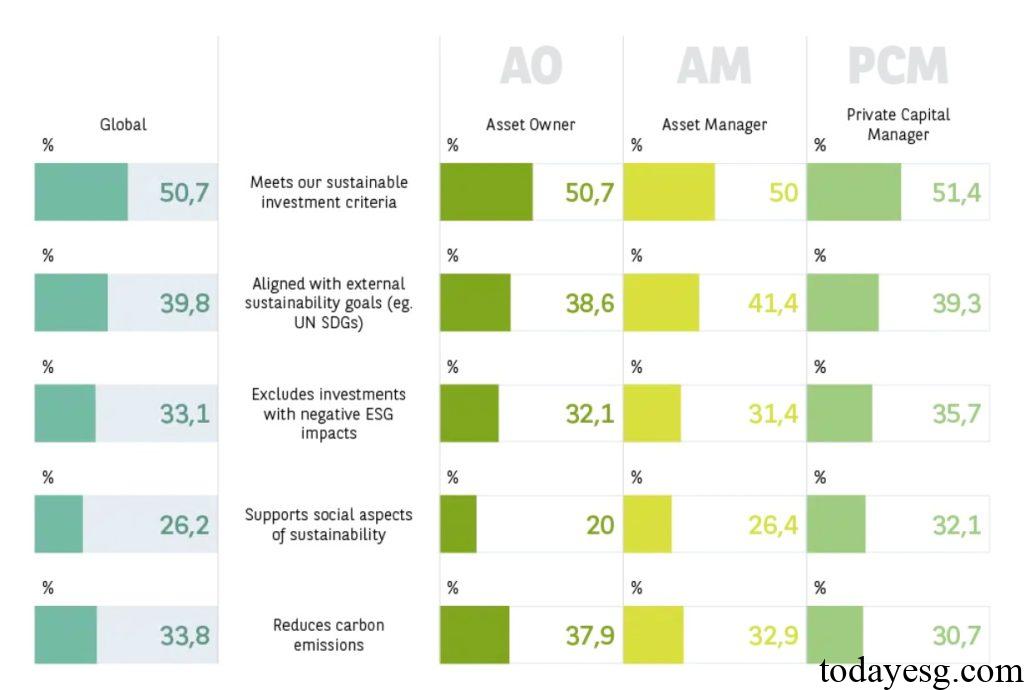

51% of investors believe that they need to meet their own defined criteria for sustainable investment, while 40% of investors believe that they need to align with external sustainability goals. In terms of sustainable investment methods, negative screening (62%), transition investment (52%), and thematic investment (50%) account for a relatively high proportion. Since 2023, the proportion of thematic investment is gradually increasing, reflecting investors’ growing focus on specific areas such as energy, biodiversity, and nature.

In terms of sustainable investment goals, increasing the allocation of transformational assets (49%), implementing proactive management to achieve ESG goals (47%), and investing in low-carbon assets (46%) account for a relatively high proportion. In terms of sustainable investment priorities, portfolio decarbonization (74%), social issues (74%), biodiversity (55%), and just transition (52%) rank high.

Despite the increasing uncertainty in the current global sustainable investment environment, 87% of investors still indicate that they will not change ESG and sustainability goals, and 74% of investors say that the pace of sustainable development in the next five years will remain consistent with the current level. In terms of sustainable investment challenges, data and research challenges (58%), the contradiction between short-term performance and long-term sustainability goals (56%), and the greenwashing risk of investees (54%) are relatively high.

Private Capital and ESG Investment

ESG investment is an emerging field in private capital and is receiving attention from private capital investors, who are also more likely to become pacesetters (36%). These investors place greater emphasis on their own sustainable investment goals and pay more attention to the social dimension than asset owners and managers. The proportion of private capital investors in low-carbon asset allocation and supporting just transition is also higher than that of other institutional investors. Private capital investors are also familiar with diversity and inclusion goals in their investments.

The performance of private equity in the ESG investment field is closely related to its employees, with 45% of private equity managers believing that they can acquire ESG and sustainable investment expertise, which is higher than the average level (45%). 59% of managers have increased the number of ESG experts in their investment teams, which is also higher than the average level (50%). 33% of managers believe that their investment activities will make positive contributions to the environment and society, while 27% of other investors hold this view.

Reference: